Mayer & Cie.: Successful 2021 - Digitisation, Sustainability and Modernisation topics for 2022

Looking back, 2021 was a positive year for the Albstadt-based circular knitting machine and braiding machine manufacturer Mayer & Cie. After two tough years, sales exceeded Euro 100 million again last year, and the outlook for this year is promising, with production working at long-term full capacity in the circular knitting machine sector.

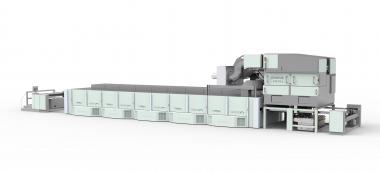

In order to maintain its market edge Mayer & Cie. continues to rely on digitisation of both its processes and its products. Substantial investment at its headquarters location, especially in machinery, is on the Mayer & Cie. agenda for 2022. In the years ahead a range of production machinery – lathes, gear cutting and grinding machines – is to be replaced at a scheduled cost running into low double-digit millions. Last year saw an investment in a robot-controlled laser hardening system for heat-treating machine components. The company passes an energy upgrade milestone these days with launching its new CHP cogeneration units.

“Compared with 2020, our Group sales were up by about 40 per cent in 2021,” said Mayer & Cie. Managing Director Benjamin Mayer. After two difficult years in 2019 and 2020 the circular knitting machine manufacturer was able last year to restore sales to a stable level of about 103 million Euro. And it could have achieved an even better result. “Supply chain problems hampered production perceptibly,” the company’s managing director said. “In view of the order situation up to five per cent more might have been possible.” The Albstadt textile machinery manufacturer’s order position has stayed at a sound, high level since the fourth quarter of 2020, and orders in hand will already keep the circular knitting machine division busy until the end of the year, with orders coming in from all over the world, but especially, and with no change, from the company’s core markets Turkey, China and India.

The Management views with concern, however, the conflict in the Ukraine, which at first glance may not affect the sales market directly but might lead to general purchasing restraint in the capital goods sector that like the trade war between the United States and China, which began in 2018, would also affect Mayer & Cie. In addition, effects of the conflict such as high energy prices and interruptions in material supplies and logistics pose a genuine challenge in the further course of the year.

In the braiding machine division, the order position recovered in 2021. Sales of new machines and, especially, spare parts exceeded the 2020 figures significantly. Mayer & Cie. has once more won an award for its in-house and external digitisation measures as one of the most innovative German SMEs. The textile machinery manufacturer won a 2022 Top 100 award for its innovative processes in particular.

Mayer & Cie.