TEXCARE ASIA AND CHINA LAUNDRY EXPO TO MERGE – CREATING ASIA’S LARGEST EXHIBITION FOR LAUNDRY EQUIPMENT AND TECHNOLOGY

As disclosed in an agreement signed on 18 July 2018 by the organisers of Texcare Asia and the China Laundry Expo, the two trade fairs will merge into a single show in a win-win arrangement to integrate industry resources.

The new joint-venture fair will be the largest annual industry event covering the textile care and laundry chain in Asia. The first edition will take place in September 2019 at the Shanghai New International Expo Centre and will be jointly organised by Messe Frankfurt (Shanghai) Co Ltd, Unifair Exhibition Service Co Ltd, the China Laundry Association, and the China Light Machinery Association.

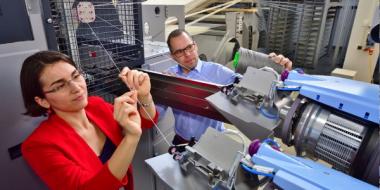

Mr Wolfgang Marzin, President and CEO of Messe Frankfurt Group, said: “The merger is fantastic news for the textile care industry in Asia as a whole and also for the Messe Frankfurt Group. By integrating Texcare Asia’s extensive resources with those of the China Laundry Expo, we will provide a larger and more complete platform for the industry to converge upon. The new show will provide coverage across the entire supply chain, including dry cleaning, dyeing, detergent and disinfecting chemicals, leather care, textile rental, digital solutions and much more.”

Ms Xiuping Han, General Manager of China Unifair Exhibition Services Co Ltd added: “The laundry industry in China faces numerous challenges, such as the tightening of sewage treatment and disposal regulations, while opportunities are also arising in the form of increased demand for energy saving technologies. By merging the China Laundry Expo and Texcare Asia under a single banner, we will provide an ideal platform to facilitate industry development and address these challenges and opportunities.”

The annual China Laundry Expo was founded in 2000 and is held on a rotating basis between Beijing and Shanghai. Organised by the China Laundry Association and Unifair Exhibition Services Co Ltd, the show receives significant government and commercial sector backing. The 19th edition is held at the Shanghai New International Expo Centre over the next three days and will play host to more than 220 exhibitors representing around 500 brands from over 10 countries and regions. The fair is also expecting to welcome over 20,000 trade and industry visitors to an impressive 23,000 sqm of exhibition space.

Key product categories of the China Laundry Expo include laundry equipment, accessories, chemicals, consumables, leather care products, energy-saving and environmental protection equipment, informationbased intelligent products and solutions, and much more. Not only do these product categories cater to the purchasing demands of visitors around the globe, but the strong variety also serves to attract more suppliers and industry players.

With a similar focus to the China Laundry Expo, Texcare Asia made its debut in Singapore in 1998 and was introduced to Hong Kong in 2002. The fair then move to China in 2005 in Beijing and has been located in Shanghai since 2013. With the strong international network and industry support from the mother fair, Texcare International, the China event is now recognised as Asia’s biggest laundry and dry-cleaning show. It has served as a biennial meeting point for textile care manufacturers, suppliers and professionals to network, trade, conduct business, and catch up with industry developments.

The fair also holds a unique position as a platform for providers of textile rental services, training services for institutions, and machinery for the cleaning of carpets, floor coverings, upholstery and buildings. By combining product groups from the China Laundry Expo with those of Texcare Asia, the merged platform promises to deliver a comprehensive value added experience for its customers and visitors.

The expanded product portfolio and merging of resources mean that the newly merged show is predicted to attract an impressive 300 exhibitors and 25,000 industry visitors across 30,000 sqm of floor space when it opens its doors in September 2019.

For further details, please visit www.texcare-asia.com, or contact texcareasia@china.messefrankfurt.com.