The yuck factor counteracts sustainable laundry habits

Most people today would lean towards environmentally friendly life choices, but not at the expense of being clean. When it comes to our washing habits, the fear of being perceived as dirty often wins out over the desire to act in an environmentally friendly way. And the more inclined we are to feel disgusted, the more we wash our clothes. This is shown by a unique study from Chalmers University of Technology, Sweden, that examines the driving forces behind our laundering behaviours and provides new tools for how people's environmental impact can be reduced.

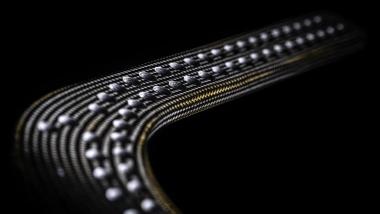

Today, we wash our clothes more than ever before, and the emissions from laundering have never been higher. Some of the reasons are that we use each garment fewer times before throwing them in the laundry bin, technological advances have made it easier and cheaper to do laundry, and access to washing machines has increased. Of the global emissions of microplastics, 16–35 percent come from washing synthetic fibres. In addition, detergents contribute to eutrophication, and the use of energy and water for washing also has environmental impacts.

"Even though the machines have become more energy-efficient, it is how often we choose to wash that has the greatest impact on the climate – and we have never done as much washing as we do today. At the same time, most of us seem to be uninterested in changing our laundering behaviours to reduce climate impact," says Erik Klint, doctoral student at the Division of Environmental Systems Analysis at Chalmers.

He has led a recently published research study that takes a new, unexplored approach to our washing habits: to examine the underlying mechanisms of excessive laundering from a psychological perspective. The study focuses on two driving forces that affect washing behaviour: (1) environmental identity – how strongly we identify with the group of environmentally conscious people, and (2) how inclined we are to have feelings of disgust. Two clearly conflicting driving forces, the study shows.

"We humans are constantly faced with different goal conflicts. In this case, there is a conflict between the desire to reduce one's washing to save the environment and the fear of being perceived as a disgusting person with unclean clothes. Disgust is a strong psychological and social driving force. The study shows that the higher our sensitivity to disgust, the more we wash, regardless of whether we value our environmental identity highly. The feeling of disgust simply wins out over environmental awareness," he says.

Disgust is an evolutionarily linked emotion

The fact that disgust drives our behaviour so strongly has several bases. Erik Klint describes disgust as an evolutionarily conditioned emotion, which basically functions as a protection against infection or dangerous substances. In addition to this, the feeling of disgust is closely related to the feeling of shame and can thus also have an influence in social contexts.

"We humans don't want to do things that risk challenging our position in the group – such as being associated with a person who doesn't take care of their hygiene," he says.

This has implications for our washing behaviour.

“Here, an evolutionarily rooted driving force is set against a moral standpoint, and in most cases you're likely to react to that evolutionarily linked emotion," he says.

"Washing campaigns have the wrong starting point"

According to Erik Klint, the study highlights that today's campaigns and messages to get people to act in an environmentally friendly way have the wrong starting point, since they often fail to take into account the psychological aspects behind people's behaviour.

"It doesn't matter how sensible and research-based an argument you have, if they run counter to people's different driving forces, such as the desire to feel a sense of belonging to a group, then they won’t work," he says.

The questions "How do we get people to wash less”, and “How do we do it in a more environmentally friendly way?” are misplaced, says Erik Klint, who points out that the focus should instead be on the indirect behaviour which leads to the actual washing. It might be subtle, but he suggests that a better question is instead “How do we get people to generate less laundry, specifically laundry that needs to be cleaned by a washing machine?”

"You do laundry because the laundry basket is full, because your favourite sweater is dirty, or because there is a free laundry timeslot in your shared laundry. Therefore, the focus needs to be on what happens before we run the washing machine, i.e., the underlying behaviours that create a need to wash. For example, how much laundry we generate, how we sort the clothes in the machine, or when we think the washing machine is full," he says.

One of the study's main suggestions is to encourage people to use clothes more often before they end up in the laundry basket.

"It can be about targeting excessive washing, with messages such as 'most people use their T-shirt more than once.' But also replacing washing machine use with other actions, such as airing the garments, brushing off dirt, or removing individual stains by hand. One way could be to highlight the economic arguments here, as clothes get worn out when they go through the machine," he says.

Hoping to reduce the environmental impact of laundry

Gregory Peters, Professor of Quantitative Sustainability Assessment at Chalmers and co-author of the study, emphasises that the research is a unique combination of behavioural science and natural science.

"This study is part of a more extensive thesis that goes beyond the usual research framework for LCA – life cycle assessments – and has made it possible to create more holistic understanding of how we wash and what drives washing behaviour. The direct result we hope for is to contribute to reduced environmental impact from laundry, but it is possible that the research can be generalised to other areas where behaviour and technology interact," he says.

More about washing habits and climate impact

- The amount of laundry washed by European consumers has increased significantly. In 2015, the average European washed four machine loads per week. Although this is 0.7 fewer loads than in 2000, it still represents a sharp increase since the washing capacity of the machines has grown sharply during the same period. In 2015, 64 percent of all washing machines had a capacity of more than six kilograms, compared with 2 percent in 2004. At the same time, most consumers state that they use the machine's full capacity.

- In 2010, it was estimated that about 30 percent of the world's households had access to a washing machine, and in 2024, according to a review of half of the world's population, living in 18 countries in different parts of the world, 80 percent of the households had access to a washing machine. Sources: Statista (2024), Pakula and Stamminger (2010)

- 16–35 percent of global emissions of microplastics come from washing synthetic fibres. Washing synthetic products leads to more than half a million tonnes of microplastics accumulating on the seabed every year. A single wash of polyester clothing can release 700,000 microplastic fibres that can then end up in the food chain.

Chalmers | Mia Halleröd Palmgren