ISPO TEXTRENDS: TEXTILE TRENDS FOR FALL/WINTER 2018/2019

- Trend preview for designers and product developers

- Registration for ISPO TEXTRENDS 2017 available now

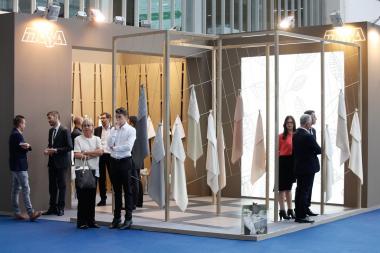

New cloths the country needs: home textiles revive the modern interior design and are the focus of the professional forum for home textiles COMFORTEX at the CADEAUX Leipzig. From September 3rd - 5th 2016 interior designers, property experts, interior designers and craftsmen learn about the "new materiality" in its whole diversity and receive a comprehensive insight into the color and design trends in fabrics and curtains. In addition, the 49th CADEAUX supplies pulses for attractive decorations and innovative glass art and a variety of inspirations around the current lifestyle and culinary enjoyment.

"In September Leipzig presents the theme living for retailers in a great variety," project director Andreas Zachlod says. "A total of 350 exhibitors and brands show on the CADEAUX and on the integrated expert forum for home textiles COMFORTEX their attractive collections and current editions of a modern lifestyle."

Modern materials for room and window

Prestigious brands dominate the exhibition program in the field of cloth and curtain. Among others, the following companies show their innovations: Brändl Textile, Dr. W. Hufnagl, Edi Michel, Florentina embroidery company, Heinz Weckbrodt, Hossner Heimtex, Jürgen Schleiß Confection, Klippan Yllefabrik, Lutex Fabrication, MB Textilmanufaktur, Otto Dotzauer, Raebel, Rovitex, Stickperle, StiVoTex, Verdi Collection, Vogtländische Home Textiles, Voigtmann & Kruschwitz, W. Reuter & Sohn and Wölfel & Co. and also the EuroCom GmbH with quality pressing irons.

About the most important interior trends in terms of cloth the trend forum "New materiality in the room and at the window" will give detailed information. A café with a lecture area invites to stay in an inspiring lounge atmosphere. Bernhard Zimmermann from the sector agency BZ- BBI (Leipzig) and his creative team provide a comprehensive trend update and draw the essential material milieus in four scenarios. In that the products of all exhibitors of home textiles are positioned in the center. Twice a day professional input about the revived enthusiasm of fabrics and of ideas for modern marketing methods will be given in lectures.

Curtains on a triumphal march

"We want to give the visitors the pleasure of selling home textiles, and illuminate advantages and potentials” Bernhard Zimmermann explains. "The creative power of cloths is just rediscovered." Pioneer was the contract business: Here innovative, easy-care fabrics would be appreciated as an excellent light and sun protection and the aesthetic, acoustic and energetic functions of the textile materials would be used. "But also in the living area we are now on the threshold of a trend reversal. The living styles are changing, curtains and drapes are coming back!"

The new "Generation Cloth"

Through cloth livable, pleasant rooms in the work environment, in healthcare, hotels and in private life would arise, so Zimmermann. "They reflect what the modern human being yearn: a cozy retreat that provides livability a new way and in modern colors and raises family warmth."

Suggestions for today's "Generation Cloth" were provided inter alia by the interpretation of advanced architecture, furniture design and creative textile drape of the 50s and 60s. "The market offers the colorations and patterns for every taste - whether comfortably-natural, progressive-young, factually-geometric or classically elegant," Zimmermann says. Not least products such as pillows, blankets or curtains offer an ideal opportunity for seasonal or mood changes in the room.

Inspirational - the lifestyle trends for fall and winter

Living, furnishing and enjoying: Many inspirations and promotional information about modern lifestyle can be experienced in other exhibition areas. Ralf Meuser demonstrates in the forum "Enjoy Meat" premium kitchen accessories in action. With matching accessories from sharp knives and sharp cutting boards, selected roasters and pans to spice mills the chef prepares high quality meat dishes. With practical tips Meuser gives the retailers important sales arguments at hand and points to the potential which lays in the theme "Enjoy Meat".

A traditional material in a stylish garb is staged in the special show GLASklar with emphasis on enjoyment, home accessories and Christmas. On display are glass products from renowned exhibitors - under the label of "Enjoyment" for example, drinking glasses, carafes, dessert bowls, bottles or étagères. Under the heading "Home Accessories" for example lamps, mirrors, pictures and decoration products will be presented. Christmas tree ornaments and figures determine the theme "Christmas". Furthermore, the forum provides a fascinating insight into the art of glass processing and refinement.

Service: opening times and admission prices

CADEAUX with the special forum for home textiles COMFORTEX is opened on Saturday / Sunday (September 3rd and 4th 2016) from 9:30 AM to 06.00 PM and on Monday (September 5th 2016) from 9:30 AM to 05.00 PM. Trade visitors who register online will receive free admission. At the box office the ticket price is EUR 17.00, for regular visitors EUR 8.00. A legitimation as trade visitor is required. The ticket includes also the admission to the open dowry-area of the parallel occurring watch and jewelry fair MIDORA Leipzig.

Milan (GTAI) – According to a study by the rating agency S & P Italy is among the European countries that are least affected by the Brexit referendum. Nevertheless, the after the Brexit resulting market turmoil threatens to slow the fragile recovery of the Italian economy and to lead the already ailing banks in a crisis. The United Kingdom is the fourth most important export market for Italian goods; British tourists are a major source of income for the tourism.

The outcome of the British referendum threatens the delicate recovery of the Italian economy. The business association Confindustria has reduced its GDP growth forecast for 2016 from 1.4% to 0.8%. However, compared to other EU Member States and according to various studies, Italy is little affected directly of the intended withdrawal of the United Kingdom from the EU, but the indirect effects through the market turbulence could become serious.

In a study about the “Brexit sensitivity" of 20 countries made by the rating agency S & P Italy comes on the penultimate place, ahead of Austria. The study analyzes the Brexit effects in the fields of export, finance, foreign direct investments and migration. The reasons for Italy's position are obvious: Compared to other European countries, exports of Italy to the United Kingdom are relatively small. In addition, the financial sector is "relatively Italian". In a European comparison, foreign direct investments in Italy are low; this also concerns the share of investment from the United Kingdom in Italy.

According to the S & P study among the Italian economic areas the activities of the financial sector are the most affected by the Brexit. Volatile markets as a result of the Brexit provide further uncertainty in the sector, which, after the long economic crisis is suffering among other things in their balance sheets under bad loans. In the days after the event the share prices of the Italian banks plunged into the depths. The Italian Government is negotiating with the EU on a new bailout.

The UK is an important trading partner

The decision of the British could have a negative impact on the Italian exports in various sectors. According to the Italian statistical office ISTAT the United Kingdom is ranked 6 of the trading partners in Italy. At the same time, the UK is the fourth largest market for Italian goods. The overall imports from the United Kingdom were EUR 10.6 billion in 2015, while the exports were significantly higher at EUR 22.5 billion. In 2015 the share of the total Italian exports amounted to 5.5%. The Italians sold more only in the United States (8.9%), France (10.5%) and Germany (12.6%).

The risks for the Italian exports may not be underestimated; experts expect a loss of Italian exports to the United Kingdom of EUR 1 to 3 billion. The losses concern primarily the processing industry. According to the study "Il Brexit e l'Italia" of the research institute Nomisma of June 2016, 97% of the Italian exports are finished goods. The most important product groups of Italian exports to the United Kingdom are machinery and equipment (EUR 3.5 billion), food and beverages (EUR 3.1 billion), chemical products (EUR 2.6 billion), Automotive and - parts (EUR 2.6 billion), fashion and clothing (EUR 2.3 billion) and processed and unprocessed metal products (EUR 1.5 billion).

Particularly dependent on British customers are the wineries and furniture designers. For the Italian wine sector the United Kingdom is one of the most important markets. In 2015 Italian wine producers were able to sell wine worth of EUR 745 million, accounting for a share of 14% of total Italian wine exports. The Italian furniture designers sold in 2015 products worth of EUR 950 million to the United Kingdom, what represents a share of 10% of total Italian furniture exports.

Northern Italy has close economic ties with the United Kingdom

According to the Nomisma study the Italian regions are different linked with the economy in the United Kingdom. More than two thirds of Italian exports to the United Kingdom are coming from northern Italy. Nevertheless, northern Italy is less affected by the Brexit than southern Italy, because the proportion of northern Italian exports to the United Kingdom of the total exports of northern Italy is markedly lower than in the south.

From the southern Italian region of Basilicata 15% of the exports go to the United Kingdom. The high rate is due to the Fiat factory in the municipality of Melfi, where two car models are being produced. From Abruzzo and Campania circa 10% of the regional exports are sold in the United Kingdom.

eyond the foreign trade the Italian restaurant and hotel operators are anxious about the impact of the Brexit: According to Banca D'Italia British tourists ranked on the 6th place of tourists and business travelers in 2015. However - the 4.4 million British visitors expended on average per capita significantly more per day than any other European travelers. Overall the expenditure of the British amounted to just over 3 billion euros in 2015 - or more than 8% of the total expenditure of foreign tourists in Italy. A devaluation of the British currency could affect adversely both the number of tourists as well as their expenditure per capita.

