COMPOSITES EUROPE 2019: Digital Process Chain makes Fibre Composites Competitive

- Strong Triple: COMPOSITES EUROPE, International Composites Conference and Lightweight Technologies Forum

- “Process live” special areas showcase technological progress

- Co-located event: Foam Expo Europe

The composites industry provides important impetus – for lightweight construction and material innovations in automotive, aviation, mechanical engineering, construction, wind power as well as in the sports and leisure sectors. So in international competition it is solutions with a high degree of automation that are in demand. COMPOSITES EUROPE from 10 to 12 September will present the trends and advances in the production and processing of fibre-reinforced plastics in Stuttgart. The trade fair will be accompanied by the International Composites Conference and the Lightweight Technologies Forum. Also held in parallel at the Messe Stuttgart premises will be Foam Expo Europe.

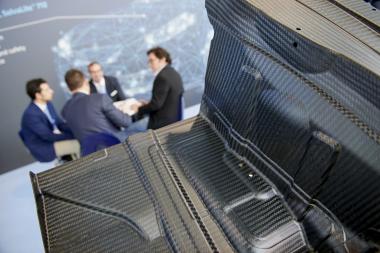

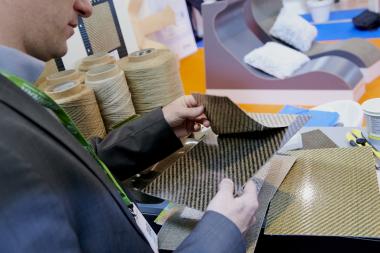

Trade fair visitors will meet with over 300 exhibitors from 30 nations who will be displaying materials, technical solutions and innovative application examples in Stuttgart. Apart from novel products the trade fair will place special emphasis on innovative process engineering. Visitors will learn about the state of play in serial production and new applications in the composites industry in the exhibition area as well as on numerous special areas, on themed guided tours, at the accompanying International Composites Conference and at the Lightweight Technologies Forum, which is dedicated to the trends in multi-material lightweight construction.

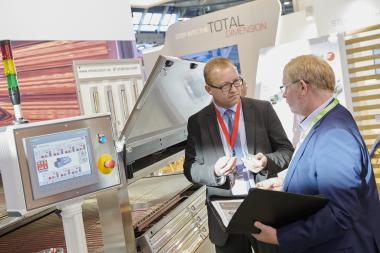

“Process live”: Technologies in Synergy

Perfectly coordinated processing and manufacturing processes will be centre stage at the “Process live” event. On shared exhibition space machinery and equipment manufacturers will exhibit their technologies in concert and – what’s more – in operation so as to show the different individual processes in a real context.

On display, to name but one exhibit, is VAP®, the Vacuum Assisted Process patented by Airbus, which will be in the limelight in the Trans-Textil and Composyst special area. This process permits the one-step production of large-surface and geometrically complex components without an autoclave, which is why it is particularly suitable for structural components in aviation, wind power, shipbuilding, in rail and road transport, in machinery and device manufacturing as well as in architecture and in the leisure industry.

The “Process live” special area care of cutting specialists GUNNAR from Switzerland specifically targets the DACH region (Germany, Austria, Switzerland) with its small and medium-sized companies. Jointly with laser projection expert LAP and composites engineering expert SCHEURER Swiss, GUNNAR introduces a connected overall process that fuses modern machinery and software with specialists’ manual jobs. The point of departure here is an automated manufacturing process for sorted layer placement in small and medium quantities involving a certain degree of skilled labour.

Fibre composite specialist Hacotech will present CNC-controlled cutting processes and various finishing possibilities in cooperation with Aristo Graphic Systeme and Lavesan. Alongside cutting, production preparation and customised sizing, the production of dimensionally correct templates and the cutting and custom-sizing of composite materials and prepregs will be on show.

Cutting technology is also centre stage in the special area of Rebstock Consulting, Broetje-Automation and Zünd Systemtechnik, which will be taking part in “Process live” with “Automated Sorting and Kitting”.

Composite producer Saertex and chemical company Scott Bader will demonstrate the RTM process for producing and curing a laminate that complies with the highest fire protection requirements in as little as 1 hour.

5th International Composites Conference (ICC)

Serial production, stable processes, new markets – the International Composites Conference (ICC) is set to inject a fresh breeze for innovations into the market and to this end brings together processors and users of fibre-reinforced plastics from all over Europe. For the first time, this renowned Conference will be held in parallel with COMPOSITES EUROPE. The lecture programme put together by the trade association Composites Germany and the trade fair will also move closer in terms of content.

One of tomorrow’s cross-cutting themes keeping the entire industry on its toes are multi-material solutions in nearly all industrial applications. In the construction sector the Conference also deals with the rising use of carbon concrete. Process engineering will focus on processing thermoplastic materials for serial production and stable processes for thermoset plastic processing.

The partner country of the Conference is the United Kingdom. Especially against the backdrop of the current Brexit debate the ICC aims to foster exchange among all European countries. After all, the UK is among the biggest producers of composites components in Europe.

