NEW TRENDS IN ITALIAN RETAIL OPEN UP OPPORTUNITIES

- Franchising takes off, more and more German retail chains discover Italy

Milan (GTAI) - The Italian retail sector is modernizing and the franchise economy is growing. Italian franchise systems are gaining ground. New modern shopping centers, including the largest in Europe, create space for new shops. German retail chains are expanding in many segments, from discount food and other consumer goods to services. Northern Italy is considered a popular test site. High quality and a price advantage are the keys to success.

The Italian retail sector is changing. The number of classic corner shops is declining, the modern organized retail trade is growing. The franchise economy in particular is developing positively. Beyond the classical areas such as food and fashion, various Italian franchise systems are spreading more and more visibly in the big cities.

According to the industry association Assofranchising, the franchise industry had a turnover of approximately EUR 24.6 billion in 2017. This represents an increase of 2.6 percent compared to the previous year and an increase of 5.7 percent since 2014. With a similar number of systems (929 in Italy, 972 in Germany), the German franchise industry generated almost five times as much turnover. One reason for this is that German franchise systems have on average more than three times as many businesses per franchise.

| 2016 | 2017 | Change (in %) | |

| Sales (Euro Mio.) | 23,930 | 24,545 | 2.6 |

| Franchise systems | 950 | 929 | -2.2 |

| Businesses | 50,720 | 51,671 | 1.9 |

| Italian businesses abroad | 7,871 | 10,079 | 28.1 |

| Italian businesses abroad (min. 3 companies) | 169 | 179 | 5.9 |

| Foreign systems in Italy | 61 | 71 | 16.4 |

| Employees | 195,303 | 199,260 | 2.0 |

| Average size of systems in Italy (number of companies) | 53.4 | 55.6 | 4.2 |

| Average size of Italian systems abroad (number of companies) | 46.6 | 56.3 | 20.9 |

Source: Rapporto Assofranchising 2018

But the segment is catching up in Italy. Italian franchise systems are expanding, also abroad. Outside Italy, their number increased by around 6 percent in 2017, while their average size (measured by the number of businesses) increased by around 21 percent. The domestic average dimension is also growing. The country is also becoming more attractive for foreign franchisors. In 2017, the number of foreign franchise systems increased by 16 percent. The relevant trade fair is the Salone Franchising, which will take place from October 25th to 27th 2018 in Milan.

New shopping centers are driving the developments forward

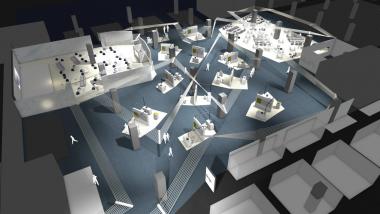

Developments in the retail sector are accompanied by new construction projects. A number of new shopping centers are currently under construction in Italy, creating space for the new generation of franchises and retail chains. The major CityLife project on the former Milan exhibition grounds is a current example. In addition to two of the three planned skyscrapers (including Allianz's new headquarter in Italy), a new shopping center was inaugurated in autumn 2017. Particularly in the catering sector new Italian chains, which are expanding nationwide, can be seen. A new gastronomy floor with restaurants and cafés in the middle price segment was recently inaugurated at the Termini railway station in Rome.

A number of modern shopping centers are still under construction, including the new Westfield Milan. Project operators describe it as the largest shopping center in Europe. With an investment EUR 1.4 billion Westfield Milan is to be inaugurated in 2020. The majority of the new construction projects are located in the larger cities in the north, but Rome and Naples will soon receive new shopping centers also.

| Designation | Investment (Mio. Euro) | Area (1,000 sqm) | Completion | Remarks |

| Westfield, Milan | 1,400 | 60 | 2020 | |

| Maximo, Rome | 300 | 61 | 2019 | Cushman & Wakefield |

| Emilia Shopping District, Parma | 200 | 74 | 2019 | |

| Maximall Pompeii, Napoli | 150 | 200 | 2019 | |

| Falcon Malls Cascina Merlata, Milan | n.a. | 65 | 2021 | http://falconmalls.it |

| Falcon Malls Concordia, Milan | n.a. | 131 | 2021 | http://falconmalls.it |

| Waltherpark Shopping - Bozen | 23 | k.A. | 2021 |

Source: Research of Germany Trade & Invest

Opportunities for German retail chains

Another trend in Italy is the expansion of German retail chains. One growth area is the market for discount foods. According to Nielsen, discounters had a market share of 17 percent of the sold food at the end of 2017. The market leader is Eurospin from Italy, followed by Lidl. In 2018 Aldi opened its first store in northern Italy and by the end of 2018 it is planned to open 45 stores. Lidl is defending itself against its new competitor with planned investments in Italy amounting to EUR 350 mio for a new inner-city store concept. A total of 40 new points of sale are planned, and a further 50 stores are to be modernized.

Both German supermarket chains confirm that a local strategy for Italian gourmets is indispensable. Lidl sources 80 percent of its food products from Italy, while Aldi's share is almost as high at 75 percent.

In terms of price, the recipe for success of the German retail chains is somewhat different from Germany. Although German retailers continue to score with a good price-performance ratio, the focus in Italy is on the mid-price segment.

The latest example is the drugstore chain dm. The first branch was inaugurated at the end of 2017. There are plans to open 100 stores in northern Italy by 2020. dm offers not only a price advantage over its Italian competitors, but also high-quality products. In addition, there are hardly any "one-stop shops" in Italy, which are also drugstores, but also sell beauty products, organic and natural products as well as baby products.

The Douglas perfumery chain is expanding also in Italy. At the end of 2017, Douglas' parent company completed the acquisition of two of the leading perfumeries in Italy, Limoni and La Gardenia.

Fielmann is another example of a German chain that has conquered the Italian market in recent years with high-quality products and a price advantage. With entry into the South Tyrol market and ongoing expansion in northern Italy, Fielmann is popular with Italian consumers despite the large competing manufacturers of glasses in Italy due to its price advantages.

Germany's successful model is not limited to food and other consumer goods. The Berlin-based company Flixbus is an example that the concept of quality and price competition can also be successfully applied to the service sector. Flixbus has been in Italy since 2015 and the number of passengers is increasing constantly. In 2017, 40 million Italians were on the road with Flixbus, twice as many as the year before. Italy is the fastest growing market among 26 countries for the company.

Robert Scheid, Germany Trade & Invest www.gtai.de