Robert Scheid, Germany Trade & Invest www.gtai.de

Sneakers remain the megatrend par excellence in spring / summer 2017. There is no boredom coming up yet. The new shoe collections present themselves varied and innovative: Safari and ethno themes are reinterpreted. Soft romantic and playful decorations set new accents. Newcomers with potential are Mules and Sabots.

While the consumer mood was positive in the first half of 2016 - the shoe retail sector unfortunately could barely benefit of it in many places. Sales in the first six months were two percent lower than last year. The weather conditions were anything but sales promotional: the last winter months were too mild, spring on the other hand was too cool. But this is just one of many causes for the sagging sales of shoe retailing. Deplored also is the loss of appeal of the inner cities and, related with this, the increasing trend of shoe purchasing in the Internet. For the stationary shoe trade this development represents a strong challenge which needs to be mastered. Hope puts the sector on the trend toward shortened trouser forms that lead more attention towards footwear. In the new season the shoe trade has to and wants to invest in target group-oriented shopping ambiance and in marketing methods to provide quality incentives. In many places the product mix has been send back to the testbed. Many traders therefore took advantage of the just ended GDS shoe fair in Dusseldorf in order to learn about the new trends for spring / summer 2017.

Sneakers continue their successful rise and belong to the generational and gender comprehensive trend shoes. The convenient slippers are now being used as footwear for the whole family, from the youngest to the elderly. This trend has often more to do with a sporty look than a sporty use, for many shoe wearer convenience has become a self-evidence. Clean and purist styled models standing next to styles of material mix: glitter, ornamental stones, mesh, metallics, reptile embossing, lasercut and neoprene come in use for the shoes. White soles are an important feature of the new sneaker.

Mules score in a new variety. In trend are toe gripers as well as mules in tube optics and wide (cross) bandages. For purchase incentives models with an anatomic formed footbed and soft uppers (like cork) should care.

Sabots, Mules and Babouch types are indispensable for the new season. The models are mostly flat and come along with slim borders. Very trendy are open toe shown mules with block heels.

Previously Espadrilles were worn only during the (beach) holiday, in the meantime these flat treads have blossomed into absolute trend-outfits. No wonder, because the new models are not only very comfortable, but super stylish also! Particularly noble shafts in a material mix like leather plus metallics come along. Trendy are also Espadrilles made out of linen, exotic printed, trimmed with stripes or sequins and pearls. Non-slipping rubber soles make the Mediterranean shoes now all-weather fit, regardless whether flat, with plateau or wedge.

Loafer with their androgynous variants like Brogue, Budapest and Monk remain important in the coming spring / summer season. It is important that the shoe is light. Filigree, unlined models made of soft suede compete with models with voluminous bottoms.

Sandals are an indispensable part of any summer collection. In addition to models with platform and wide drums are sportier variants. For innovations are sandals with block heels, T-clips and high-front cuts. Hardly to overlook are Lace-up Sandals, a mix of Roman-sandal and Ballerina.

The ethnic and safari trend remains unbroken in spring / summer. Shaft designs with colorful pompons, tassels, embroidery, pearls and braiding determine the optic. Thick, profiled soles ("Briquette plateau") or soles with "shark tooth" profiles have entered the mainstream. Ideal for women who like to “grow” a few centimeters without walking on high heels.

With the great demand for sneakers, the portion of high-tech materials is growing. Leather naturally will not be relinquished for shoes, especially not as soft nappa and suede. Very smooth and glossy surfaces are there among reptile embossing.

The color spectrum in the spring / summer 2017 is discreet. Monochrome color images produce a sustainably-quality look. From pearl gray to titanium ranges the gamut of grays. In addition there are clear, creamy tones with a touch of rosé, sandy shades and powdery-bright models.

Regardless whether as high heel or sneaker - metallic colors of "subtly iridescent" to "mega-glittery" light up many shoes. Silver, bronze and gold are not only trendy in fashion clothes, even the feet are decorated with it in the new season.

Kind + Jugend enjoys unabated popularity: the year's most important business platform for the international baby and children's outfitting industry opens its doors in Cologne from 15 to 18 September 2016. The 100,000 square metres of exhibition space in halls 10 and 11 of Koelnmesse are already completely booked, three months prior to the start of the fair. Around 1,200 companies from more than 50 countries will present their new products and continuing product developments in the segments of children's furniture, safety seats, textile outfitting, prams and hygiene items. Trade visitors from around the world can look forward to industry products of the highest quality. With its 'Support Circle' concept, KInd + Jugend also offers support and information for all target groups of the trade fair.

In terms of the quality of the offering, Kind + Jugend is the measure of all things in international comparison: nowhere else will industry pros find a similarly high number of the most important and high quality manufacturers of baby and toddler products. In 2016, a number of renowned companies from around the world are once again represented with their brands, for example: Alvi, Angelcare, Artsana - Chicco, Britax Römer, Cybex/GB, Done by Deer, Dorel, Doudou et Compagnie, ergobaby, Geuther, Hape, Hartan, Hauck, iCandy, Joolz, kiddy, Käthe Kruse, Mayborn - Tommee Tippee, Micuna, Mutsy, Nuby, Osann, Paidi, Peg Perego, Philips Avent, Pinolino, Recaro, Roba, Rotho, Silver Cross or Julius Zöllner.

Among others, Kind + Jugend this year welcomes Sigikid (Germany), Easywalker (Netherlands), Mima (Spain), 3 sprouts (Canada) or Little Unicorn (USA) as new or return exhibitors.

Supporting programme provides support for industry pros

In addition to the high-class product show, Kind + Jugend, with its so-called 'Support Circle', offers promotional and information offerings for all target groups of the trade fair, from startups and young designers to established, globally active brand manufacturers.

The information and promotional offering is oriented to the typical development and distribution chain of a product. A convincing concept and a prototype is always at the start of a product development process. Kind + Jugend presents the best prototypes with the nominees of the KIDS DESIGN AWARD. The best design will be distinguished on the first day of the trade fair. Furthermore, sponsorships between young designers and industry representative also have an appealing effect. The entry deadline for this year's KIDS DESIGN AWARD is 24 June 2016. Further information can be found here: http://www.kindundjugend.de/kindundjugend/Die-Messe/Events-Veranstaltungen/Kids-Design-Award/index.php.

From 26 to 28 July 2016 trade visitors from the shoe sector will be able to learn about the current trends and innovations revolving around shoes and accessories at GDS – Global Destination for Shoes & Accessories in Düsseldorf. Since the awareness of sustainability in the European footwear sector is increasing and seen as a long-lasting trend in business strategies, the European Confederation of the Footwear Industry (CEC) together with the other European partners of the “Step To Sustainability” project call upon footwear companies to participate in the International Footwear Workshop on Sustainability. The workshop entitled “Green Shoes for a Sustainable life” will be organised at the GDS shoe fair on 28 July 2016. During the workshop, companies will learn how they can increase their business value and sales whilst having a positive influence on social and environmental conditions by adopting sustainable strategies.

The workshop is being organised by the EU funded project “Step To Sustainability”, the aim of which is to create and pilot a new occupation and qualification profile and corresponding training course in the area of sustainable manufacturing in footwear. The project addresses the needs of companies wishing to engage in sustainable manufacturing by elaborating a new qualification profile, which will equip students with the necessary skills and competences to deal with sustainability issues and contribute to increasing the competitiveness of footwear manufacturers.

Applying sustainability to industry is also an important step to take. Environmental sustainability is certainly increasing in the European footwear sector. The footwear industry contributes to and is affected by the environmental degradation and social challenges that society is now facing. What initially was considered as an external environmental regulation to comply with, meaning an obligation, is now becoming part of the DNA of some companies. By introducing positive changes in production choices, companies can increase the popularity of their products and brand among consumers and business partners alike.

Carmen Arias Castellano, General Secretary of the CEC - European Confederation of the Footwear Industry stated: “Not only the environment benefits from a sustainable strategy. It also enhances social responsibility and will allow businesses to enjoy numerous advantages such as increasing revenue and cutting costs, increasing employee attraction and retention rates, creating a healthy workplace leading to greater productivity, and enhancing relationships with stakeholders and communities.”

