TV TECSTYLE VISIONS: IMPRESSIVE CONFIRMATION OF STATUS AS LEADING TRADE FAIR

- High internationality and excellent visitor quality ensure top ra-tings

The trade fair combination for visual communication and haptic adver-tising, EXPO 4.0, was an impressive event with 421 exhibitors and 12,518 visitors held from 30 January to 1 February 2020 in Stuttgart:

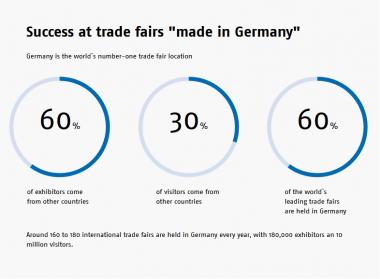

TV TecStyle Visions, trade fair for textile decoration and promotion, enriched the trade fair combination with a top-class exhibitor offering, high internationality and an accompanying programme characterised by innovations and know-how transfer. It proved its status as a leading trade fair for the European textile decoration industry in an impressive way: 262 exhibitors, including all relevant companies from the exhibition segments textiles and technology, mark the importance as a European industry get-together every two years in Stuttgart. The leading trade fair confronts the uncertain European market situation and uncertainties in trade, the number of exhibitors remained almost constant compared to the previous event (2018: 270). The 126 international exhibitors came from 21 countries to Stuttgart. The top 5 countries of origin are Germany, Great Britain, Spain, Poland and Italy.

Many decision-makers from the Germany/Austria/Switzerland region

Within the framework of TV TecStyle Visions the visitors were particularly interested in the different printing processes, embroidery and textiles. The EXPO 4.0 trade fair combination attracted 17 per cent international visitors from 50 countries to Stuttgart. The appeal of the leading European trade fair is manifested with the top visitor countries Switzerland and Austria. 35 percent of all visitors to TV TecStyle Visions travelled more than 300 kilometres to Stuttgart.

The quality of the visitors has been a reliable constant for years: four out of five visitors are actively involved in purchasing and procurement decisions, 87 percent have concrete intentions to invest and 84 percent of the visitors want to invest in the next 12 months. An overall rating of the trade fair combination of 2.0 ("good") and a return visit rate for 4 out of 5 visitors highlight the positive synergy effects created by the parallel timing of the three trade fairs in the trade fair combination EXPO 4.0. This is also reflected in the amount of time visitors spend at the event - on average 4.8 hours at the three trade fairs.

Comprehensive accompanying programme

Apart from the exhibition offering, TV TecStyle Visions has been convincing for years with a comprehensive accompanying programme. Not only real innovations and trends that move the industry are showcased at the stands. At this year's trade fair the TecCheck Area acts as a look into the near future. In the digital microfactory nine companies demonstrated the possibilities of digitalisation in production under the coordination of DITF (German Institutes for Textile and Fibre Research, Denkendorf). A polo-shirt was made in one hour, from the 3D design and conception, through to the printing, thermosetting, cutting and making-up of the garment. The trend topics of the industry and the degree of innovation were also shown in the forum, such as the option of personalisation and automation in textile finishing/textile decoration/garment decoration. The TecStyle Fashion Show, the forum and also Charlie's Corner gave visitors a platform to exchange information and ideas and for know-how transfer, as well as another presentation possibility for the exhibitors.

The next TV TecStyle Visions takes place in the EXPO 4.0 trade fair combination with WETEC and GiveADays in two years. The dates 10 to 12 February 2022 are currently reserved.

Messe Stuttgart

Messe Stuttgart