Lenzing implements performance program in response to lack of market recovery

- Revenue of EUR 1.87 bn and EBITDA of EUR 219.1 mn in the first three quarters of 2023

- Positive free cash flow of EUR 27.3 mn in the third quarter

- Implementation of performance program focusing on positive free cash flow, strengthened sales and margin growth and sustainable cost excellence

- Modernization and conversion of Indonesian site successfully completed – EU Ecolabel received

The anticipated recovery in markets relevant for the Lenzing Group has to date failed to materialize. The continued sharp increase in raw material and energy costs on the one hand and very subdued demand on the other had a negative impact on Lenzing’s business trends as well as on industry as a whole during the reporting period.

Revenue in the first three quarters of 2023 decreased by 5.3 percent year-on-year to EUR 1.87 bn. This reduction was primarily due to lower fiber revenues, while pulp revenues were up. The earnings trend was mainly influenced by the market environment. As a consequence, earnings before interest, tax, depreciation and amortization (EBITDA) in the reporting period decreased by 16.7 percent year-on-year to EUR 219.1 mn. The net result after tax amounted to minus EUR 96.7 mn (compared with EUR 74.9 mn in the first three quarters of 2022), while earnings per share amounted to minus EUR 4.90 (compared with EUR 2.16 in the first three quarters of 2022).

Outlook

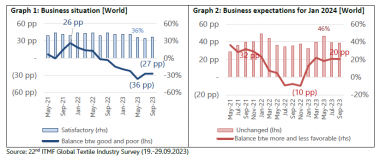

According to the IMF, a full return of the global economy to pre-pandemic growth rates appears increasingly out of reach in the coming quarters. In addition to the consequences of the pandemic and the ongoing war in Ukraine, growth is also being influenced by restrictive monetary policy and extreme weather events. The consequences of the renewed military confrontation in the Middle East are not yet foreseeable. Overall, the IMF warns of greater risks to global financial stability, and expects the growth rate to decrease to 3 percent this year and to 2.9 percent next year.

The currency environment is expected to remain volatile in the regions of relevance to Lenzing.

The general market environment is continuing to weigh on the consumer climate and on sentiment in the industries relevant to Lenzing.

In the trend-setting market for cotton, the current 2023/24 crop season is emerging as a further 1.7 mn tonnes of inventory build-up, following 1.8 mn tonnes of inventory build-up in the previous season.

Earnings visibility remains severely limited overall.

Lenzing is fully on track with the implementation of the reorganization and cost reduction program and on this basis is implementing a comprehensive performance program focused on positive free cash flow, strengthened sales and margin growth as well as sustainable cost excellence. The overarching goal is to position Lenzing even more strongly and to further increase its crisis resilience.

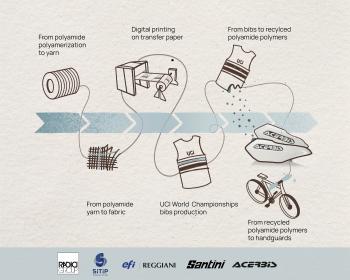

In structural terms, Lenzing continues to anticipate growth in demand for environmentally responsible fibers for the textile and clothing industry as well as the hygiene and medical sectors. As a consequence, Lenzing is very well positioned with its “Better Growth” strategy and plans to continue driving growth with specialty fibers as well as its sustainability goals, including the trans-formation from a linear to a circular economy model.

The successful implementation of the key projects in Thailand and Brazil as well as the investment projects in China and Indonesia will further strengthen Lenzing’s positioning in this respect.

Taking the aforementioned factors into consideration, the Lenzing Group continues to expect that EBITDA for the 2023 financial year will lie in a range between EUR 270 mn and EUR 330 mn.

Lenzing AG