AZL: Plastic-based multi-material solutions for cell-to-pack battery enclosures

The future of e-mobility will be determined in particular by safe battery enclosures. As batteries for electric vehicles become more performant, higher volumetric energy density plays a crucial role. If more energy is to be stored in less installation space, new material and design solutions are required. The development of suitable enclosures made of safe and highly robust lightweight materials is also required. This is a case for the Aachen Centre for Integrative Lightweight Production (AZL). A project on cell-to-pack battery enclosures for battery-electric vehicles, which has been eagerly awaited in the industry, will start in October this year there.

The design of battery housings is crucial for safety, capacity, performance, and economics. The Cell-to-Pack project, which is starting now, will focus on developing concepts for structural components and for producing them based on a variety of materials and design approaches. The concepts will be compared in terms of performance, weight and production costs, creating new know-how for OEMs, producers and their suppliers throughout the battery vehicle value chain. Companies are now invited to participate in this new cross-industry project to develop battery enclosure concepts for the promising and trend-setting cell-to-pack technology.

The basis for the project is the lightweight engineering expertise of the AZL experts, which they have already demonstrated in previous projects for multi-material solutions for module-based battery housings. Together with 46 industry partners, including Audi, Asahi Kasei, Covestro, DSM, EconCore, Faurecia, Hutchinson, Johns Manville, Magna, Marelli and Teijin, 20 different multi-material concepts were optimized in terms of weight and cost and compared with a reference component made from aluminum. All production steps were modelled in detail to obtain reliable cost estimates for each variant. Result: depending on the concept, 20% weight or 36% cost savings potential could be identified by using multi-material composites compared to the established aluminum reference.

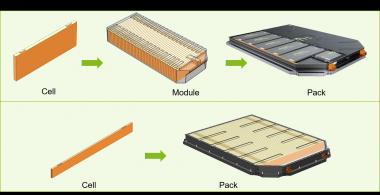

It is expected that the design concept of battery enclosures will develop in the direction of a more efficient layout. In this case, the cells are no longer combined in modules in additional production steps, but are integrated directly into the battery housing. The elimination of battery modules and the improved, weight-saving use of space will allow for higher packing density, reduced overall height and cost saving. In addition, various levels of structural integration of the battery housing into the body structure are expected. These new designs bring specific challenges, including ensuring protection of the battery cells from external damage and fire protection. In addition, different recyclability and repair requirements may significantly impact future designs. How the different material and structural options for future generations of battery enclosures for the cell-to-pack technology might look like and how they compare in terms of cost and environmental impact will be investigated in the new AZL project. In addition to the material and production concepts from the concept study for module-based battery enclosures, results from a currently ongoing benchmarking of different materials for the impact protection plate and a new method for determining mechanical properties during a fire test will also be incorporated.

The project will start on October 27, 2022 with a kick-off meeting of the consortium, interested companies can still apply for participation until then.

AZL