Heimtextil 2020

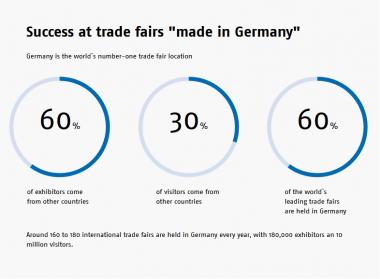

For the 50th edition of Heimtextil (7-10 January 2020), the international trade fair for home and contract textiles will once again sparkle with the world’s largest product range for textile interiors and its unique presentation of the hottest trends. Around 3000 international exhibitors will present their innovations in Frankfurt.

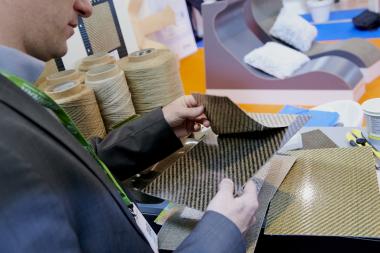

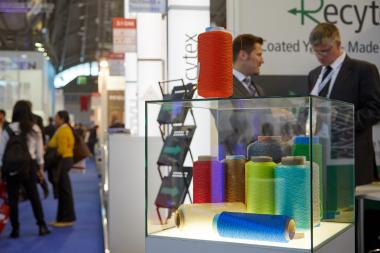

More than 250 companies will be presenting sustainably produced textiles at Heimtextil. The Green Directory, a separate exhibitor index focusing on the theme of sustainability that will be published by Heimtextil for the tenth time in 2020, lists these companies and their product innovations. The number of companies included in the directory has increased considerably and is higher than ever before. Progressive, sustainably produced materials can also be seen in the new Future Materials Library, part of the Trend Space. Here, visitors can explore the nature and production method of innovative materials. The focus is on recycled fabrics and cultivated – so-called living – textiles, among other things. The Green Village in hall 12.0 also functions as a hub for all questions relating to green issues. Seal providers and certifiers are among those introducing themselves here and offering companies their support in acting more sustainably. The United Nations will also present its Sustainable Development Goals here for the first time.

Trend Space: the furnishing trends of the future

The programme highlight for those interested in design is the Trend Space in hall 3.0. In this trend and inspiration area, visitors and exhibitors alike can look forward to a wealth of material innovations, colour trends and new designs. Sustainability is a top priority here too: thanks to targeted selection of materials, material requirements can be reduced and the environmental footprint kept to a minimum. On an area of around 2000 square metres, designers thus create a forum comprising primarily of textiles and materials that can be reused after the event. The overarching theme is “Where I belong”, which invites visitors to take an inspiring journey of discovery thanks to its numerous interactive elements. An accompanying programme of talks and guided tours give far-reaching insights into new design projects. The Trend Space has been designed by Stijlinstituut Amsterdam.

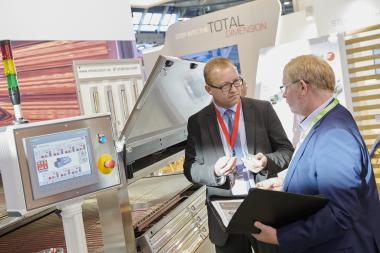

Expanded area for printers and processing machines

At its upcoming edition, Heimtextil will present an extended range of machines for the textile industry and expand the product segment “Textile Technologies”. The background to this is that the digital revolution is currently leading to fundamental changes in the manufacture and processing of home textiles. Heimtextil will present the opportunities offered by technological change in the industry and, under the new name “Textile Technologies”, will present the latest product developments in hall 3.0, from digital printing machines, software and corresponding accessories to machines for textile processing. The trade fair will also offer its own lecture programme with experts from industry and research for the first time.

Further growth in furniture and decorative fabrics

In the “Decorative & Furniture Fabrics” segment in particular, Heimtextil is experiencing unstoppable growth. At the upcoming fair, 40 new exhibitors will be joining and adding new perspectives to the already very large selection of furniture and decorative fabrics as well as leather and imitation leather. Over 400 international producers will present their new collections in halls 4 and 6. European top producers in particular are strongly represented. Another new aspect is that for the first time Heimtextil will be identifying around 250 weavers of furniture and decorative fabrics, curtains and bed linen fabrics with their own logo at stands and in the catalogue – for the better orientation of visitors. This innovation applies to both hall 4 and hall 8.0.

Design Dialog highlights trends for the furnishing industry

Representatives from the furniture industry will find hall 4 an attractive place thanks the expanded product range and information offered by the Design Dialog. Heimtextil will be providing information on the latest design trends for the furniture industry in the Lecture Area of hall 4.2 on the Wednesday of the trade fair between midday and 1.30 pm. Those present will include Christiane Müller from Studio Müller Van Tol, Anne Marie Commandeur from Stijlinstituut Amsterdam, representing the Heimtextil Trend Council, and product and furniture designer Werner Aisslinger. Susanne Tamborini-Liebenberg, editor-in-chief of md- Magazin, will chair the event.