Themed Tours on Digitalisation, Fibre Glass, Thermoplastics, Automotive and Wind Power

Guided tours and hands-on demonstrations in the exhibition halls complement the conference programme. Themed guided tours revolving around composites application, materials and markets guide trade fair visitors and congress delegates right to the stands of selected exhibitors, who will share with visitors their innovations in the fields of digitalisation of composites production, automotive manufacturing, building and construction, fibreglass, new mobility, thermoplastic materials and wind power.

New ideas on special areas and joint stands

“Material and Production Technology” is the name of the new special area set up under the guidance of the Institute of Plastics Processing (IKV) of the RWTH Aachen University. In cooperation with other institutes such as the Aachen Center for Integrative Lightweight Production (AZL) the IKV will place manufacturing technology centre stage at the trade fair. In particular, the special area will trace the path from scientific development to practical, industrial implementation.

Tomorrow’s automotive experts will also be given a separate forum: under the heading “Formula Student” students and trainees will present to visitors racing cars and bikes they have engineered.

Lightweight Technologies Forum: platform for multi-material lightweight construction

Lightweight construction remains a driver across the board for many developments in the composites sector. The Lightweight Technologies Forum (LTF) held as part of COMPOSITES EUROPE makes it clear how lightweight construction can be achieved in an economical and resource-efficient manner. This Forum views itself as a cross-industry and multi-material think tank where all parties involved can reflect on these new concepts.

To this end, the Forum in Stuttgart pools lightweight construction projects from automotive manufacturing, aviation and aerospace and mechanical engineering, to name but a few industries that serve as a driving force for many sectors with high demands made on materials, security and reliability.

This year’s keynote speakers include Airbus Innovation Manager Peter Pirklbauer, lightweight construction expert Prof. Jörg Wellnitz (TU Ingolstadt), Dutch racing driver Jeroen Bleekemolen and lightweight construction, aviation and aerospace specialist Claus Georg Bayreuther (AMC). In their talks they will provide an overview of reference projects and novel manufacturing and joining technologies.

Combining its own exhibition space with a lecture forum, the LTF demonstrates how glass-fibre reinforced plastics (GRP) and carbon fibre reinforced plastics (CFRP) leverage their strengths mixed with other materials in hybrid structural components. Exhibitors at the Forum and in the neighbouring Lightweight Area include “Leichtbau-Zentrum Sachsen” (Lightweight Construction Center Saxony), Chem-Trend, Gößl + Pfaff, Krempel, Mitsui Chemicals Europe, Leichtbau BW, the VDMA, Gustav Gerster, Potters Ballotini (UK), Yuho (Japan), Riba Composites (Italy) and Stamixco (Switzerland) as well as the journals Lightweight Design (Springer Fachmedien) and Automobil Industrie (Vogel Communications Group), to name but a few.

“Ultralight in Space”: market study on lightweight construction trends in the aerospace industry

The aerospace industry has always served as a pioneer for ultra-lightweight construction pushing many disciplines to their limits as a driver of innovation. The latest technical trends are currently under scrutiny via a market study carried out by consultancy Automotive Management Consulting (AMC) in cooperation with the Luxembourg-based aerospace OEM GRADEL. The results will be presented for the first time at the LTF in Stuttgart on 10 September.

Presentation of the AVK Innovation Prize

Innovative products and applications in fibre-reinforced plastics, manufacturing processes and the latest insights from research and science, will again be recognised by the German trade association AVK – Industrievereinigung Verstärkte Kunststoffe e. V. with its renowned Innovation Prize. The winners will be announced as part of the trade fair on 10 September and the award-winning products and projects will be on display in a special area.

Presentation of the SMB-BMC Design Award

The European Alliance for SMC BMC will announce the winners of the SMC BMC Design Award 2019 – also on 10 September. The contest already held for the second time now, honours and promotes the design excellence of students or young design professionals who use SMC and BMC components (sheet and bulk moulding compounds) in their designs. This year saw sustainable mobility take centre stage as a theme.

COMPOSITES Night

The event to celebrate the midway point of the trade fair: the COMPOSITES Night at the end of the second trade fair day offers visitors and exhibitors additional opportunities for networking. Participants are in for buffets and live music at the Stage Palladium Theater in Stuttgart.

Matchmaking programme makes trade fair visit more efficient

Thanks to the complimentary networking & meeting platform “matchmaking” visitors and exhibitors can already reach out to contacts in the run-up to COMPOSITES EUROPE. Who is at the trade fair? Who has answers to your specific questions? Who can you team up with to turn new ideas into practice? The matchmaking platform allows you to “filter” and make direct appointments with potential cooperation partners by product category, industry, country, or company.

Career & Composites

With its career&composites stand COMPOSITES EUROPE targets students and graduates who can come here to establish contact with potential employers. On the special area the exhibitors present their companies to interested junior employees and attract attention to vacancies and career opportunities via a Job Wall.

Co-located with Foam Expo Europe

COMPOSITES EUROPE will be co-located with Foam Expo Europe for the first time. This trade fair covers the supply chain of technical foam production and presents moulded, rigid and soft foam solutions – from raw materials to equipment and machinery. The parallel exhibition dates generate special synergies for gaining an overview of lightweight construction materials for such shared applications as the automotive, aviation, construction and sports & leisure industries.

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

(c) Photos: Reed Exhibitions/ Oliver Wachenfeld

Reed Exhibitions Germany GmbH