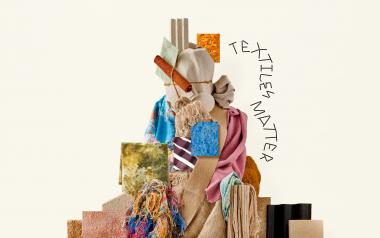

Heimtextil Trends 23/24: Textiles Matter

The Heimtextil Trend Preview 23/24 presented future-oriented design concepts and inspiration for the textile furnishing sector. With ‘Textiles Matter’, Heimtextil 2023 wants to set the benchmark for tomorrow’s forward-facing and sustainable textile furnishing. Hence, the focus is on circularity. Marta Giralt Dunjó of futures research agency FranklinTill (Great Britain) presented the design prognoses for 23/24. At the coming Heimtextil in Frankfurt am Main from 10 to 13 January 2023, the presentations of new products will generate stimulating impulses in the Trend Space.

The Heimtextil Trend Council – consisting of FranklinTill Studio (London), Stijlinstituut Amsterdam and Denmark’s SPOTT Trends & Business agency – offers insights into the future of the national and international market. The focus is more than ever before on sustainability and the circular economy, the main factors in setting the trends for the season 23/24.

Textiles Matter: bear responsibility

Textiles are an integral part of modern life. The material applications and the manufacturing processes are no less multifarious than user expectations. And this represents a great challenge for the international textile industry, which obtains its raw materials from a broad spectrum of sources and uses numerous processes to make a huge variety of products. This offers a great potential for the sustainable development of the textile industry in the future. The Heimtextil Trends show ways in which this potential can be utilized and sustainable developments promoted. Under the motto ‘Textiles Matter’, visitors can explore concepts for increased circularity, which will generate new impulses for the sustainable market of the future.

"Considering the state of environmental emergency we are currently living through, the textile industry has a responsibility to examine its processes, and change for the better. That is why for this edition of the Heimtextil Trends we are taking a material’s first approach, and focusing on the sourcing, design, and sustainability of materials. Textiles Matter showcases the potential of circularity and celebrates design initiatives that are beautiful, relevant and importantly sustainable”, explains Marta Giralt Dunjó of FranklinTill.

Change via circularity

The Trend Space at the coming Heimtextil 2023 will revolve around ideas and solutions for circularity in the textile sector. How can textiles be produced in a sustainable way? What recycling options are there? What does the optimum recycling of textile products look like? Within the framework of the circular economy, materials are continuously reused. On the one hand, this reduces the need for new raw materials and, on the other hand, cuts the amount of waste generated. In the technical cycle, inorganic materials, such as nylon, polyester, plastic and metal, can be recycled with no loss of quality. In the biological cycle, organic materials, such as linen and bast fibres, are returned to nature at the end of their useful life. This is the basis of the four trend themes: ‘Make and Remake’, ‘Continuous’, ‘From Earth’ and ‘Nature Engineered’.

Make and Remake

Pre-used materials, deadstock and remnant textiles are given a new lease of life with the focus shifting to the aesthetics of repair and taking the form of a specific design element of the recycled product. Bright and joyful colours and techniques, such as overprinting, overdyeing, bricolage, collage and patchwork, result in new and creative products. Layered colour patterns and graphics lead to bold and maximalist, yet conscious, designs.

Continuous

The Continuous trend theme describes closed-loop systems in which materials are recycled into new, waste-free products again and again. Putative waste materials are separated out and reprocessed as new fibres, composites and textiles. Thus, synthetic and cellulose yarns can be produced zero-waste. Thanks to technically advanced reclamation processes, the materials retain their original quality and aesthetic. Practicality, essentialism and longevity determine the design of Continuous products.

From Earth

This theme focuses on the natural world and harmony with the nature of organic materials. Natural colours communicate warmth and softness. Imperfect textures, signs of wear and irregularities create ecological and earth-born aesthetics. Earthen and botanic shades, natural variation and tactile richness dominate the From Earth segment. Unrefined and raw surfaces, unbleached textiles and natural dyes celebrate materials in their original states.

Nature Engineered

Nature Engineered uses mechanical means to elevate and perfect organic materials, such as bast fibres, hemp, linen and nettles. Cutting-edge techniques process natural textiles into sophisticated and smart products. Combined with shades of beige and brown, clean lines and shapes are the distinguishing features of this theme.

Heimtextil, Messe Frankfurt