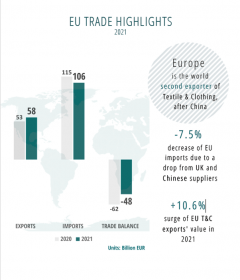

EURATEX 2022 Spring Report: Exports of textile and clothing articles +10.6%

EURATEX has just released its Spring report, offering a detailed insight into trade figures for the European textile and apparel industry in 2021. The numbers are encouraging: comparing with the dramatic corona-year 2020, EU exports of textile and clothing articles increased by +10.6%, while imports dipped by -7.5%. As a result, the EU trade deficit improved, even it remains significant (- €48 billion).

Furthermore, import prices went slightly down in clothing and dropped in textiles, following a strong decrease of Chinese import prices of face masks and protective medical supplies.

The boost in exports was mainly due to strong performance on the Swiss, Chinese and US markets. On the other side, EU sales of textile & clothing to the United Kingdom fell sharply (-23%), due to Brexit new requirements, customs’ delays and shortage of truck drivers. Imports from the EU top supplier, China, plunged by -28%, corresponding to €13 billion. Similarly, textile and clothing imports from the United Kingdom recorded a sharp decrease over the period (-48%, equal to €-3 billion).

Director General Dirk Vantyghem commented: “the 2021 export figures, presented in this Spring report, confirm that EURATEX members have gained momentum; even if energy prices are causing some serious short-term disruptions, our long-term ambition remains to be a world leader on sustainable textiles.”

The international trade dimension is indeed critical for the competitiveness of the European textile ecosystem, and needs to be fully embedded in the EU’s Strategy for Sustainable and Circular Textiles. The Commission insists that “all textile products placed on the EU market, are durable, free of hazardous substances, produced respecting social standards…” This is an essential condition to create a level playing field between all textile and apparel companies, regardless of their production base. With €100 billion of imports, and over 20 billion of “foreign” textile items put on the Single Market, this requires a dramatic upscaling of market surveillance, without however disrupting fluid supply chains.

Looking at the impact of war in Ukraine, EURATEX has strongly condemned the Russian aggression, and offered support to the Ukrainian textile industry. Ukraine offers valuable sourcing opportunities for European textile and apparel brands, as part of a broader nearshoring trend, which seems to emerge from the trade figures.