Naturalistic silk spun from artificial spider gland

Researchers led by Keiji Numata at the RIKEN Center for Sustainable Resource Science in Japan, along with colleagues from the RIKEN Pioneering Research Cluster, have succeeded in creating a device that spins artificial spider silk that closely matches what spiders naturally produce. The artificial silk gland was able to re-create the complex molecular structure of silk by mimicking the various chemical and physical changes that naturally occur in a spider’s silk gland. This eco-friendly innovation is a big step towards sustainability and could impact several industries. This study was published January 15 in the scientific journal Nature Communications.

Famous for its strength, flexibility, and light weight, spider silk has a tensile strength that is comparable to steel of the same diameter, and a strength to weight ratio that is unparalleled. Added to that, it’s biocompatible, meaning that it can be used in medical applications, as well as biodegradable. So why isn’t everything made from spider silk? Large-scale harvesting of silk from spiders has proven impractical for several reasons, leaving it up to scientists to develop a way to produce it in the laboratory.

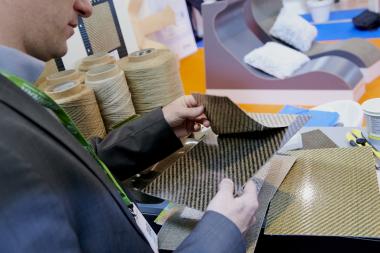

Spider silk is a biopolymer fiber made from large proteins with highly repetitive sequences, called spidroins. Within the silk fibers are molecular substructures called beta sheets, which must be aligned properly for the silk fibers to have their unique mechanical properties. Re-creating this complex molecular architecture has confounded scientists for years. Rather than trying to devise the process from scratch, RIKEN scientists took a biomimicry approach. As Numata explains, “in this study, we attempted to mimic natural spider silk production using microfluidics, which involves the flow and manipulation of small amounts of fluids through narrow channels. Indeed, one could say that that the spider’s silk gland functions as a sort of natural microfluidic device.”

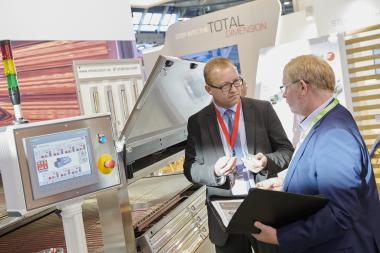

The device developed by the researchers looks like a small rectangular box with tiny channels grooved into it. Precursor spidroin solution is placed at one end and then pulled towards the other end by means of negative pressure. As the spidroins flow through the microfluidic channels, they are exposed to precise changes in the chemical and physical environment, which are made possible by the design of the microfluidic system. Under the correct conditions, the proteins self-assembled into silk fibers with their characteristic complex structure.

The researchers experimented to find these correct conditions, and eventually were able to optimize the interactions among the different regions of the microfluidic system. Among other things, they discovered that using force to push the proteins through did not work; only when they used negative pressure to pull the spidroin solution could continuous silk fibers with the correct telltale alignment of beta sheets be assembled.

“It was surprising how robust the microfluidic system was, once the different conditions were established and optimized,” says Senior Scientist Ali Malay, one of the paper’s co-authors. “Fiber assembly was spontaneous, extremely rapid, and highly reproducible. Importantly, the fibers exhibited the distinct hierarchical structure that is found in natural silk fiber.”

The ability to artificially produce silk fibers using this method could provide numerous benefits. Not only could it help reduce the negative impact that current textile manufacturing has on the environment, but the biodegradable and biocompatible nature of spider silk makes it ideal for biomedical applications, such as sutures and artificial ligaments.

“Ideally, we want to have a real-world impact,” says Numata. “For this to occur, we will need to scale-up our fiber-production methodology and make it a continuous process. We will also evaluate the quality of our artificial spider silk using several metrics and make further improvements from there.”

RIKEN Center for Sustainable Resource Science, Japan