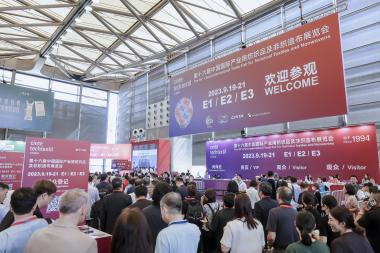

Cinte Techtextil China taking place in September 2024

With four months until the show opens doors, key exhibitors have already confirmed participation for the Cinte Techtextil China 2024. In conjunction with a positive global outlook, key players are eager to congregate again at the Shanghai New International Expo Centre from 19 – 21 September, to showcase innovations and connect with buyers from various sectors.

The fair will closely align with Messe Frankfurt’s ‘Texpertise Econogy’ – the umbrella for the group’s sustainability activities at its more than 50 textile trade shows worldwide. New energy elements, such as battery and hydrogen, will appear at the Innovation Showcase Area, on top of other interactive fringe events which centre around sustainability.

With environmental protection as one of the top sourcing categories at the previous edition, products with medical, home, protection, and building applications rounded out the top five. By product group, in-demand sourcing categories included nonwovens; technology and accessories; woven fabrics, laid webs, knitted fabrics, braidings; composites; as well as coated textiles and bondtec. The show saw 15,542 visits from 52 countries and regions last year.

Catering to various key players in 2023, the well-known Groz-Beckert East Asia brought their latest innovative needling tools for the nonwovens sector. Speaking at the show, Mr Kabilen Sornum, Vice President Asia Pacific of Marketing & E-Commerce, commented: “While we are focusing on the China market, we have also seen buyers from the Middle East, Europe, Korea, and North Asia. Cinte Techtextil China is a more international fair – we can see that everyone is here, and the quality and innovation of buyers has improved greatly in the past three to four years. E-mobility and sustainability are two very clear trends.”

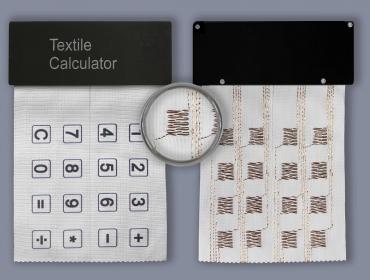

The fair’s product categories cover 12 application areas, which comprehensively span a full range of potential uses in modern technical textiles and nonwovens. These categories also cover the entire industry, from upstream technology and raw materials providers to finished fabrics, chemicals and other solutions. This scope of product groups and application areas ensures that the fair is an effective business platform for the entire industry.

Messe Frankfurt (HK) Ltd