EcoVadis Platinum rating for Stahl

Stahl, an active proponent of responsible chemistry, has been awarded the highest EcoVadis Platinum rating, placing it within the top 1% of companies assessed by EcoVadis. The award underlines Stahl’s commitment to collaborating with its partners to reduce its environmental impact and build a more responsible and transparent supply chain.

EcoVadis is a globally recognized evidence-based assessment platform that reviews the performance of more than 90,000 organizations across key sustainability criteria. These include environmental impact, labor and human rights standards, ethics, and sustainable procurement practices. The latest report from EcoVadis highlights Stahl’s positive progress across all these areas and builds on the Gold rating achieved by the company in 2021. Stahl’s 2030 target is to maintain the EcoVadis Platinum rating by working closely with its value-chain partners to help them reduce their environmental impact – including by supporting their transition to renewable feedstocks. In 2021, 80% of Stahl’s total spend on raw materials was supplied by EcoVadis-rated suppliers.

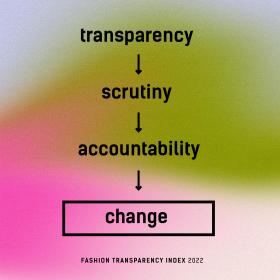

The new EcoVadis rating comes as Stahl accelerates its efforts to ensure a more responsible and transparent supply chain. Recent steps toward this goal have included establishing a dedicated Supply Chain Transparency division within the company’s Environmental, social, and governance (ESG) department. The division will be tasked with coordinating a new product development framework that prioritizes the responsible sourcing of raw materials. Furthermore, in July 2022, Stahl submitted a new greenhouse gas (GHG) emissions reduction target, including a specific commitment regarding the company’s Scope 3 upstream emissions. Stahl aims to reduce these by at least 25% over the next 10 years, compared with the base year (2021). Stahl expects to achieve this reduction primarily by working with its suppliers to replace fossil-based raw materials with lower-carbon alternatives.

Stahl Holdings B.V.