At the workshop, there will be a presentation on the results of the Step To Sustainability project by a Portuguese SME, which participated in the pilot, as well as two panels of relevant industry representatives, who will explain best practices in the footwear sector. The first panel will focus on the manufacturing phase with presentations from El Naturalista and BATA Brands as well as the organisation LeatherNaturally; while the second will present the retailers’ approach to ensuring sustainability with contributions from Deichmann, Zumnorde, and Avocado Store GmbH.: www.cec-footwearindustry.eu

In its recent business-travel analysis for 2016, the German Business Travel Management Association (Verband Deutsches Reise-management – VDR) announced that German companies are sending more employees on business trips than ever before. In 2015, they made a total of almost 183 million business trips, four percent more than the year before. Five years ago, only one in four employees made a business trip at least once a year. Today, that figure has reached almost 40 percent. Moreover, the number of people taking their holidays abroad is also set to rise to 1.8 billion by 2030 according to the World Tourism Organisation (UNWTO). Three years ago, it was around one billion. A great opportunity with an excellent growth potential for the contract business – for the number of overnight stays increases concomitantly. Hotels and aircraft have to be furnished and equipped to cater for so many guests. Accordingly, it is a field of business that is booming. “The contract business is an enormous growth market. Therefore, Tendence is characterised by numerous high-grade exhibitors for furnishing specialists, interior architects, hotels and restaurants. Thanks to the special services offered, contract-business buyers can plan and organise their visit to the fair for maximum efficiency”, says Tendence Director Bettina Bär.

At Tendence, over 65 specialist exhibitors present an attractive spectrum for furnishing hotels and restaurants. AdHoc, Asa Selection, Koziol and Zero One One offer products from the tableware and wining & dining segments for the premium contract business. In the furniture, home and decorative accessories segment, renowned companies such as Decorama, DPI, Fink, Guaxs, Lambert and Scholtissek are distinguished by great experience in furnishing commercial premises. When it comes to textile furnishings, the exhibitors with suitable ideas include Rica Riebe, Steen Design and Zoeppritz.

The exhibition stands of suppliers for the contract business are clearly marked with the Contract Business label. Additionally, all Contract Business exhibitors are marked in the Tendence catalogue and listed in a separate section in addition to their entry in the main part.

Tendence, the international consumer-goods event

Tendence (27 to 30 August 2016) is Germany’s most international and biggest order fair for consumer goods in the second half of the year with an extensive range of products from the home, furnishing, decorating, gifts, jewellery and fashion accessory segments. At this new-products platform, top brands and key players present their Christmas trends thus giving the national and European retail trade the opportunity to place follow-up orders for the Christmas season. At the same time, they show their collections for the coming spring and summer.

The tourist industry is suffering in many traditional destination countries. Yet outdoor companies say that sales of luggage, accessories and travel wear remains unaffected. Independent tourism is thriving. Good news for outdoor manufacturers - as functional clothing offers more crossover potential than any other sector. OutDoor 2016 in Friedrichshafen - the leading international trade show - will be providing an overview of the latest trends and innovations for the travellers of tomorrow from July 13 to 16, 2016.

The German Travel Association (DRV) has reported the impact of geopolitical factors on the tourism industry. For example, summer bookings are down by 40 per cent in Turkey compared to the previous year. Other European travel associations are reporting similar lower-than-usual booking levels for Egypt and Tunisia. However, the outdoor industry appears unaffected. "We‘ve not seen any impact on our market,? says Columbia (Portland, US). "People continue to travel lots, although given the current political situation they are choosing different destinations.? Lonely Planet, the independent traveller’s bible, currently recommends visiting the following countries: Botswana, Japan, Poland, Palau, Latvia, Australia, Uruguay, US, Greenland and Fiji. Not exactly classical, low-cost family destinations, but still potential paradises for outdoor and adventure travel.

Thomas Groeger, country manager Fjällräven Germany is also confident, "More and more people are looking for alternatives to the conventional beach holiday. Outdoor- and sport-related travel is particularly popular.? Gerold Ringsdorf, product trainer Jack Wolfskin sees "interrail travellers and globetrotters? as "important founders of the outdoor movement.” Travel garment manufacturer ExOfficio (Seattle, US) agrees, pointing to a survey where 42 per cent of Europeans describe themselves as adventure travellers. Package tourism might still dominate the market, but it continues to be frowned upon. In contrast, independent travel is seen as an attractive, if complicated option for the masses.

The Future institute “Zukunftsinstitut” (Frankfurt/ Vienna) observes a new phenomenon which it calls the "normtrotter”: vacationer looking for a personalized experience and personalized service, but who still want their bookings arranged in advance. And from America, there’s a newly-coined expression to describe more affluent backpacking for normal travellers: flashpacking. The term refers to traditional backpacking only with flash, or style, i.e. adventure travellers who desire style and comfort. Travelers in this growing segment prefer to sleep in their own hotel room, hire a car instead of using overcrowded coaches and plan ahead using modern communication devices rather than going with the flow and improvising.

"Backpacking used to be the exception, something for adventurers only. Nowadays, it‘s a common way of travelling,“ comments Thomas Groeger. Young people in particular prefer to travel in a simpler manner. "The gap year - young people wanting to work and travel abroad - is a definite trend,“ adds Gerold Ringsdorf.

Modern travel equipment is designed to meet people’s requirements regarding performance and security. Backpacks and bags have anti-theft slashproof straps to stop bag slashers and RFID-blocking pockets to keep personal information and data safe. Travel apparel is often made of insect-repelling fabrics or has UV protection suitable for tropical sun, plus moisture management and odour control. In addition, today‘s travel wear is lightweight, easy-care and takes up little space in your backpack.

Modern travel wear also offers significant crossover potential for outdoor and everyday use. UV protection and protection against mosquitoes or ticks is also useful in central and northern Europe. "Of course urban outdoor, outdoor lifestyle and travel wear styles often look pretty similar,? says Wolfgang Jahn, sales manager Europe Royal Robbins, while Oliver Robens, sales director Europe Craghoppers adds, "it’s possible to look good both in the jungle and about town.? However, real travel apparel sets itself apart through its functional characteristics and extra details. And this is exactly why specialist providers have been so successful over the years.

To find out which new trends and products innovations will be shaping the industry in 2017, visit the international OutDoor trade show in Friedrichshafen. OutDoor 2016 is open to industry visitors only from Wednesday, July 13 to Saturday, July 16 (Wednesday to Friday from 9 a.m. to 6 p.m. and Saturday from 9 a.m. to 5 p.m.). For more information, please visit: www.outdoor-show.com.

© Messe Friedrichshafen | OutDoor Show | www.outdoor-show.de

© Messe Friedrichshafen | OutDoor Show | www.outdoor-show.de

© Messe Friedrichshafen | OutDoor Show | www.outdoor-show.de

© Messe Friedrichshafen | OutDoor Show | www.outdoor-show.de

© Messe Friedrichshafen | OutDoor Show | www.outdoor-show.de

© Messe Friedrichshafen | OutDoor Show | www.outdoor-show.de

© Messe Friedrichshafen | OutDoor Show | www.outdoor-show.de

© Messe Friedrichshafen | OutDoor Show | www.outdoor-show.de

© Messe Friedrichshafen | OutDoor Show | www.outdoor-show.de

© Messe Friedrichshafen | OutDoor Show | www.outdoor-show.de

© Messe Friedrichshafen | OutDoor Show | www.outdoor-show.de

© Messe Friedrichshafen | OutDoor Show | www.outdoor-show.de

Moscow (GTAI) – In spring 2016 the Russian government has decided a "Strategy for the development of the light industry until 2025" and a "Federal program to support enterprises of the light industry" (anticrisis plan). Hence the Russian textile enterprises should be supported in the crisis. It is the aim of the Ministry of Industry and Trade to double the share of domestic producers on the clothing market from currently 25% to 50% in the year 2025.

According to the Ministry of Industry and Trade 14,000 companies (including 200 large enterprises) of the Russian light industry are producing clothing, textiles, footwear and leather goods. They generate annually a turnover of Ruble 270 billion. Of that 653 large and medium and 4,000 small businesses are operating in the yarn and textile industry. Because the purchasing power and consumer demand fell, the light industry slowed its production in 2015 by 12%.

To give the clothing and textile factories more security, the Russian government adopted in spring 2016 a "Strategy for the development of the light industry until 2025" and a "Federal program to support enterprises of the light industry" (anticrisis plan). It is the aim of the Ministry of Industry and Trade to double the share of domestic producers on the clothing market from currently 25% to 50% in the year 2025. In this context up to 330,000 additional jobs should be achieved.

Anticrisis plan provides subsidies of Ruble 1.475 billion

In the anticrisis plan Ruble 1.475 billion will be granted. This should especially support manufacturers of school uniforms, children's apparel and textile factories that work on government orders. The financial support includes: subsidies for producers of school uniforms for the lower classes made out of Russian worsted fabrics (Ruble 600 million), subsidies for working capital loans to support purchases of raw materials (Ruble 800 million), subsidies for investment loans for technical modernization of enterprises (Ruble 75 million).

Industrial parks and clusters for the light industry are growing

In addition, two industrial parks for the clothing and textile industry will be set up in the areas of Ivanovo and St. Petersburg. In addition, a regional cluster of the light industry in the Chelyabinsk region of the South Ural is growing. The fund for the development of the Russian industry promotes investments with low interest rates on credits, for example the project of Praimteks (Primetex) in the Ivanovo region for the production of textiles using digital textile printing (credit: Rubles 466 million rubles).

Further, the domestic producers of clothing and footwear should gain access in future to the funding instruments of the federal association for the development of small and medium-sized enterprises. Critics complain, that the subsidies reach mostly large companies only and above all companies working with government contracts.