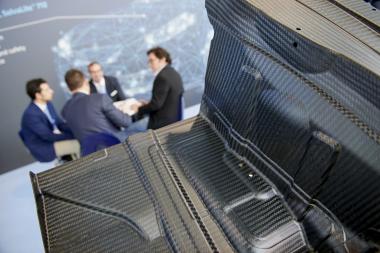

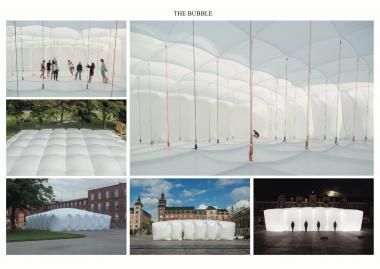

Interior.Architecture.Hospitality by Heimtextil

Heimtextil offers new business segments and sales opportunities for contract furnishers. Around 370 exhibitors will provide solutions for the contract sector aimed specifically at interior designers, architects and hospitality experts. Selected suppliers will present their wares at the Interior.Architecture.Hospitality EXPO. The product offer will be supported by a new materials library, the Interior.Architecture.Hospitality LIBRARY. It will present a selection of exhibitor products with functional characteristics such as flame-retardant, sound-insulating, abrasionresistant and water-repellent. Numerous information offers, such as expert presentations and guided tours of the trade fair, complete the programme.

Hall 8.0: Hotspot for the latest interior collections

Curtains, decorative and furniture fabrics, drapery and curtain hardware, sun protection systems, carpets and tools for textile processing will be presented in Hall 8.0 under the title "Window & Interior Decoration". In addition, Heimtextil bundles all participating textiles editeurs and optimally integrates them into the product range for interior decorators and retailers. Around 50 international editeurs present their collections for the coming season.

Showcase: design classics from the past 50 years

Suppliers of pillows, blankets and plaids as well as table and kitchen linen will be exhibiting in Hall 9.0 under the title "Beautiful Living" – together with lifestyle-oriented accessories. Heimtextil thus creates a starting point full of brands for high-quality retailers. On the occasion of the 50th Heimtextil edition, the fair stages design classics from the past 50 years. On this showcase area the fair invites to a journey through five decades of Heimtextil history. Four designed tell about the colors, shapes, furniture and design objects of the past decades. The showcase will be complemented by a café, which will be realized in cooperation with Schöner Wohnen, Europe's largest interior design magazine.

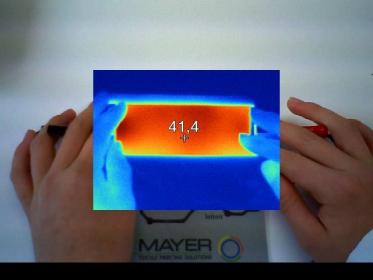

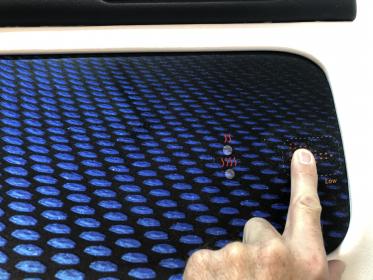

Sleep: new findings and product solutions

Heimtextil puts the sleep theme prominently on the agenda: with the product segment Smart Bedding, the trade fair offers new insights into healthy sleep in hall 11.0 and presents concrete product solutions. Mattresses, bedding, sleep systems and associated technology can be viewed here, as well as duvets and pillows. 140 major players in the industry will bring the theme of sleep to life. There will also be some exciting start-ups that will cause a sensation with smart market innovations. More in depth-information is offered in presentation area “Sleep! The Future Forum”. Here, in the foyer of hall 11.0, visitors can look forward to discussions with sleep experts. These include professional athletes such as Olympic luge champion Susi Erdmann, sleep coach Nick Littlehales and scientists from Berlin’s Charité, the Fraunhofer Institute and the German Sleep Research Society. Speakers from Ikea, Hästens and Auping will talk about progressive sleep topics. The lecture programme covers the top themes of digital, sport, hospitality, sustainability and interior design. In this way, Heimtextil presents the latest findings from sleep research and showcases the latest developments in industry and trade.

(c) Mese Frankfurt Exhibition GmbH, Petro Sutera

(c) Mese Frankfurt Exhibition GmbH, Petro Sutera

(c) Mese Frankfurt Exhibition GmbH, Petro Sutera

(c) Mese Frankfurt Exhibition GmbH, Petro Sutera

(c) Mese Frankfurt Exhibition GmbH, Petro Sutera

(c) Mese Frankfurt Exhibition GmbH, Petro Sutera

Heimtextil

Mese Frankfurt Exhibition GmbH