THE DRAW OF THE FUNKHAUS: HUGE EXHIBITOR DEMAND FOR GREENSHOWROOM AND ETHICAL FASHION SHOW BERLIN

- Impetus for retailers: Practice-oriented talk in cooperation with TEXTILWIRTSCHAFT and shop-in-shop concept “JETZT!”

- Optimised hallstructure: better overview with new segmentation

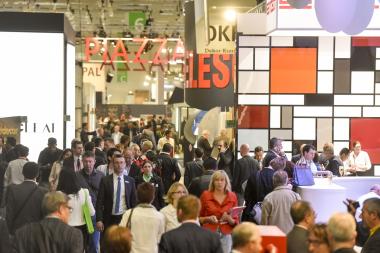

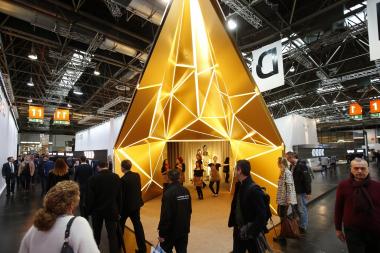

The trade fair duo Greenshowroom and Ethical Fashion Show Berlin will start the coming summer season with a new location, fresh impetus and a special focus on retail. The new Funkhaus Berlin abode in particular has met with great enthusiasm and promises to give the three-day fashion event during the Berlin Fashion Week (4-6 July 2017) an extra boost. 'Numerous key players and established labels have already announced their intention to take part in the trade fair and we and they are looking forward to the excellent presentation possibilities that the Funkhaus offers', says Olaf Schmidt, Vice President Textiles & Textile Technologies at Messe Frankfurt.

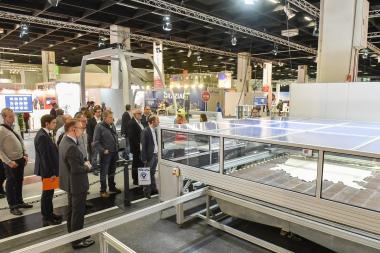

With the so-called Shedhalle, the new location has a level exhibition hall flooded with light, meaning that the trade fair duo can be hosted in spacious and clearly laid out surroundings. As part of this change of location, Messe Frankfurt is optimising the structure of the exhibition space and introducing new segmentation. This will provide better orientation for visitors to the trade fair. The multifaceted Ethical Fashion Show Berlin in particular will gain from this new structural segmentation. The fashion shows will also take place in the Shedhalle. The Funkhaus offers a stimulating backdrop for the catwalk shows, during which the exhibiting labels will present their highlights.

Greenshowroom: contemporary and high fashion

Greenshowroom will present an exclusive selection from the contemporary and high fashion segment. High-class labels will showcase avant-garde design in the front section of the Shedhalle. Greenshowroom highlights include Ackermann Taschenmanufaktur, Biaggi, Jan ’n June, Jungle Folk, Nat-2, Ombre Claire, Suite 13, Werner 1911 and Xess+Baba.

Ethical Fashion Show Berlin: New segments for a better overview

At the Ethical Fashion Show Berlin, identifying segments in the following way will make orientation easier in future: denim and streetwear labels that present progressive and authentic styles can be found in the “Urbanvibe” category (Grand Step Shoes, Feuervogl, Jaya, LangerChen, Miss Green, Recolution, Skunkfunk, Ultrashoes, Zerum). “Moderncasual” stands for clear, long-lasting collections that range from casual to business (Alma & Lovis, Frieda Sand, Harold’s, John W. Shoes, La-na, Lanius, Naturaline, Ten Points). “Craft” presents products made with traditional craftsmanship interpreted in a new way (Toino Abel). “Individual” comprises pioneers of eco fashion and showcases styles with individual class (El Naturalista, Insecta Shoes, Minu). And the “Kids” area delivers fash-ionable highlights for children and teens (Disana, Serendipity Organics).

Focal point retail: Retail area “JETZT!”, presentations and practice-oriented talk in co-operation with TextilWirtschaft

The trade fair duo is focusing more on the visitor group of retailers than ever before, providing them with a range of attractive information and inspirational offers. The central point of focus is the retail area “JETZT!”. With it, the trade fair duo presents a concept space that gives retailers a vision of how they can integrate sustainable fashion and lifestyle brands in their product ranges – showcased in a fashionable, experience-oriented and contemporary manner. The area presents a shop-in-shop concept that can be individually decorated by retailers within a variable space. Greenshowroom and the Ethical Fashion Show Berlin function as a source of ideas with the aim of making access to the topic of sus-tainable product worlds easier for retailers and motivating them to establish contemporary presentations in their own shops. Guided tours are also offered to interested visitors to get them more involved in the sales concept.

The programme of talks also provides information and incentives relating to retail. In addition to a range of talks from retail experts, visitors can look forward to a special event highlight on the third day of the trade fair at 11 a.m. in the Shedhalle of the Funkhaus: with the practice-oriented talk “How you can earn money with green fashion”, TextilWirtschaft, as a media partner of the trade fair duo, has developed a new discussion format. It is derived from the TW Fair Fashion and will take place on the exhibition grounds of Greenshowroom and the Ethical Fashion Show Berlin for the first time in cooperation with BTE Handelsverband Textil. On the podium, experts from the eco fashion industry will discuss how you can be successful in retail with fair fashion.