EU-India Free Trade negotiations

- Opportunity to rebalance trade relations and promote a global sustainable textile industry

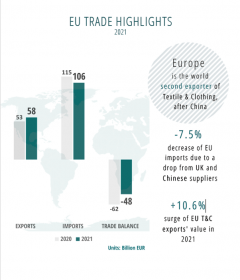

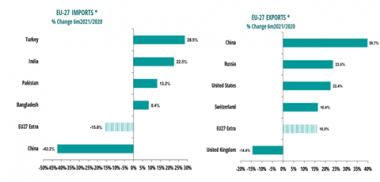

Today’s trade relations between the EU and India in textiles and clothing are characterised by a large and systemic trade deficit for the EU; annual imports from India exceed €6 bln (2021) – making it the 4th supplier – while EU exports to India reached just half a billion – the 20th place in our export markets.

Against this background, the free trade negotiations are an opportunity to rebalance that relationship; European textile and clothing companies can offer high quality and innovative products for the Indian market, but they can also offer solutions to reduce the environmental footprint of the textile industry.

EURATEX, as the voice of textiles and apparel manufacturers in Europe, supports an ambitious EU trade agenda, that puts reciprocity, transparency, fair competition and equal rules at the centre of its action. The FTA is an opportunity to establish a more sustainable and fair trading system, based on rules, global environmental and social standards, which are effectively respected by all.

In this context, EURATEX highlights that the sector needs open and efficient markets, but combined with effective controls where necessary, thus ensuring level playing field for European companies. It is clearly essential that the same level of market access to India – both in terms of tariff and non-tariff barriers – is available to EU producers as vice versa.

India today benefits from reduced customs duties due to GSP. For European companies instead, market access to India is challenging, facing non-tariff barriers (related to proof of origin, quality control procedures, etc.) as well as national or state-level support programmes which distort the level playing field between EU and Indian companies.

That level playing field should also apply to our sustainability targets. As the EU will roll out its EU Textile Strategy, setting ambitious standards and restrictions (e.g. on chemicals), we must ensure the FTA is fully aligned with that strategy.

Director General Dirk Vantyghem commented: “We look to these negotiations with great interest. The FTA is an opportunity to develop a shared ambition between the European and Indian industry to make sustainable textiles the norm, and to create a regulatory framework where our companies can compete in a free and fair environment.”

EURATEX