INDA releases 2024 Nonwovens Supply Report

INDA, the Association of the Nonwovens Fabrics Industry, announces the publication of the eleventh edition of the annual North American Nonwovens Supply Report.

Based on extensive research, producer surveys and interviews with industry leaders, this report provides a comprehensive view of the North American supply of nonwoven materials including the key metrics of capacity, production and operating rates, and regional trade through 2023.

The Executive Summary from annual Supply Reports, the quarterly INDA Market Pulse and monthly Price Trends Summary are provided to INDA members on a complimentary basis as part of their membership. The data gathered for this annual report serves as the foundation for both the biennial Global Nonwoven Markets Report to be published in October 2024 and the biennial North American Nonwovens Industry Outlook, which was published in October 2023.

Findings from this year’s Supply Report include:

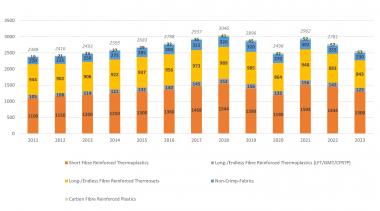

- North American capacity continues to increase with investments being made across all processes and for a variety of end-uses. Production output is shifting and has slowed down in 2023 to reflect larger machine installations just now coming on-line.

- In 2023, the capacity of nonwovens in North America reached 5.713 million tonnes, an increase from the previous year of over 230,000 tonnes.

- Many new nonwoven production lines were installed in 2023, but mostly in the long-life sectors which shows a positive move towards sustainable goals across the board.

INDA, the Association of the Nonwoven Fabrics Industry