EURATEX at 1 year EU Textile Strategy – Yes, but …

On 30 March 2022, the European Commission presented its vision for the future of the textile industry. The strategy mainly focuses on reducing the environmental footprint and promote sustainability and transparency in the value chain.

EURATEX has welcomed the publication of the strategy, as it recognises the strategic importance of the European textile industry, and its core competitive values of quality and creativity. At the same time, the association has warned that translating that vision into reality is a delicate process, as the industry needs to reconcile sustainability with competitiveness. Making the green (and digital) transition should make companies stronger; the benefits should outweigh the costs.

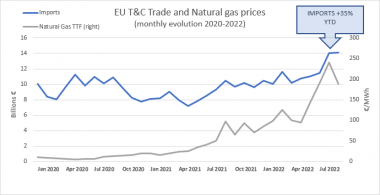

This premise had a serious blow by the Russian war in Ukraine, which erupted at almost the same time when the strategy was launched, and has dramatically changed the economic context. Energy prices increased by a factor of 10 (!), putting the European industry at a significant disadvantage with its global competitors, leading to company shutdowns or relocations. Extended lock downs in China and defensive trade policies in the US and elsewhere have further generated uncertainty on the market and disrupted supply chains.

Today, one year after its publication, EURATEX remains carefully optimistic about the implementation of the strategy, but needs to warn against some important pitfalls on the road ahead.

- Despite these turbulent times, the Commission is moving ahead “swiftly” in translating their EU Textile Strategy into (draft) legislation. At present, at least 16 pieces of legislation are on the table, which will turn the textile industry into a strictly regulated sector. The quality of this new regulatory framework is critical to the success of the strategy: upcoming rules need to be coherent, technically feasible and enforceable, and have a minimal cost for SMEs. EURATEX calls for a realistic timetable and “competitiveness test” for each piece of legislation before it is adopted.

- Textile companies need to be informed and supported to comply with this new framework. This requires substantial funding which should be earmarked exclusively to the sector, covering areas of innovation and digitalisation, skills development, support to start ups and internationalisation, as well as access to affordable energy. In this regard, EURATEX calls on the Commission to translate the current “good intentions” into concrete decisions.

- The EU strategy will not work if there is no demand for sustainable textiles, both from individual consumers and public authorities (procurement). Concrete measures need to be taken to offer a competitive advantage to sustainable and high quality textile products, e.g. through a different VAT rate, strict procurement rules, closer cooperation between the brands/retailers, producers and consumers.

- The EU strategy could also fail, if the global dimension of the textile industry is ignored. Up to 80% of clothing products are produced outside the EU; these products need to comply with the new framework, but it remains unclear how to ensure that level playing field. Market surveillance needs to be stepped up massively – also targeting on line sales – but this would require significant efforts from member states, which are not available as of today.

Despite these important challenges, EURATEX remains committed to the successful implementation of the EU Textile Strategy. Director General Dirk Vantyghem commented: “We want to be a global leader in sustainable textiles, building on the entrepreneurship, quality and creativity of nearly 150,000 European textile companies. Creating this new framework is an incredible challenge, requiring a close dialogue between the industry and the regulator. But if well designed and carefully implemented, it can set a new era for the European textile industry”.

Euratex