Capacity building for chemical fibers

Export opportunities are seen by the Ministry of Industry in synthetic fibers. In the textile cluster Ivanovo (http://invest-ivanovo.ru/data/prog.pdf) a chemical fiber plant is growing with public aid, scheduled to begin production from 2018. With that 250,000 t chemical fibers would additionally annually be available. Until now both manufac-turers Komitex and Wladimirski Polyefir produce together 33,000 t chemical fibers per anno. Viscose is currently not being produced at all in Russia. The import share of polyester is 74%, of polyamide 88%.

In future the synthetic fibers may be supplied to BTK Textile and other customers. The production complex of BTK Textile in the textile City Shakhty in the Rostov region, was inaugurated in June 2015. The company manufactures high-tech textiles and knitwear made out of synthetic fibers of which work-wear, sport-wear and ski-wear are being sewn. BTK Textile has fabric production capacities of about 12 million square meters per year, General Director Sergey Bazoev says. Up to now BTK Textile has to buy the synthetic fibers and yarns predominantly in Asia. That could change soon. The BTK Group is the largest Russian manufacturer of men's clothing and uniforms.

| Description | 2015 | Change 2015/2014 |

|---|---|---|

| Cotton fiber (mio. bales) | 111.0 | 4.4 |

| Chemical fibers (mio. bales) | 66.0 | -4.5 |

| Fabrics (mio. sqm) | 4,542 | 14.7 |

| .thereof from: : | ||

| .Silk (1,000 sqm) | 253,0 | 31.8 |

| .Wool (1,000 sqm) | 9.262,0 | -20.9 |

| .Linen | 25,9 | -26,6 |

| .Cotton | 1.176,0 | -4,5 |

| .Chemical fibers | 237,0 | 14,2 |

| Fabrics made out of other materials | 3.084,0 | 25,1 |

| Fabrics with plastic impregnation (mio. sqm) | 32,3 | 14,6 |

| Bed-linen (mio. pieces) | 59,8 | -9,6 |

| Carpets (mio. sqm) | 22,6 | -3,7 |

| Knitwear (1,000 t) | 14,2 | 29,8 |

| Stockings (mio. pair) | 199 | -5,6 |

| Coats (1,000 pieces) | 989 | -22,1 |

| Lined jackets (1,000 pieces) | 1.887 | -45,4 |

| Suits (1,000 pieces) | 4.690 | -12,6 |

| Men’s jackets and blazer (1,000 pieces) | 870 | 14,1 |

| Women’s coats with fur collar (pieces) | 5.543 | -46,1 |

| Clothing made out of artificial fur (1,000 pieces) | 24,5 | 21,0 |

| Uniforms and workwear (mio. pieces) | 20,7 | -8,2 |

| Work- and protective clothing (mio. pieces) | 99,8 | 14,6 |

| Overalls (1,000 pieces) | 733 | -62,4 |

Source: Rosstat 2016

| Description | 1st Quarter 2016 | Change 1st Quarter 2016 / 1st Quarter 2015 |

|---|---|---|

| Sewing thread made out of synthetic fibers (mio. reels) | 14,0 | -0,6 |

| Fabrics (mio sqm) | 1,2 | 23,3 |

| Bed linen (mio pieces) | 14,7 | -7,7 |

| Knitted stockings (mio. pairs) | 55,4 | 34,0 |

| Knitwear (mio. pieces) | 24,8 | -6,0 |

| Workwear, uniforms (mio. pieces) | 31,1 | 11,2 |

| Coats (1,000 pieces) | 269 | 9,1 |

Source: Rosstat 2016

Contact addresses:

Ministry of Industry and Trade

Department of Light Industry

Denis Klimentewitsch Pak, Director of the Department

109074 Moskau, Kitajgorodskij proesd 7

Tel.: 007 495/632 8004 (Sekretariat), Fax: -632 88 65

E-Mail: dgrvt@minprom.gov.ru, Internet: http://minpromtorg.gov.ru

(Sub) department of Light Industry: Director: Irina Alekseewna Iwanowa,

Tel.: -632 87 31, -346 04 73; E-Mail: ivanovaia@minprom.gov.ru

Internet: http://minpromtorg.gov.ru/ministry/dep/#!9&click_tab_vp_ind=1

"Strategy for the development of Light Industry until 2025."

http://www.kptf.ru/images/company/Presentation.pdf (Presentation of the strategy)

http://minpromtorg.gov.ru/docs/#!strategiya_razvitiya_legkoy_promyshlennosti_rossii_na_period_do_2025_goda (Text of the strategy and action plan)

Russian Union of Entrepreneurs of Textile and Light Industry

107023 Moskau, uliza Malaja Semenowskaja 3

Tel.: 007 495/280 15 48, Fax: -280 10 85

E-Mail: info@souzlegprom.ru, Internet: http://www.souzlegprom.ru

Ullrich Umann and Edda Wolf, Germany Trade & Invest www.gtai.de

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

Textination

An overview of the programme (location: Club at the Postbahnhof):

Tuesday 28 June 2016

| 10 a.m. | Opening. In German. |

| 10.30 a.m. | Press tour following the opening (start point: press Lounge) |

| 11 a.m. | Press conference TransFair e.V. "Designing supply chains to be sustainable – Fairtrade textile standards and textile plan" (location: press lounge, upper floor, Postbahnhof). In German. |

| 2 p.m. | Press tour (start point: press Lounge) |

| 3 p.m. | Salonshow with outfits by Austriandesign.at, Bhusattva, Carpasus, Cocccon, Elementum by Daniela Pais, Elisa F., Heartcouture, Inti Ferreira, Lanius, Soome, Studio Elsien Gringhuis, Studio Jux, Tuschimo. Invitation only! |

| 5 p.m. | Ethical Fashion on Stage with outfits by Anzüglich organic and fair, Chapati, Daily´s Nothings Better, De'qua, Get Lazy, La Robe d'Inna, Milena with Love, Mud Jeans, Najha, Noumenon, Päälä, Tijar, Tranquillo, Verena Bellutti. Invitation only! |

Wednesday 29 June 2016

DTB Infotag – Responsible Management of Supply Chains Social Compliance and Chemical Input

Moderation: Rolf Heimann, Vorstand, hessnatur Stiftung

| 10.00 a.m. | Welcome and introduction by the DTB and Messe Frankfurt |

| 10.15 a.m. | "The consequences of global free trade", Dr Sabine Ferenschild, Research Assistant, Südwind e.V. |

| 10.45 a.m. | "Corporate Responsibility Review 2016 – annual report on global corporate responsibility", Lisa Häuser, Senior Analyst, Oekom Research AG |

| 11.30 a.m. | "Transparent and sustainable sourcing", Deniz Thiede, Managing Director, ATICS GmbH |

| 11.50 a.m. | "Sustainability, REACH etc. – Quo Vadis?“, Dr Dirk von Czarnowski, Vice President Global Chemical, Intertek Holding Deutschland GmbH |

| 12.15 a.m. | Guided tour(s) of the trade fairs |

| 1.45 p.m. | Update on the Partnership for Sustainable Textiles, Dr Bernhard Felmberg, assistant state secretary, Federal Ministry for Economic Cooperation and Development |

| 2 p.m. | Presentation of a collaborative project to promote sustainability, Carolin Bohrke, hessnatur Stiftung |

| 2.20 p.m. | "Best practices in supply chain management transparency", Prof. Patrick Kugler, HAW Hamburg |

| 2.40 p.m. | "Company-customer relationships in a CSR context", Prof. Rudolf Voller, Hochschule Niederrhein |

| 3.15 p.m. | "The Emperor's New Clothes – is transparency coming to the fashion industry?" Panel discussion with speakers, exhibitors and companies in the industry |

| 12.30 p.m. | Press conference Bündnis für nachhaltige Textilien / GiZ (location: press lounge, upper floor, Postbahnhof) |

Thursday 30 June 2016

| 10 a.m. | Talk “The true costs of cotton", Mariska Przyklenk, Fairtrade Deutschland. In German. |

| 11.30 a.m. | Talk "GOTS and IVN-Best summarised. How the certification ensures that you can meet the requirements of governmental and non-governmental organisations", Claudia Kersten, GOTS und Heike Scheuer, IVN. In German. |

| 1 p.m. | Talk "More sustainable fibres and materials – from vision to volume", Simone Seisl, Textile Exchange. In German. |

| 2 p.m. | Podium discussion "Transparency in the supply chain", with Renate Künast (MdB, Bündnis 90/Die Grünen), Stefan Genth (Managing Director HDE Handelsverband Deutschland), Matthias Hebeler (Managing Director Brainshirt), Claudia Lanius (Managing Director Lanius). In German. |

| 3.30 p.m. | Talk and interactive game: "Fair Wear Foundation towards sustainable global garment supply chains", Andrea Spithoff and Maaike Payet, Fair Wear Foundation. In English. |

Videos, photos and other Information:

www.greenshowroom.com

www.ethicalfashionshowberlin.com

www.facebook.com/greenshowroom

www.facebook.com/ethicalfashionshowberlin

www.youtube.com/greenshowroom

www.youtube.com/EFSBerlin

www.instagram.com/greenshowroom

www.instagram.com/ethicalfashionshowberlin

Dubai / Islamabad (GTAI) - Pakistan's textile and clothing industry has urgently to invest. The international competition has intensified. The companies need to modernize their technology and increase their processing depth. The country wants to get away from the production of simple fabrics and yarns. The GSP Plus agreement with the EU and an improvement in the security situation have improved the investment climate. In high-end machines Pakistan is dependent on imports.

