Cooperation between CARBIOS and Nouvelles Fibres Textiles

CARBIOS and Nouvelles Fibres Textiles, a French company specializing in the recovery of end-of-life textiles, announce the signing of a Memorandum of Understanding to establish a contract for the supply of polyester textiles to the world's first PET biorecycling plant currently under construction in Longlaville, France. The polyester textiles supplied will come from used or end-of-life textiles prepared in France by Nouvelles Fibres Textiles for recycling using CARBIOS' enzymatic depolymerization technology. This contract will enable 5,000 tons a year of these textiles to be redirected towards biorecycling from 2026 onwards, over an initial 5-year period, demonstrating the commitment of industrial players all along the value chain to achieving textile circularity for a more sustainable textile sector.

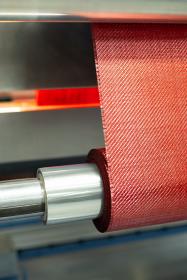

Nouvelles Fibres Textiles and its various partners opened a semi-industrial site with an annual capacity of 1,000 tons in November 2023, the first step towards building a 20,000-to-30,000-ton unit in 2026. This first site, a research center for textile recycling, combines the know-how of Andritz Laroche (a leader in textile recycling), Pellenc ST (French leader in intelligent sorting solutions), Synergie TLC (a French player in collection and first sorting for solidarity) and the Tissages de Charlieu group (a French player in weaving, garment manufacturing and textile recycling). This unit transforms used textiles into high-quality raw materials, supplying the various industries that use textile fibers (non-wovens, insulation, plastic, textiles, etc.) by automatically sorting them by composition, while eliminating hard points (buttons, zips, patches, etc.).

CARBIOS' biorecycling technology uses enzymes to break down polyester fibers into their basic components. These components are then used to produce high-quality recycled PET materials, such as fibers for the textile industry. This “fiber-to-fiber” solution will enable polyester to become a truly circular fiber on a large scale.

CARBIOS