European textile industry increasingly exposed to global pressure

"Policy makers need to consider that global dimension."

EURATEX released its 2023 Spring Report, which analyses latest trade flows for textiles and clothing products.

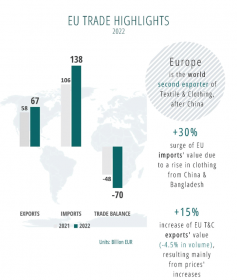

In 2022, EU trade in textiles and clothing has exceeded, for the first time in history, the €200 billion mark. This record growth of total trade is mainly due to a sharp increase of clothing imports (+36,6% in value), especially from China and Bangladesh, which outweighs Europe’s positive export performance. As a result, the EU’s trade deficit in textiles and clothing has increased to €70 billion, which is 48% higher than the year before.

Such a growing deficit is a cause for concern; the objective of the EU’s Industrial Strategy to strengthen resilience and “strategic autonomy” is not happening. Instead, the dependency has increased, and becomes critical in certain raw materials and fibres.

It also challenges the Commission’s ambition is to promote – and prevail – high quality and sustainable textile products on the Single Market – regardless where they have been produced. With imports now reaching €140 billion, it will be a challenge to effectively control the quality and compliance over these imports. Market surveillance will need to be stepped up massively, without becoming a barrier to trade.

The efforts on the EU’s export performance need to be strengthened, so as to rebalance the European trade relations with the rest of the world. EU companies are world leader in high end fashion products and in technical textiles. More needs to be done to support their activities in established markets but also emerging economies. For instance, the ongoing FTA negotiations with India should focus on improving market access and ensure “fair” competition with local companies.

The EURATEX Spring Report highlights significant differences between trade in value and in volume. EU’s export of textile products has increased by 13% in value, but actually dropped by nearly 7% in volume. This obviously reflects the very high inflation figures from last year, caused initially by the rising energy prices and changing central bank policies. This in turn leads to uncertainty with the consumer, resulting in low demand and gloomy prospects for the entire value chain.

Director General Dirk Vantyghem commented on these latest figures: “This report confirms once again that “textiles” is one of the most globalised sectors of the European economy, and hence the importance of taking that global dimension into account, when designing EU and national policies. Failing to do so may have a devastating effect on the global competitiveness of the European textile industry.

Looking forward, he added: “It is essential to stabilise inflation, restore consumer confidence and ensure a level playing field for all operators in the textile industry. On that basis, European companies can prosper and offer quality jobs to 1.3 million workers”.