Pakistan's textile and clothing industry expects better sales opportunities abroad in the next few years, particularly with the European Union. Early 2014 Pakistan has received from the EU the GSP Plus status (Generalized System of Preferences) that allows the country to supply goods at a lower rate of duty or even with a completely duty exempt in the EU. Particularly the textile and clothing industry benefits from the agreement, as the sector provides almost 80% of Pakistan's exports to the EU. The government even hopes on additional exports for the sector worth USD 1 billion per year.

Following the latest available trade figures, Pakistan increased in 2014, the year in which the GSP Plus agreement came into force, its total exports of clothing by almost 10% to around USD 5 billion. Official figures of exports to the EU are not available. According to the foreign trade statistics, in any case exports to Germany have increased in clothing by 13% to almost USD 500 million, in textiles by 18% to USD 434 million and in footwear by 27% to USD 34 million.

| SITC | Productgroup | 2013 | 2014 | Change 2014/2013 |

|---|---|---|---|---|

| Export | ||||

| 65 | Textiles | 9,341 | 9.077 | -2,8 |

| 84 | Clothing | 4,549 | 4.991 | 9,7 |

| 85 | Shoes | 109 | 132 | 21,1 |

| 26 | Textile Fibres | 370 | 308 | -16,8 |

| ..2631 | Cotton | 217 | 181 | -16,7 |

| Import | ||||

| 65 | Textiles | 1,245 | 1.545 | 24,2 |

| 84 | Clothing | 68 | 86 | 26,0 |

| 85 | Shoes | 67 | 84 | 25,2 |

| 26 | Textile Fibres | 1,369 | 1.287 | -6,0 |

Source: UN Comtrade

Demand for textile machinery rises

Market observers anticipate increased investments in machinery. A particular dynamic effort is expected in the demand for textile printing machines, dyeing machines, tenter frames and other finishing techniques. Positive for the investment climate will be the effect of the expected increase in textile exports to the EU and the improvement of the security situation. In recent years power shortages and a precarious security situation have inhibited the production and investment activity.

The market for textile machinery (SITC 724) grew significantly since 2014. In the country itself only relatively simple machines are being manufactured. High-end equipment is mostly imported. The import of textile machinery rose to USD 585 million in 2014, an increase of 17% compared to 2013.

| Year | Value (in Mio. US$) |

|---|---|

| 2014 | 585 |

| 2013 | 498 |

| 2012 | 439 |

| 2011 | 488 |

| 2010 | 455 |

| 2009 | 217 |

| 2008 | 385 |

*) SITC 724, including pieces

Source: UN Comtrade

| Land | 2014 | Veränderung 2014/2013 | Anteil |

|---|---|---|---|

| VR China | 145 | 40.7 | 24.8 |

| Japan | 139 | 22.6 | 23.7 |

| Schweiz | 75 | 55.2 | 12.8 |

| Deutschland | 71 | -24.9 | 12.1 |

| Italien | 50 | 9.3 | 8.6 |

| Indien | 15 | 28.0 | 2.6 |

| Gesamt | 585 | 17.5 | 100 |

*) SITC 724, including pieces

Investments urgently needed

Competition from PR China, Bangladesh, India and Sri Lanka has intensified. Pakistan's textile industry needs to modernize and upgrade, to increase its productivity and the added value. Pakistan covers the entire value chain from fiber preparation from to the end product. Despite this well-position predominantly simple products are being produced. Only an estimated 40 companies are vertically integrated and cover the entire textile processing.

With an annual harvest of about 13 million bales Pakistan is the world's fourth largest cotton producer. In addition about 600.000 tons of synthetic fibers are being manufactured in the country. According to reports there are 21 manufacturers of filament yarn with a capacity of 100.000 t; the production is supported by a PTA plant with a capacity of 500.000 t.

| Product | Value (in Mio. US$) | Change | Share |

|---|---|---|---|

| Knitwear | 1,792 | 7.5 | 18 |

| Readymade Garment | 1,548 | 8.5 | 15 |

| Bed Wear | 1,570 | -2.4 | 15 |

| Towels | 580 | 1.8 | 6 |

| Tent, Canvas, Tarpaulin | 105 | 82.0 | 1 |

| Made-ups (Other Textiles) | 486 | -0.5 | 5 |

| Cotton Cloth | 1,860 | -26.5 | 18 |

| Cotton Yarn | 1,461 | 2.0 | 14 |

| Raw Cotton | 142 | -9.4 | 1 |

| Art-Silk& Synthetic Textile | 274 | -17.0 | 3 |

| Other Textile Products | 350 | 0.0 | 4 |

| Summe | 10,168 | -1.6 | 100 |

Sources: Pakistan Bureau of Statistics; TMA - Towel Manufacturers Association

Yarn production has lost competitiveness

According to sector experts In the past decade yarn manufacturers made no larger investments to upgrade their production, although money would have been available for such investments. The reason for that should have been the heavy competition from China, India and Bangladesch. Ten years ago Pakistan used to be one of the most efficient yarn manufacturers worldwide. Because modernization investments failed to materialize, this technique applies as outdated in Pakistan today.

The companies complain about high production costs and are demanding more favorable electricity tariffs and protectionist measures against import competition. A negative effect on the production and the investment climate in the country also have the electricity shortages and the tense security Situation.

The textile sector in Pakistan is characterized by numerous large textile companies with quite a large number of small businesses opposite which mostly belong to the so-called informal sector. The informal sector, for example, includes small family companies or small productions, which are not taxable. The informal sector produces mainly simple products for the domestic market. It works with discarded equipment of the larger companies, imported used machinery or cheap equipment from China. The official statistics do not take the informal sector into account.

| SITC | Productgroup | 2013 | 2014 | Veränd. |

|---|---|---|---|---|

| 724.3 | Sewing machines, from | 18.508 | 31.034 | 67,7 |

| PR China | 9.795 | 19.925 | 103,4 | |

| Japan | 2.596 | 3.694 | 42,3 | |

| Vietnam | 479 | 911 | 90,3 | |

| Germany (Rank 5) | 856 | 750 | -12,4 | |

| 724.4 | Spinning and other machines for textile processing, from | 255.311 | 258.348 | 1,2 |

| Japan | 74.961 | 61.771 | -17,6 | |

| Switzerland | 36.203 | 57.814 | 59,7 | |

| Germany (Rank 3) | 64.086 | 46.545 | -27,4 | |

| 724.5 | Weaving machines, from | 121.860 | 179.424 | 47,2 |

| Japan | 29.997 | 68.090 | 127,0 | |

| PR China | 31.305 | 53.706 | 71,6 | |

| Italy | 6.666 | 11.275 | 69,1 | |

| Germany (Rank 6) | 5.290 | 6.097 | 15,2 | |

| 724.6 | Auxiliary machines, from | 30.953 | 36.801 | 18,9 |

| PR China | 8.797 | 11.935 | 35,7 | |

| Germany (Rank 2) | 6.429 | 4.880 | -24,1 | |

| Japan | 2.055 | 3.614 | 75,9 | |

| 724.7 | Machines for dying, washing, drying, from | 61.620 | 64.825 | 5,2 |

| PR China | 9.855 | 12.455 | 26,4 | |

| Italy | 14.867 | 11.527 | -22,5 | |

| Germany (Rank 3) | 16.652 | 11.494 | -31,0 | |

| 724.8 | Machines for leather processing and footwear manufacturing, incl. parts, from | 5.854 | 8.722 | 49,0 |

| Italy | 3.674 | 4.985 | 35,7 | |

| PR China | 1.542 | 2.338 | 51,6 | |

| Finland | k.A | 192 | k.A. | |

| Germany (Rank 5) | 29 | 140 | 381,6 | |

| 724.9 | Parts for textile machines, from | 3.996 | 5.760 | 44,2 |

| PR China | 2.107 | 2.854 | 35,5 | |

| Germany (Rank 2) | 617 | 669 | 8,4 | |

| Italy | 528 | 661 | 25,3 |

Katrin Pasvantis, Germany Trade & Invest www.gtai.de

Moscow (GTAI) - Sales of apparel and home furnishings will continue to decline in 2016. Lower real income leads to falling demand. Russian customers buy fewer clothes and are increasingly watching the price. Most sales shrink in the medium price segment. Fashion chains react on the declining market volume by closing stores and focus on profitable locations. In contrast, the online trade is growing. In comparison to the year before Russia's clothing market shrank in 2015 year by 9% to a volume of Rubles 1.4 billion. Converted into USD the decline was even 43%. The discrepancy between the value in Rubles and in USD is due to the drastically fallen value of the Russian currency. For the textile and clothing industry, the Ruble devaluation means a fundamental change in the general framework: more expensive imports, lower personnel costs in Russia and rising export opportunities.

