Cooling down with Nanodiamonds

Researchers from RMIT University are using nanodiamonds to create smart textiles that can cool people down faster.

The study found fabric made from cotton coated with nanodiamonds, using a method called electrospinning, showed a reduction of 2-3 degrees Celsius during the cooling down process compared to untreated cotton. They do this by drawing out body heat and releasing it from the fabric – a result of the incredible thermal conductivity of nanodiamonds.

Published in Polymers for Advanced Technologies, project lead and Senior Lecturer, Dr Shadi Houshyar, said there was a big opportunity to use these insights to create new textiles for sportswear and even personal protective clothing, such as underlayers to keep fire fighters cool.

The study also found nanodiamonds increased the UV protection of cotton, making it ideal for outdoor summer clothing.

“While 2 or 3 degrees may not seem like much of a change, it does make a difference in comfort and health impacts over extended periods and in practical terms, could be the difference between keeping your air conditioner off or turning it on,” Houshyar said. “There’s also potential to explore how nanodiamonds can be used to protect buildings from overheating, which can lead to environmental benefits.”

The use of this fabric in clothing was projected to lead to a 20-30% energy saving due to lower use of air conditioning.

Based in the Centre for Materials Innovation and Future Fashion (CMIFF), the research team is made up of RMIT engineers and textile researchers who have strong expertise in developing next-generation smart textiles, as well as working with industry to develop realistic solutions.

Contrary to popular belief, nanodiamonds are not the same as the diamonds that adorn jewellery, said Houshyar. “They’re actually cheap to make — cheaper than graphene oxide and other types of carbon materials,” she said. “While they have a carbon lattice structure, they are much smaller in size. They’re also easy to make using methods like detonation or from waste materials.”

How it works

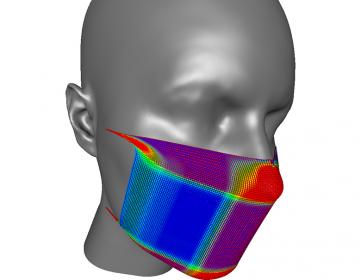

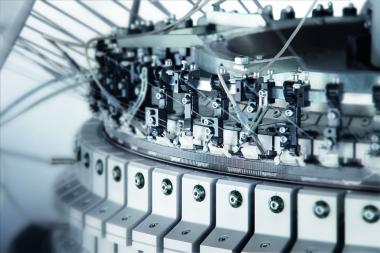

Cotton material was first coated with an adhesive, then electrospun with a polymer solution made from nanodiamonds, polyurethane and solvent.

This process creates a web of nanofibres on the cotton fibres, which are then cured to bond the two.

Lead researcher and research assistant, Dr Aisha Rehman, said the coating with nanodiamonds was deliberately applied to only one side of the fabric to restrict heat in the atmosphere from transferring back to the body.

“The side of the fabric with the nanodiamond coating is what touches the skin. The nanodiamonds then transfer heat from the body into the air,” said Rehman, who worked on the study as part of her PhD. “Because nanodiamonds are such good thermal conductors, it does it faster than untreated fabric.”

Nanodiamonds were chosen for this study because of their strong thermal conductivity properties, said Rehman. Often used in IT, nanodiamonds can also help improve thermal properties of liquids and gels, as well as increase corrosive resistance in metals.

“Nanodiamonds are also biocompatible, so they’re safe for the human body. Therefore, it has great potential not just in textiles, but also in the biomedical field,” Rehman said.

While the research was still preliminary, Houshyar said this method of coating nanofibres onto textiles had strong commercial potential.

“This electrospinning approach is straightforward and can significantly reduce the variety of manufacturing steps compared to previously tested methods, which feature lengthy processes and wastage of nanodiamonds,” Houshyar said.

Further research will study the durability of the nanofibres, especially during the washing process.

Shu Shu Zheng, RMIT University