IndustriAll Europe and Euratex: Joint SSDC Textiles & Clothing Statement

The European textiles and clothing sector is set for a major transformation which will affect both industry and workers. The EU’s strategy for sustainable and circular textiles aims to ensure that by 2030, textile products placed on the EU market are long-lived and recyclable with the industry moving from a linear to a circular business model. This strategy is accompanied with the EU’s transition pathway for a more resilient, sustainable, and digital textiles ecosystem linking the green transition with the digital transition while stressing the need for the sector to remain competitive.

IndustriAll European Trade Union (industriAll Europe) and Euratex, representing the workers and employers in the textiles and clothing sectors respectfully, jointly highlight both the challenges and opportunities of the giant forthcoming transformation of the sector and call for action to ensure that European industrial policy is fit for purpose and enables the sector to transform without negatively impacting workers or European industry.

Specifically, the European social partners jointly call for:

- EU action to guarantee that the European textiles ecosystem remains competitive, including ensuring a level global playing field.

- Measures to increase the demand of sustainable products including awareness raising campaigns, incentives such as lower VAT rates, and sustainability criteria in public procurement.

- Measures to ensure access to green and affordable energy.

- Policy gaps to be addressed, such as promoting a harmonised Extended Producer Responsibility approach across the EU and ensuring that SMEs can use Product Environmental Footprints.

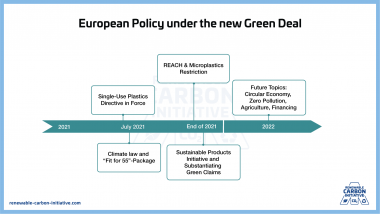

- Action to ensure that the Sustainable Products Regulation and the forthcoming Digital Product Passport will offer a transparent, predictable and SME-friendly framework.

- Investment in attracting, training and reskilling workers including via concrete support for the EU Pact for Skills.

- Appropriate funding, sound metrics and legal incentives at regional, national, and European level to support the green and digital transitions of the textile and clothing sectors.

- Regional and national authorities to coordinate with sectoral social partners to ensure that the green and digital transitions are fair and just and do not leave the industry, regions or workers behind.

Euratex