Customers change from the middle to the lower price segment

In addition, the real income of the Russian population declines and thus the purchasing power. Russian customers buy less clothing and watch more and more the price. Sales shrink at the most in the medium price segment. Many customers orientate themselves on low-price segments (mass market), which will increase in 2016 by 5 to10% to a share of 65 to 70%, the Fashion Consulting Group predicts. The proportion of the premium and luxury segment remains unchanged.

An average Russian household has cut its spending on clothing and home textiles by 30 to 50%, experts estimate. Especially the suppliers of imported textiles and clothing got to feel this, their prices had to be increased most, what damaged the business of foreign brand suppliers. In 2015 the Russian imports of textiles and clothing fell by 25%. This tendency continues in 2016.

Distribution networks in the stationary trade become thinned

Because of the price pressure manufacturers and retailers in the fashion market shorten their staff, negotiate discounts for the shop rental, reduce the collections, simplify cuts and save on quality. While many Russian brands used to buy their materials in the EU and in Turkey, designers and producers now can only afford cheap synthetic fabrics from China. The advertising budgets were slashed in 2015 by 40 to 45%. Moreover clothing suppliers react by closing stores and concentrate on most profitable locations. Since 2014 more than eleven international brands have left the Russian market. These include Gerry Weber from the middle price segment, Laura Ashley, Chevignon and Seppälä; from the mass market segment Esprit, New Look, OVS, River Iceland and Wendys.

Marks & Spencer closed 3% of its stores, Mango 7%, Gloria Jeans 12%. The largest drop in the number of stores are reported from the brands Vis-a-Vis (-65%), Motivi (-40%), Savage (-29%) and Incity (-17%). Maratex closed its franchise stores for clothing brands like Esprit, New Look, OVS and River Iceland 2015 in Russia. The Finnish Stockmann sold its seven department stores in Russia for EUR 5 million to Reviva Holdings Ltd. (owner of the franchise store chain Debenhams) and gave up the business of its brands Lindex and Seppälä.

Adidas has closed 2015 167 of its 1,100 shops in Russia, planned are 200. The German sportswear manufacturer acquired 2015 the central warehouse Chekhov-2 with an area of 120,000 square meters in the Moscow region. The purchase price is supposed at a total between USD 70 and 100 million. The Finnish Kesko informed in February 2016 that it wants to sell the Russian Intersport chain because of poor financial results.

The retail chain Modny continent (brands: Incity, Deseo) reduced the number of its stores by 35. At the end of the first quarter of 2016 they still owned 301 stores. The Melon Fashion Group disposed in 2015 27 unprofitable stores, for this they opened 37 new ones. Melon owned December 31st 604 stores throughout Russia (befree 234, Zarina 203, Love Republic 167), of which 134 are franchise stores (befree 56, Zarina 44, Love Republic 34). A new concept of the stores - larger retail space and more modern design – should help against the crisis.

The Spanish designer brand Desigual closed its Russian stores end of September 2015, but they remain on the market in multibrand stores. A similar course is followed by other brands.

Eleven fashion brands enter the Russian market in the first half year of 2016

A small gleam of hope: Eleven fashion brands announced to enter the Russian market in the first half year of 2016. This happened already at the end of 2015 with budget brands like Cortefiel, Superdry and Violetta by Mango. H & M, Monki, Uniqlo and Forever 21 want to continue to expand in Russia.

Already in 2015 the number of H & M stores grew in Russia by 35% to 96 stores. On April 28th 2016 the menswear house Henderson opened a new salon in the shopping center "Zelenopark" in Zelenograd near Moscow. With this Henderson (brands: Henderson, Hayas) is now represented in 164 major shopping centers in 56 Russian cities. Hugo Boss inaugurated on April 8th 2016 a new shop in the Outlet Village Pulkovo.

The vertically integrated chain Gloria Jeans has changed it’s headquarter at the beginning of 2016 from Rostov-on-Don to Moscow and rented there 3,500 square meters in the Arma plant. Until the end of 2016 Gloria Jeans plans to extend on 5,000 square meters and further to 10,000 square meters until 2017. The capital should serve as a gateway to the world market: Gloria Jeans plans to open an office in Hong Kong. The company has eight regional offices and two large logistics complexes in Novosibirsk and Novoshakhtinsk.

| Nr. | Brand | Country | Profile | Shopping mall | Price segment |

|---|---|---|---|---|---|

| 1 | Demurya | France/Russia | Clothing | Smolenskij Passash | Premium |

| 2 | John Varvatos | USA | Clothing | Crocus City Mall | Premium |

| 3 | Il Gufo | Italy | Clothing for children | ZUM | Premium |

| 4 | Barbour | United Kingdom | Clothing | GUM | upper middle |

| 5 | Armani Exchange | Italy | Clothing | Mega, Aviapark | middle |

| 6 | Veta | Estland | Clothing | Streetretail, Kamenoostrowskij | middle |

| 7 | Love Stories | Netherlands | Underwear | Einkaufszentrum "Modny Seson" | middle |

| 8 | Victorias Secret Pink | USA | Underwear, clothing | Evropejskij | middle |

| 9 | Hunkemöller | Germany | Underwear | Mega | middle |

| 10 | Undiz | France | Underwear | Mega | lower |

| 11 | Aigle | France | Clothing, shoes | Street retail, Olimpijskij pr-t | middle |

Source: Retail.ru

Online sale with clothing is growing – Chinese suppliers are expanding

In contrast to the declining sales in the stationary apparel trade, the demand in outlets and on the Internet is rising. The number of visits and the average amount of receipts at the Fashion House Outlet Centre Moscow has risen by two times since July 2013, director Brendon O'Reily reports. The Fashion House Group offers online shopping since 2016.

The association of Internet trading companies (http://www.akit.ru) estimates that sales on the Internet in 2015 were Rubles 760 billion (+ 7%). The share of clothing and footwear was 35 %. Already in 2014 the online trade had grown by a third. Online stores are operated by KupiVIP, Lamoda and Finn Flare. Alone at KupiVIP the number of orders increased by 45% to a volume of Rubles 16.5 billion in 2015.

Manufacturers and distributors therefor boost the online trade. The government wants to promote the export of Russian goods and is planning a large Internet trading platform. Models are Alibaba (China) and JD.com. However Russian customers are buying increasingly from Asian webshops. Only in 2014 the popularity of online orders in China increased threefold.

Contac addresses

Fashion Consulting Group

(Consulting, Marketing, PR)

125009 Moskau, Maly Gnezdnikowskij pereulok 4

Tel.: 007 495/629 74 25, -629 76 23

E-Mail: info@fashionconsulting.ru, Internet: http://www.fashionconsulting.ru

Russian Buyers Union

119034 Moskau, ul. Prechistenka 40/2, Gebäude 3, Büro 110

Tel.: 007 499/350 51 40

E-Mail: info@buyersunion.ru, relations@buyersunion.ru

Internet: http://www.buyersunion.ru

Ullrich Umann und Edda Wolf, Germany Trade & Invest www.gtai.de

Moscow (GTAI) - Sales of textiles and clothing will continue to decline. Production in Russia however will rise. Due to the strong Ruble devaluation in the last two years, the conditions for the textile and clothing industry have completely changed. On the one hand falling real incomes lead to declining demand. On the other hand labor costs have fallen under Asian benchmarks.

| Description of goods 2015 | Change | 2015/2014 |

|---|---|---|

| Cotton fiber (mio. bales) | 111.0 | 4.4 |

| Man-made fiber (mio roles) | 66.0 | -4.5 |

| Fabrics (mio. sqm) | 4.542 | 14.7 |

| thereof: | ||

| Natural Silk (1.000 sqm) | 253.0 | 31.8 |

| Wool (1.000 qm) | 9,262.0 | -20.9 |

| Linen | 25.9 | -26.6 |

| Cotton | 1,176.0 | -4.5 |

| Man-made fiber | 237.0 | 14.2 |

| Fabrics made of other materials | 3,084.0 | 25.1 |

| Fabrics with plastic impregnations (mio. sqm) | 32.3 | 14.6 |

| Bed linen (mio. sets) | 59.8 |

-9.6 |

| Carpets (mio. sqm) | 22.6 | -3.7 |

| Knitwear (1.000 t) | 14.2 | 29.8 |

| Hosery (Mio. Pair) | 199 | -5.6 |

| Coats (1.000 pc.) | 989 | -22.1 |

| Lined jackets (1.000 pc.) | 1,887 | -45.4 |

| Suits (1.000 pc.) | 4,690 | -12.6 |

| Mens jackets and blazer (1.000 pc.) | 870 | 14.1 |

| Ladies coats with fur collar (pc.) | 5,543 | -46.1 |

| Clothing made out of artificial fur (1.000 pc.) | 24.5 |

21.0 |

| Uniforms and workwear (mio. pc.) | 20.7 | -8.2 |

| Work – and protective wear (mio. pc.) | 99.8 | 14.6 |

| Overalls (1.000 pc.) | 733 | -62.4 |

Source: Rosstat 2016

| Description of goods | 1st Quarter 2016 | 1st Quarter 2016 / 1st Quarter 2015 |

