Autoneum updates its outlook for 2022 as a result of the Ukraine war

Due to the impact of the war in Ukraine on the automotive industry and vehicle production as well as of rising inflation, Autoneum is adjusting its corporate outlook for the 2022 financial year. The market recovery will be delayed by current developments.

Since the outbreak of war in Ukraine, new bottlenecks in global supply and logistics chains have been impacting vehicle manufacturer production volumes and thus slowing the revenue and earnings development of the automotive supply industry, especially in Europe. Current developments are accompanied by accelerated inflation and significant price increases on the commodities markets, which have been further exacerbated by the war. These are felt at Autoneum through rising material, energy and transport costs. With regard to the rising costs, automotive manufacturers and suppliers are now required to ensure a fair burden sharing as partners.

In addition, renewed coronavirus-related lockdowns in China are delaying growth in Asia. According to the revised market forecasts1), global automobile production is expected to reach 80.4 million units in 2022, which represents an increase of 4.1% compared to 2021. Growth will thus be significantly lower than was still expected in mid-February.

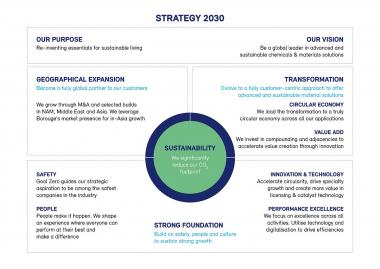

Autoneum will do its utmost to minimize the impact on the Group. Despite the present challenges, the strategy will continue to be consistently implemented with a focus on innovative and sustainable technologies for growing markets of the future.

Based on current developments and knowledge, Autoneum has updated the forecasts that it presented at the Media Conference, which had not yet included the impacts of the war as outlined above. Autoneum continues to expect revenue to develop in line with the market. For the first half of the year, the Company expects an EBIT margin at break-even level. On the basis of the ongoing collaborative discussions with customers to participate in the sharing of the sharply increased energy and material costs, Autoneum anticipates an improvement in the EBIT margin to 2.0 to 3.0% (previously: 4.0 to 5.0%) for the full year 2022. Free cash flow for 2022 is expected to be in the mid to high double-digit million range.

Autoneum is very well positioned for the transformation of the automotive industry towards e-mobility and sustainability. Our product portfolio is suitable for all drive types, whether internal combustion, hybrid or pure electric vehicles. The medium-term forecasts that Autoneum published in November 2021 remain unchanged positive. The timing of the market recovery will be delayed by current events and will also depend on further geopolitical developments.

Autoneum Management AG