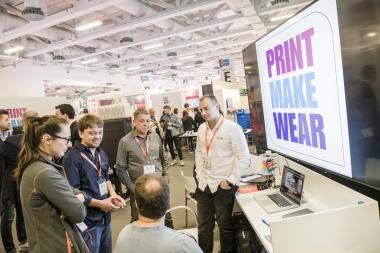

FESPA GLOBAL PRINT EXPO 2019: PRINT MAKE WEAR FAST FASHION-FACTORY

- The Print Make Wear fast fashion factory feature at FESPA Global Expo 2019 in Munich (14-17 May 2019) will double in size compared with its launch in 2018 in response to positive visitor feedback.

The feature was introduced at the flagship FESPA event in Berlin in 2018 to meet the needs of visitors interested in the opportunities in printed fashion textiles and garments. Taking the form of a live production environment, Print Make Wear addresses every step in the garment production process. This begins with planning, design and prepress, progressing to printing, drying, cutting, sewing, welding and embellishment and finishing with packing and retail display.

At FESPA Global Print Expo 2019 the expanded feature will allow more space to showcase an even more comprehensive range of garment printing technology solutions and consumables, as well as incorporating a staged area for presentations and debates and a catwalk for fashion shows. The visitor experience will also be enhanced with two separate guided tours, one with a focus on direct-to-garment production and the other tailored to visitors interested in roll-to-roll production.

The technologies showcased within Print Make Wear 2019 will include direct-to garment digital and screen printing presses with both automatic and manual presses printing on water-based inks, the roll-to-roll digital technologies will include dye-sublimation as well as other textile print technologies, with the support of brands including Adobe, Adelco, EFI, HP, Mimaki, Vastex MagnaColours, Easiway and Premier Textiles.

The garments produced and modelled within Print Make Wear will carry a striking series of exclusive designs on the theme of ‘Elements’, with the tagline Inspired by Nature – Powered by Print, which have been created specifically for FESPA by photographer and illustrator Jasper Goodall. FESPA is also working with young fashion designer Aminah Hamzaoui, who is collaborating on the design of the garments being produced using the roll-to-roll technologies.

FESPA Head of Events, Duncan MacOwan comments: “Year after year, independent market insights and visitor feedback reinforce the rising levels of interest in textile printing, while our own FESPA Census in 2018 indicated that sports apparel and fast fashion are two of the most dynamic growth applications in our community. Visitor response to the first Print Make Wear feature last year was extremely positive, with more than 2,000 visitors taking part in our expert-guided tours.”

He continues: “By increasing the floor space dedicated to this feature in Munich we can accommodate visitors more comfortably, enrich the overall experience and elevate the educational content. We’re confident that, whatever their level of knowledge or investment in garment printing, visitors to Print Make Wear 2019 in Munich will leave with a deeper understanding of the opportunities to optimise production, improve sustainability and boost profitability.”

Print Make Wear is free to attend for registered visitors to FESPA Global Print Expo 2019 and the co-located European Sign Expo. Guided tours can be pre-booked at https://www.fespaglobalprintexpo.com/features/print-make-wear. The feature is part of a programme of free educational content which also includes the new Colour L*A*B* colour management showcase and conference, Printeriors and a comprehensive schedule of live seminars in the Trend Theatre.

For more information about Print Make Wear, visit www.fespaglobalprintexpo.com/features/print-make-wear. To pre-register to attend FESPA Global Print Expo 2019 visit https://www.fespaglobalprintexpo.com/ and use code FESM906 for free entry.