|---|---|---|

| Sewing threads- made out of synthetic fiber (mio. rolles) | 14.0 | -0.6 |

| Fabrics (billion sqm) | 1.2 | 23.2 |

| Bed linen (mio sets) | 14.1 | -7.7 |

| Knitted stockings (mio. pairs) | 55.4 | 34.0 |

| Knitwear (mio. pc.) | 24.8 | -6.0 |

| Workwear Uniforms (mio. pc.) | 31.1 | 11.2 |

| Coats (1.000 pc. ) | 269 | 9.1 |

Source: Rosstat 2016

Contact addresses

Russian Union of Entrepreneurs of the Textile and Light Industry

107023 Moskau, uliza Malaja Semenowskaja 3

Tel.: 007 495/280 15 48, Fax: -280 10 85

E-Mail: info@souzlegprom.ru, Internet: http://www.souzlegprom.ru

Ministry of Industry and Trade

Department of Light Industry

Denis Klimentewitsch Pak, Director of the Department

109074 Moskau, Kitajgorodskij proesd 7

Tel.: 007 495/632 8004 (Sekretariat), Fax: -632 88 65

E-Mail: dgrvt@minprom.gov.ru, Internet: http://minpromtorg.gov.ru

Light industry department:

Director: Irina Ivanova Alekseewna,

Tel.: -632 87 31, -346 04 73; E-Mail: ivanovaia@minprom.gov.ru

Internet: http://minpromtorg.gov.ru/ministry/dep/#!9&click_tab_vp_ind=1

"Strategie für die Entwicklung der Leichtindustrie bis zum Jahr 2025"

http://www.kptf.ru/images/company/Presentation.pdf (Präsentation zur Strategie)

http://minpromtorg.gov.ru/docs/#!strategiya_razvitiya_legkoy_promyshlennosti_rossii_na_period_do_2025_goda (text of the strategy and action plan)

Ullrich Umann and Edda Wolf, Germany Trade & Invest www.gtai.de

Warsaw (GTAI) - The outlook for sales of clothing and footwear in Poland is favorable. Domestic chains such as LPP, Bytom, Vistula and Monnari are opening additional stores. In 2016 the shoe chain CCC is investing around EUR 33 mio in new sales areas, including in Germany. The western neighboring country is by far the biggest buyer of clothing from Poland. Increasingly popular too is fashion from Germany, which occupies the third place among supplying countries.

In Poland the demand for clothing and footwear is steadily growing. The market research firm PMR (http://www.pmrpublications.com) expects in 2016 sales worth of Zloty 35.3 billion (approximately EUR 8.2 billion, 1 Euro = 4.3283 Zl, as of April 22nd 2016). The price war however is very tough due to the higher US dollar exchange rate, the dealers can hardly pass their higher costs on to the customers. This concerns mainly imported commodity goods from the Far East, while the outlook for the upscale segment outfitters is better.

| 2012 | 2013 | 2014 | 20151) | 20162) | 20172) |

|---|---|---|---|---|---|

| 28.7 | 28.9 | 31.8 | 33.4 | 35.3 | 37.1 |

1) Estimation, 2) Forecast

Source: market research company PMR

The company for classic clothing Bytom (http://www.bytom.com.pl, from the same city (Bytom – Beuthen)) that serves the upper segment, wants to create an offer for the masses. It lowered its prices in March 2016. In order to reach more customers, it plans to increase its sales area of from 10,300 square meters in spring 2016 to 15,000 square meters by the end of 2018. The number of its stores should simultaneously rise from 97 to 120.

Bythom will avoid quality losses through savings in the purchasing of clothing. According to Michal Wojcik, chairman of the company, negotiations with representatives of procurement markets are on the way. In 2019 the retail sales of Bytom should reach around 250 million PLN, double as much as in 2015 (123 million PLN). The company will serve the middle segment between large markets with

mass-production goods and expensive boutiques with domestic and foreign luxury brands.

The two great rivals Bytom and Vistula (http://vistula.pl) from Krakow (Krakau) are receiving increasing competition by smaller companies. Vistula was able to win in 2016 the soccer star Robert Lewandowski for promotional activities, he will appear in suits of the company.

The stockbroker office of the Bank BZ WBK believes in good opportunities of the smaller chain Monnari (http://www.emonnari.pl), which could double its sales area until 2019. With the proliferation of the growing clothing and footwear chains a consolidation of the retail structure goes along, and the total numbers of stores will overall decrease.

The chains Vistula, Bytom and Monnari are expanding domestically only, where they expand their retail spaces annually by 10 to 25%. Since only one third of the by Vistula and Bytom sold collections are being settled on a USD basis, they are not hurt as much by the strong upvaluation of the US currency as LPP, the manufacturer of mass-products. This company buys almost its entire collection in the

Far East in US currency. In the case of the footwear chain CCC, the proportion is 40 to 50%.

| 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|

| Clothing | 32,100 | 30,700 | 29,400 | 28,700 | 28,400 |

| Shoes |

7,610 |

7,464 | 7,215 | 7,029 | 6,86 |

Source: Bisnode

CCC strives towards west

The retail chain CCC (http://ccc.eu), which is also represented abroad including in Germany and Austria, has acquired for more than ZL 200 million the online shop for shoes eobuwie.pl (http://www.eobuwie.pl). By 2016 a further strong expansion is planned, for which it wants to raise about PLN 140 million. The sales area should become 27% net bigger with at least 100,000 square meters. This was announced by the deputy chairman of CCC, Mr. Piotr Nowjalis.

The majority of the new area (77,000 square meters) is planned abroad, where 110 stores should be opened. In the focus here are Germany, Austria and Romania. Domestically CCC is planning a new sales area of 23000 square meters for 40 stores. These plans represent an acceleration compared to 2015, when the total sales area had increased by 66,000 square meters net (+ 22%). At the end of 2015 there were at home and abroad 773 CCC stores with a total of 372,000 square meters.

| Company | Revenues 2015 | Revenues 2016 *) | Net income 2015 | Net income 2016 *) |

|---|---|---|---|---|

| LPP | 5,130 | 6,062 | 352 | 510 |

| CCC | 2,407 | 3,043 | 237 | 271 |

| Vistula | 517 | 565 | 31.5 | 38.5 |

| Monnari | 214 | 258 | 35.5 | 34.5 |

| Bytom | 131 | 160 | 13.3 | 16.1 |

| CDRL | 183 | 201 | 14.2 | 14.9 |

| Gino Rossi | 278 | 301 | 6.7 | 10.0 |

| Wojas | 220 | 240 | 6.3 | 8.4 |

*) Forecast of the press agency Bloomberg, February 2016

Source: Newspaper Rzeczpospolita

According to a forecast of Bloomberg, the most important apparel and footwear companies will improve their results in 2016. Leader LPP supplies with its brands Reserved, Mohito, Cropp, House and Sinsay a wide audience. To the upscale segment belongs the new brand Tallinder, which is being offered since February 2016 in a first store in Gdansk (Danzig). Beginning in 2019 there should be 30 sales stores for the brand Tallinder, which then will compete with Vistula, Bytom and Prochnik.

| Vistula und Wolczanka | Bytom | Prochnik | Übrige |

|---|---|---|---|

| 30 | 14 | 6 | 50 |

Source: Newspaper Rzeczpospolita

In 2016 LPP wants to increase its retail space at home and abroad by 11 to 13%, that is about 90,000 square meters. End of the year thus 1,716 shops could belong to the company. To date, 23% of the sales area of LPP is in the Russian Federation and Ukraine. The profits there were again impacted by the devaluation of the local currencies against the Zloty.

