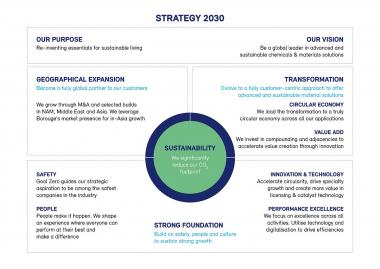

Borealis-Strategy 2030: Sustainability in the centre

- Strategy and purpose affirm Borealis Group vision to be a global leader in advanced and sustainable chemicals and material solutions

- Sustainability at the centre of all activities, supporting OMV Group’s ambition for a net zero business by 2050

- Strong foundation supports continued geographic expansion with enhanced focus on Middle East and Asia, North America

Borealis announces the introduction of the Borealis Strategy 2030. At the core of this strategic evolution is sustainability, which is supported by the Borealis foundation of dedication to safety first, its people, innovation and technology, and performance excellence. This foundation powers continued geographic expansion and the ongoing transformation towards the circular economy. The strategy stipulates new and more ambitious sustainability targets with regard to greenhouse gas (GHG) emissions reductions, energy consumption, and the circular economy. Underlying the Borealis Strategy 2030 is an evolved purpose, “Re-inventing Essentials for Sustainable Living,” whose intent and spirit is shared across the OMV Group.*

* See attached document for more information.

Borealis / ikp