EURATEX: Latest economic data confirm further recovery of the textile and clothing industry

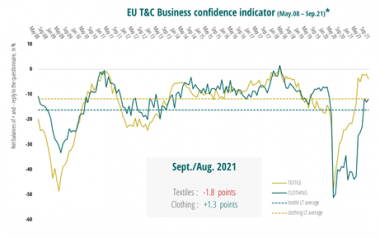

European Textiles and Clothing (T&C) industry coming out of the Covid19-crisis, but facing new challenges ahead. This recovery may however be disrupted by the current supply chain and energy problems. Latest economic data on the European T&C industry confirm further recovery from the corona pandemic. The textile activity has now surpassed its pre-pandemic level from Q4 2019 (+3.6%); the clothing sector still remains 11.5% below, but continues to improve.

In quarter-on-quarter terms, the EU turnover showed signs of improvements across the sector. The textile turnover increased by +3.3% in Q2 2021, after slightly contracting in Q1 2021. Similarly, the business activity in the clothing sector expanded by +7% in Q2 2021, after increasing by +1% in the previous quarter.

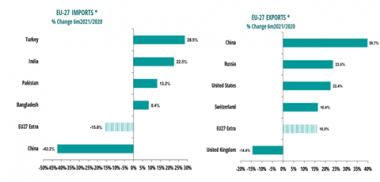

In the 2nd quarter 2021, the EU-27 trade balance for T&C improved, resulting mostly from an increase of export sales across third markets and a drop of textile imports. T&C Extra-EU exports boomed by +49% as compared with the same quarter of the previous year. T&C Extra-EU imports went down by -26% as compared with the same quarter of the previous year, following a decrease of imports from some main supplier countries. EU imports from China and the UK collapsed due to a combination of Brexit and weaker demand in Europe.

During the second quarter of 2021, job creation was slowly stabilising in the textile industry (-0.2% q-o-q), while employment in the clothing sector continued to be affected by lower levels of production activity in industry during the first part of the year (-1.2%). When compared to its pre-pandemic level in Q4 2019, EU employment in Q2 2021 was still 4.4% down in textiles and 11.8% down in clothing.

However, this fragile recovery is hampered by higher shipping costs and prices’ increase in raw materials and energy. The cost of energy, in particular gas, has increased more than 3 times since the beginning of this year. Since the announcement of the EU’s “Fit for 55” package, we have seen CO2 prices rising above €60. This inevitably has an impact on the industry’s competitiveness, especially in a global context. The future recovery is also threatened by some factors limiting production, such as shortage of labour force and equipment, which are putting additional pressure on T&C industries.

Director General Dirk Vantyghem commented on these latest figures: “Our companies have shown great resilience during the pandemic, and their latest export performance is an encouraging sign of recovery. This recovery may however be disrupted by the current supply chain and energy problems. Once again, recent developments show that this transition towards more sustainable production can only work if organised in a global context, avoiding carbon leakage and with an effective level playing field. This must be considered in the upcoming EU Textiles Strategy.”