DIGITEX SHOW 2019 GEARS UP FOR ANOTHER MILESTONE

Digital textile printing technologies to take Centre Stage at Gartex Texprocess India 2019 – the 3-day comprehensive exhibition on complete supply-chain of garmenting & textile manufacturing solutions

India’s leading trade show, dedicated completely to garmenting and textile manufacturing solutions and technologies, Gartex Texprocess India is scheduled from 10-12 August 2019. Spread over 1,50,000 sq. ft. exhibit area, the show will be held across six halls in Pragati Maidan, wherein more than 200 companies will display over 400 brands. A hub dedicated completely for showcasing and highlighting latest developments in machinery, inks, software and services in digital textile printing, the Show is designed to take the country’s fabric printing & apparel industry to the next level.

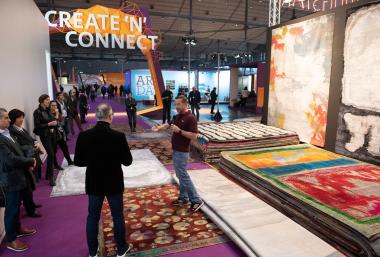

The 4th edition of the Show is gearing up incorporating DIGITEX Show highlighting the developments and innovations taking place in the digital textile printing technology, which is eventually picking up fast in the apparel manufacturing industry across the country. More than 20,000 enthusiastic visitors are expected to witness the latest developments during the three days of extreme business activities. They would not only take a glimpse of what new has hit the turf in the digital textile printing, but will also experience the newest technologies through various live demonstrations that the leading brands catering to the solution for soft signage and sublimation printing would put on the display.

The transformation in digital technologies over the past few years has been tremendous, which the organisers found important to bring forth under the DIGITEX @ Gartex Texprocess 2019. The advancement in technologies and rapidly increasing awareness has brought it at a revolution of sorts. Digitex hopes to become a one-stop solution hub for the latest machinery, inks, software and services to serious buyers and decision makers of the digital textile printing industry. The Show would also witness renowned brands offering live demo of their respective machines to let the visitors feel and appreciate the development taking place in the fabric digital printing arena which is slowly but steadily picking up.

Ever since direct to garment (DTG) printing has been introduced, textile printing industry has started finding new horizons with a fast and flexible production solution that delivers exceptional image quality, which in turn is opening up new doors of opportunities for those who are willing to enter into the apparel industry or are eager to expand their garmenting & textile business. Digitex @ Gartex Texprocess India is an important event for the digital printing technology leaders as it offers them the perfect Launchpad as far as Indian market is concerned.

Moreover, experts feel that increasing thrust and resultant R&D investment in progression of digital textile printing technology will further boost the growth avenues for the digital textile industry in near future. Meanwhile, increasing popularity of polyester as an alternative to cotton as a textile fabric further creates opportunities for digital textile printing equipment providers to expand their business. Attributing to such significant demand for digital textile printing technology, there is scope for manufacturers to enhance their business in time to come.

Many leading names like ColorJet India, Fortuna Colours & Prints Llp, Apsom Technologies, Kornit Digital, True Colors Group, Epson India, Jaysynth Dyestuff (India) Ltd., etc. are lined up with their new arrivals and eagerly awaiting the Show dates to launch their latest printers. Featuring continuous production and a wide range of printing capabilities, most of these new age digital textile printers work on minimal maintenance and come with easy cleaning options for smooth operation. All these activities clearly evince that overall textile printing technology market has positive growth prospects, riding on the back of the country’s burgeoning textile industry.

Companies like Arrow Digital, AT Inks, Britomatics, Cosmic Trends, DCC Print Vision Llp, E.I.DuPont India Pvt. Ltd. Electronics For Imaging India Pvt. Ltd. (Efi Optitex), Epson India, Fortuna Colours & Prints Llp, Ganpati Graphics, Grafica Flextronica, Green Printing Solution, Green Tech, Hi Tech Marketing, HP India Sales Pvt. Ltd., Jay Chemicals Industries Ltd., JN Arora & Co., Kamal Sales Corp., KNR Technology Company, Mac Printing Solutions, Mouvent, Negi Sign Systems & Supplies Co., Orange O Technology Pvt. Ltd., Somya Digital Technologies, Spintex Pvt. Ltd./Aura, Tanya Enterprises, Texzium International Pvt. Ltd./Wenli, Veekay Enterprises, & many more are coming up with their technological innovations to showcase their latest product range under the DIGITEX.

The extensive exhibit profile ranging from new printers and inks to upcoming techniques will explore new and exciting opportunities offered by digital printing for home furnishing & interior decoration, apparel & fashion and corporate interiors. On the display will be digital textile machinery, digital textile printing machines, dye sublimation process, screen printing machines, t-shirt printing machines, transfer printing process, digital textile printing chemicals, digital textile printing inks (disperse, reactive and pigment inks), heat transfer machines, sublimation paper, software & many more.

Moreover, it’s a great opportunity for digital printing companies, signage industry stakeholders, screen printing industry people from graphic arts industry, merchandisers and other industry players to interact with the leading digital printing technology suppliers and to witness the latest range and innovations in the sector. This is because following the advent of digital printing solution, the applications of fabric or textile is not limited only to the clothing and home furnishing, but has gone far beyond to include signage, flags, posters, back-lit, front-lit, etc. to bring forth a wholesome idea that where all digital textile printing technology can be used.

Points to be noted are numerous benefits of soft signage. Textile or soft signage presses are very eco-friendly, run over water-based inks with little to no odour and low power consumption. Soft signage facilitates customers save on shipping because of being much lighter in weight than other materials used in the signage and graphics industry. Also, fabric-printed signs fold up to create smaller packages, again decreasing shipping costs. But overall, the Show would be a win-win for business visitors as it has much more than focusing on digital printing technology, bringing entire value chain of garmenting and textile printing manufacturing solution under one roof.

Organised by the MEX Exhibitions Pvt. Ltd. in association with Messe Frankfurt India, Gartex Texprocess, this year, will have three more shows apart from the Digitex. These are namely, FABRIC & TRIMS SHOW: A focused area to source all embellishments & fabrics, DENIM SHOW: A zone that aims to bring together the denim supply chain under one roof, and INDIA LAUNDRY SHOW: An ideal platform offering a wide range of business and networking opportunities to manufacturers, suppliers and service providers in the laundry and dry-cleaning industries.

Additionally, there are a couple of focus areas i.e., EMBROIDERY ZONE highlighting the significant evolution that has been taking place in the invention of new technologies and machinery for embroidery. The top variants of embroidery machines, software & allied products will be highlighted in this dedicated segment. Another focus area is GARMENTING & APPAREL MACHINERY that would showcase technological developments in the Garment & Apparel Manufacturing Sector.

Broad exhibit categories at Gartex Texprocess 2019 include embroidery machines, cutting and sewing machines, fabrics & accessories, needles & threads, laundry & washing equipment, finishing equipment, laser cutting machines, digital textile printing machines, automation and software.

MEX Exhibitions Pvt. Ltd. / Messe Frankfurt