Foreign trade increases

The Polish imports of clothing exceed the exports. Especially Asian countries could increase their deliveries in 2014, but also Germany belongs to the leading suppliers and attained growth. Among the importing countries Germany plays by far the most important role. The followers are the Netherlands, Czech Republic, Austria, Sweden and other, mostly European countries.

| Custom tariff 6201 bis 6209 | 2012 | 2013 | 2014 |

|---|---|---|---|

| Import, including | 5,251.0 | 5,392.4 | 6,910.0 |

| PR China | 2,319.4 | 2,115.3 | 2,532.3 |

| Bangladesch | 666.6 | 758.4 | 1,019.2 |

| Germany | 278.8 | 522.1 | 607.7 |

| Turkey | 333.0 | 290.6 | 404.3 |

| India | 264.5 | 258.8 | 329.9 |

| Export, including | 5,416.9 | 5,895.4 | 6,830.1 |

| Germany | 2,628.9 | 2,997.3 | 3,677.7 |

Source: Central Statistical Office GUS

Although Poland supplies clothing to Germany at a large extent, it is not easy for the companies to settle in the western neighboring country with own shops and their own brands. LPP opened its first store in Germany in September 2014, in spring of 2016 there were already twelve. In three years there should be 30 stores. In 2015 the German LPP stores generated approximately 94 million PLN, but probably without profit because of investment costs and advertising.

| Zolltarifposition 6101 bis 6114 | 2012 | 2013 | 2014 |

|---|---|---|---|

| Import, including | 4,990.3 | 5,191.6 | 6,748.2 |

| PR China | 1,575.2 | 1,574.1 | 1,970.7 |

| Bangladesch | 963.9 | 903.2 | 1,258.8 |

| Germany | 349.2 | 538.1 | 723.8 |

| Turkey | 479.3 | 512.9 | 628.7 |

| Cambodia | 278.4 | 235.4 | 464.3 |

| Export, thereof | 4,150.1 | 4,521.4 | 5,108.9 |

| Germany | 1,794.8 | 1,888.0 | 2,343.8 |

Source: Central Statistical Office GUS

In 2015 Polish exports of apparel, accessories and other textile products and footwear continued to rise.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|---|

| Apparel, Accessoires, Textiles | 12.0 | 13.5 | 13.9 | 15.1 | 17.3 | 21.4 |

| Shoes | 1.6 | 1.9 | 2.4 | 3.0 | 3.3 | 4.0 |

Source: Central Statistical Office GUS

Beatrice Repetzki, Germany Trade & Invest www.gtai.de

Almaty (GTAI) - Although the Kazakhstan textile industry is far away from the production figures in earlier Soviet times, increases have been achieved in recent years. Against the general trend, imports of textile machinery have grown strongly in 2015. The lack of skilled workers and the small domestic market has a negative effect on the development of the sector. The Special Economic Zone (SEZ) Ontustik in Shymkent could become an important center of the light industry.

The textile, clothing and leather goods industry used to be one of the most important economic sectors in Kazakhstan. After the collapse of the Soviet Union, these three sectors, identified as light industry in the country, have however lost much of its importance. In 2015 they contributed only 1.2% of the total output of the manufacturing sector. Compared to 2008 (0.9%), the proportion rose at last slightly again.

Hand in hand with the devaluation the output of the industry, measured in USD, pointed significantly down. The overall output amounted to USD 320 million in 2015. In reality in 2014 (+ 4.0%) and in 2015 (+ 3.4%) a production growth could be achieved.

| 2013 | 2014 | 2015 | Change 2015/14 2) | |

|---|---|---|---|---|

| Manufacturing, thereunder | 38,471 | 33,999 | 25,936 | 0.2 |

| Light industry, thereof | 427 | 353 | 320 | 3.4 |

| Textile industry | 208 | 148 | 155 | 0.5 |

| Clothing industry | 193 | 166 | 136 | 6.1 |

| Leather goods industry | 27 | 39 | 29 | 3.1 |

1) Change at the respective annual exchange rate; 2) real change in %

Source: Agency for Statistics, Astana

Investments in the light industry rise

Gross fixed investments in the light industry show an upward trend in recent years. According to the Kazakhstan Statistics Agency the investments grew from 2012 to 2015 from USD 18.5 million to USD 45.6 million. A role hereby played the support of modernization projects by government subsidies.

| 2013 | 2014 | 2015 | |

|---|---|---|---|

| Manufacturing, thereunder | 4,514.9 | 4,065.8 | 3,491.8 |

| Light industry, thereof | 32.6 | 23.0 | 21.7 |

| Textile industry | 4.6 | 4.1 | 23.2 |

| Clothing industry | 0.4 | 11.3 | 0.8 |

*) Change at the respective annual exchange rate

Source: Agency for Statistics, Astana

The recent increase in investments is reflected in imports of machinery and equipment for the sector. Against the general trend the import of textile machinery (HS positions 8444-8453, without 8450) increased nominally by 28.3% to USD 35.2 million in 2015. However, one reason for the strong growth are the weak prior years (2013: USD 40.3 million; 2014: USD 27.5 million) also. The imports however develop well above the level of 2010 and 2011 with average imports totaling nearly USD 16 million. Most important supplier of textile machinery is the PR of China. According to the Federal Statistical Office exports from Germany numbered to EUR 4.3 million in 2015, (2014: EUR 4.4 million).

The light industry suffers less from the economic crisis than other sectors

Currently the Kazakhstan economy is suffering from the slump in commodity prices and the consumers had to endure enormous losses in their purchasing power due to the devaluation. The light industry however is less affected by the negative economic situation. An advantage is the price increase of imported textiles and a gain in competitiveness due to the lower wages. Nevertheless - the sector is highly dependent on imports of both machinery and primary products.

According to the latest available information provided by the Bureau of Statistics, the average income in the textile industry in 2014 was 52,800 Tenge (T) per month, equivalent to a value of USD 294. Converted to the current exchange rate however, the amount - excluding wage increases - has shrunk to USD 150.

Hand in hand with the increased purchasing power Kazakhstan’s import of textile products had multiplied from 2006 to 2014 from USD 332 million to just under USD 2.1 billion. In 2015 the upward trend was halted. Imports broke nominally by 38.6% to USD 1.3 billion, they came down to a level of 91% of the market volume in 2014 and 2015.

| 2006 | 2008 | 2010 | 2012 | 2014 | 2015 | Change 2015/14 2) |

|---|---|---|---|---|---|---|

| 332 | 429 | 394 | 1.458 | 2.087 | 1.281 | -38,6 |

1) HS tariff positions 50 - 67; 2) nominal Change %

Sources: UN Comtrade, Customs Committee of the Republic of Kazakhstan, Eurasian Economic Commission

| 2014 | 2015 | Change 2015/14 | |

|---|---|---|---|

| Imports 1) | 2,087 | 1,281 | -38.6 |

| Exports 1) | 147 | 186 | 26.5 |

| Local production 2) | 353 | 320 | -9.3 |

| Market Volume | 2,293 | 1,415 | -38.3 |

1) HS tariff positions 50 - 67; 2) nominal Change %

Sources: UN Comtrade, Customs Committee of the Republic of Kazakhstan, Eurasian Economic Commission

The light industry offers potential for development

Preconditions for a greater development of the light industry are given in Kazakhstan, but weak points remain. According to information of Lyubov Chudowa, president of the association of the light industry enterprises, these include the great shortage of skilled labor. In addition there are the small size of Kazakhstan's local market and the great distances in the country.

On the other hand the steppe republic has a great potential in the livestock farming sector, that can provide resources like leather and wool. In addition there is the cultivation of cotton in the territory of South Kazakhstan. Though - on the global scale in these areas Kazakhstan is a small player only.

The processing of crude products is still weak. According to information provided by the regional administration of South Kazakhstan, 90% of the in the country produced cotton is being exported. At the same time the sector companies need to import most of their primary products.

SEZ Ontustik in Shymkent

The in 2005 in Shymkent (South Kazakhstan region) founded Special Economic Zone (SEZ) Ontustik, could become an important center of the light industry. Key aspect of the SEZ is presently the light and paper industry.

As in the other SEZs in Kazakhstan for the settled companies a variety of reductions in custom duties and taxes and simplifications for the employment of foreign workers applies. In addition there are tariffs for electricity, water and gas, which are 35% below the local level.

In the SEZ so far eight companies have started to operate, USD 144 million were invested in the buildings. According to the company which runs UK SEZ Ontustik, until 2020 twelve more companies are expected to come. With the establishment of the Eurasian Economic Union the interest of foreign companies in manufacturing settlements has increased. The management of the park aims to expand the profile of SEZ to other areas of the manufacturing sector, such as for example the pharmaceutical industry.

Concentration process in light industry

From 2010 to 2014 the number of sector companies has declined from 565 to 455. An overview of the most important companies is available on the website of the association of light industry enterprises.

Internet addresses

Special Economic Zone Ontustik

Internet: http://www.sez-ontustik.kz

Association of Light Industry Enterprises of the Republic of Kazakhstan

Internet: http://www.aplp.kz

Fabian Nemetz, Germany Trade & Invest www.gtai.de

Cairo (gtai) – Egypt’s vertically integrated textile and clothing industry has a strong basis. To remain competitive more modern equipment and innovative products are required. Also the cooperation with local suppliers is upgradeable. The government is planning two new textile industrial zones. The import of textile and leather machinery in the first three quarters of 2015 reached USD 135 million. Of this 17% were Ger man deliveries.

The situation of the textile and clothing industry in Egypt provides ample material for both optimists and for doomsayer. Technical modernization of the mills and a focus on products with higher added value offer opportunities. Potential also has a better link between the production stages. These would include installation for spinning, weaving and laundries for denim. As upgradeable product groups like underwear, high quality knitwear and fabrics can be seen. With such the benefits of Egypt could be better accentuated. These include the favorable geographical location, the proximity to major markets and a variety of trade agreements. According to the American Chamber of Commerce Egyptian manufacturers already provide clothing for international brands such as Calvin Klein, Disney, Gap, Timberland and Zara.

The chances however are being opposed by a number of difficulties. Also the textile and clothing sector was hit by the energy crisis and the lack of foreign exchange. Many companies have a limited level of liquidity. Research and development were neglected for years, although there are positive examples of innovative companies also. Many producers were forced to close in recent years. Due to the risks in the sector banks are very reluctant in lending money.