“WHERE I BELONG”: HEIMTEXTIL PRESENTS THE DESIGN TRENDS FOR 2020/2021

„Heimtextil will launch the new 2020/2021 trend season with the general theme “WHERE I BELONG”. For the official Heimtextil Trend Preview, Stijlinstituut Amsterdam director Anne Marie Commandeur introduced the new design themes. The presentation in the run-up to Heimtextil (7-10 January 2020) took place at the Textile Museum’s Textile Lab in Tilburg, the Netherlands on 11 September 2019 and was streamed worldwide.

This season, Stijlinstituut Amsterdam is responsible for the Trend Book content and Trend Space implementation at the upcoming international trade fair for home and contract textiles. Alongside Stijlinstituut Amsterdam, London-based studio FranklinTill and Danish agency SPOTT trends & business contribu¬ted to the 20/21 global forecast for perspective-related interior design. Together with the Heimtextil management team, these Trend Council participants gave insights into future styles during a workshop.

At the annual international Trend Council workshop, identity was an ever-present topic: part of a broader discussion on gender and cultural diversity, on tolerance and curiosity. Today, the self-identification process seems more complex than ever. Identities are now formed through experiences that take place simultaneously, on different levels. Locally, nationally, globally, both online and offline. Identity therefore can consist of many different layers. In fact, individuals can all have multilayered identities.

Making Room for the Multifaceted Self

As an overarching theme, “WHERE I BELONG” addresses layered identities via the five diverse Heimtextil 20/21 trends. “Maximum Glam” turns the glamorous life tech-savvy, “Pure Spiritual” finds balance in nature and mysticism, “Active Urban” values utilitarian, adaptable solutions, whereas “Heritage Lux” celebrates rich historical legacies and “Multi-Local” embraces global cultural influences.

Reflecting on this year’s Heimtextil trend “WHERE I BELONG” shows one size does not fit all. To unravel and reveal the layers of our identities in an informative and inspiring way, Stijlinstituut Amsterdam invited four design studios and two photographers to capture the core of each theme. Each creative was assigned a theme matching their philosophy, practice and methodology, enabling them to bring a personal and authentic aspect to the stories.

Establishing five worlds as spaces to experience, made for with and of exhibitors’ products, the Trend Space will also realise 2D visualisations from the book as 3D spaces. Conceptual installations will actively engage visitors and motivate them to share their experiences by creating dynamic settings all about performance and interaction. Settings can be bizarre, beautiful, and at times bewildering: it’s now up to the visitors to define where they and their target customers belong.

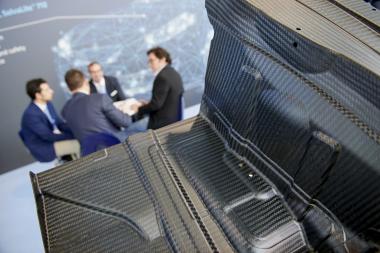

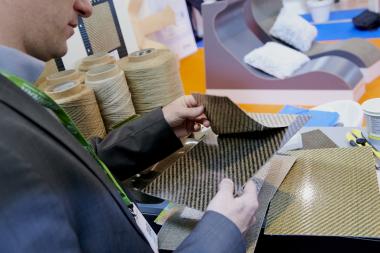

Future Materials Library

A highlight of the Heimtextil Trend Space 2020 will be the Future Materials Library curated by FranklinTill, presenting emerging sustainable material innovation to the interior textile industry. Focused on material composition and manufacturing innovation, the library exhibits will provide invaluable insight and inspiration for visitors and exhibitors alike, complementing the curated showcase of aesthetic design and colour trends. Each showcased sample will feature on-point information about each material’s raw origins, manufacturing process and potential afterlife.

Material Manifesto

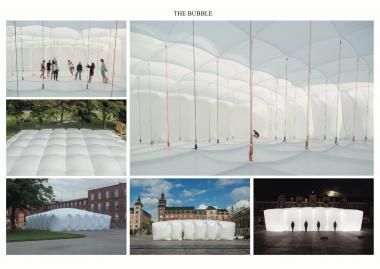

Heimtextil and the international trend team created a Material Manifesto outlining how to manage resources used during the event and avoid using new materials that can end up as waste when the exhibition closes. Through intelligent material choice, Stijlinstituut Amsterdam will reduce material impact to create an immersive forum with a minimal footprint.

Filling the 2,000 sqm Trend Space over four exhibition days is a challenge that the Heimtextil and Stijlinstituut Amsterdam teams must collaborate on to make a forum built primarily of textiles and inflatables with materials that can be reused after the event. Working according to the principles of circularity, these textiles fit for reuse will be combined with Messe Frankfurt stock components and rented and loaned materials. These installations go beyond decorative backdrops: they will tell distinctive stories representative of this year’s trends while meeting Heimtextil’s commitment to sustainability.

MAXIMUM GLAM

Pleasure seekers revel in layering theatrical influences and glamorous showtime aesthetics, forging a fantastic marriage between the crafted and digitally rendered. Textiles show a ‘more is more’ attitude through a mash-up of glam, gradients and spectrums, fake fur, pile and fringe, jacquard weaves and fantastic prints. The flashy, kitsch colour range becomes brutally glam thanks to electric sheen, synthetic shimmer, digital glitch and artful blur. A riot of clashes and rebellion.

PURE SPIRITUAL

Idealists seek perfection and purity, restoring equilibrium by connecting with the uber-natural. They embrace technology for good while shifting between realism and mysticism in pursuit of a personal haven. To address a renewed bond with nature, organic matter, raw materials and pure textiles are selected which show nature’s traces, organic structures and irregularities. Shades are created from the earth and cultured by man. An elemental and pure range reflects the source of their existence.

ACTIVE URBAN

Urban dwellers confront the challenges of the fast paced, shape-shifting, man-made environment by searching for utilitarian, adaptable solutions. They value tech performance while making smart use of available and renewable resources. Functionality is prioritised, while looking cool and working well remains key. Interior/sportswear hybrid textiles show smooth surfaces and a fun mash-up of graphic textures. The palette shows uniform blue, asphalt grey and caterpillar yellow.

HERITAGE LUX

Preservers of historic legacies treasure sensuousness alongside the uncanny, enlightenment together with darkness, for a whole new immersive experience. This new narrative translates to a love for luxury and splendour, decoration and embellishment. Finding beauty in history and nature through ornamental patterning and alluring surface enhancement. Reflecting on ancient history results in a palette featuring enigmatic blood red, sapphire and a lustrous mother-ofpearl.

MULTI-LOCAL

Hyper-locals go global, celebrating inclusivity over appropriation, honouring traditional craftsmanship and adjusting the world’s gaze to embrace exchange, creative integrity and diverse identities. Indigenous style meets global influences. This is a celebration of crafted and decorative pattern, from tribal and folkloric to geometric and abstract. Textile colours become part of a wider cultural narrative, linked to local community, cultural heritage and private identity.

Photo: Stephen Tayo, Jan Hoek

Photo: Stephen Tayo, Jan Hoek

Photo by Michelle und Chris Gerard

Photo by Michelle und Chris Gerard

© Bart Hess

© Bart Hess

© B.I. Kingelez, Foto: Maurice Aeschimann

© B.I. Kingelez, Foto: Maurice Aeschimann

Photo: Magnhild Kennedy

Photo: Magnhild Kennedy

Photo: Ronald Smits, Roel Deden

Photo: Ronald Smits, Roel Deden

Messe Frankfurt Exhibition GmbH