PERFORMANCE DAYS: Positive Feedback for Online Fair and sustain & innovate Conference

As a result of the Corona pandemic, the PERFORMANCE DAYS fair on December 9th - 10th and the accompanying sustain&innovate conference for sustainability on December 10 could only take place in digital form. Nevertheless: exhibitors, visitors and partners can look back on a successful event. The focus topic “Nothing to Waste – Closing the Loop“ relating to the issue of the textile circular economy in the course of the sustain&innovate conference also provided great discussion material while generating a positive response.

The PERFORMANCE DAYS team also expresses its satisfaction. Because despite the event being solely a digital event on the 9th and 10th of December 2020, an estimated 15,000 participants made extensive use of the comprehensive online offerings of the 191 digital exhibitors, among them drirelease/OPTIMER, Merryson, Stotz, HeiQ, Schoeller Textil, Long Advance, Dry-Tex, Utenos, Fidlock, Cifra, dekoGraphics and Jia Meir, during the week of the fair. The popular “Contact Supplier” function was supplemented with a new online tool that allows exhibitors to be contacted directly via chat, call or per video. A total of 3,250 fabric sample orders were placed with exhibitors. The variety on offer included fabric innovations for Autumn/Winter 2022/2023 within the top class PERFORMANCE FORUM and an extensive digital supporting program via live-stream with informative webinars, talks and rounds of discussions. Best of all: the resulting videos will be available on demand on the PERFORMANCE DAYS website free of charge.

Finally standard: PERFORMANCE FORUM with sustainable materials

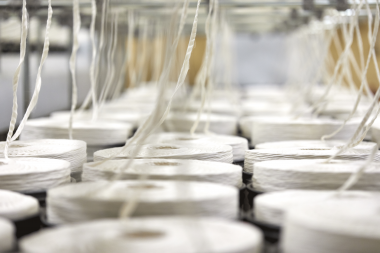

Innovative, sustainable and cutting-edge: the 240 fabrics plus accessory trends at this year’s PERFORMANCE FORUM impressed throughout with exciting environmentally conscious solutions. Natural fibers such as hemp, organic cotton, bamboo, wool or coconut shell remain in demand, while manufacturers are also increasingly refraining from the use of environmentally harmful chemicals, avoiding microplastics, advocating natural dyeing processes and either trying to return fabrics to the cycle, recycle plastic and other waste in order to produce fibres in such a way that they are biodegradable. This environmental awareness is also reflected in this year’s FOCUS TOPIC – so here the 24 best fabrics not only score in terms of sustainability, but also demonstrate that they are both functional and can be returned to the textile cycle, true to the motto “Nothing to Waste – Closing the Loop.

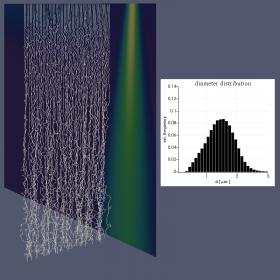

In the Marketplace section, visitors have the opportunity to view more than 9,500 exhibitor products, including the fabric highlights of the individual categories of the PERFORMANCE FORUMS. In order to be able to digitally present the fabrics to visitors as realistically as possible in terms of feel, design and structure, the Forum has been equipped with innovative 3D technology, including innovative tools such as 3D images, video animations and U3M files for download.

From fiber to fiber: successful sustain&innovate conference generates discussion

Textile circular economy is considered part of the solution to the global waste problem, curbing the consumption of resources and reducing climate damaging greenhouse gases. But what exactly is the circular economy and how can it succeed? Most importantly, how far are fiber manufacturers in developing mono-component fabrics that can eventually be returned back into the textile cycle?

The Focus Topic of this year’s sustainability conference, launched in cooperation with SPORTSFASHION by SAZ, offered a platform for discussion and strove to enlighten with evocative talks, discussion rounds and webinars. Christiane Dolva, Head of Sustainability at Fjällräven, got to the heart of the matter at the start of the expert talks on the second day of the fair, outlining how important emotional consistency is for the brand itself and ultimately also for the consumer – especially when it comes to textile recycling. Durability, good quality, in combination with timeless design are more important than ever today and in the future in terms of sustainable action. Added to this is the possibility of reviving products by means of a repair service. Equally exciting: the development of new technologies in terms of recycling. Erik Bang from the H&M Foundation provided a first glimpse of the new Greenmachine, which should make it possible to separate mixed fabrics such as cotton and polyester as early as 2021. Alternatively, old clothing is converted into new fibres thanks to companies such as WornAgain, Re:newcell, Spinnova or Infinited Fiber, which soon promises to be more than just a mere vision. For those who wish to gain insight into the supply chain of their purchased garment, the start-up know your stuff lets customers track the journey of the respective garment by simply scanning a QR code on the garment in a store or online.

Free extensive retrospective

The next edition of PERFORMANCE DAYS is planned as a hybrid fair and will take place on May 19th and May 20th, 2021 in Munich as well as online. Until then, the PERFORMANCE DAYS platform will remain accessible, for instance with the Marketplace and further inspiring topics of (video) material stories to make online sourcing even easier. The talks from the first day of the fair and the conference will be accessible free of charge on the fair website.

The most importantt links:

Highlights of Expert Talks & Webinars

https://www.performancedays.com/digital-fair/expert-talk-webinar.html

Marketplace:

https://www.performancedays.com/marketplace.html

3D-Forum:

https://www.performancedays.com/digital-fair/forum-highlights/3d-forum.html

PERFORMANCE COLORS by Nora Kühner

https://www.performancedays.com/digital-fair/color-trends.html

Performance Days

PERFORMANCE DAYS functional fabric fair