RadiciGroup: Bibs made from recyclable materials for UCI Cycling World Championships

On the occasion of the 2023 UCI Cycling World Championships, the Union Cycliste Internationale chose Santini to make the bibs from recyclable materials. The UCI's partner brought together a pool of companies, all in the Bergamo area (Italy): RadiciGroup, Sitip, EFI Reggiani and Acerbis.

In 2022, the Union Cycliste Internationale released the UCI Climate Action Charter, which lays out an action plan to advance the environmental sustainability of the sport with a specific principle to reduce waste and accelerate the transition to a circular economy. This year, the UCI Cycling World Championships, which will be held from 3 to 13 August, are bringing together most of the cycling disciplines in a single location: Glasgow and across Scotland.

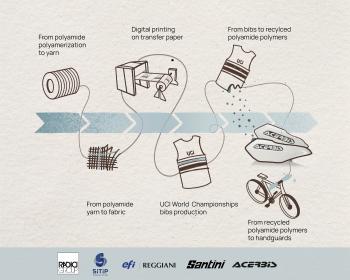

To mark the occasion, the UCI turned to its Official Partner, Santini, to make the bibs that the staff (judges, volunteers, commissaires etc.) and accredited photographers wear throughout the event. The bibs are "eco-designed", which means they are specifically created to have a second life after use. Once the event is over, the bibs could be collected and sent to RadiciGroup and transformed into new material, to be then processed by Acerbis to create X-Elite handguards for mountain bikes. This project is a concrete example of the circular economy at work, allowing 100% of the materials used to be recovered.

To optimise the production cycle of the bibs for the 2023 UCI Cycling World Championships, the products must be eco-friendly from the very first phase. The fabrics were therefore made from Italian nylon yarn produced by RadiciGroup. The choice of nylon – an infinitely recyclable thermoplastic material – is intertwined with UCI's sustainability goals for "limited-use" garments: RadiciGroup was able to channel its know-how and expertise in the field of chemistry to create "circular" bibs, working alongside the other partners. As the innovative yarn selected by RadiciGroup allows for easy and high-quality printing, the fabric is also customisable. The yarn is then provided to Sitip to create the "ARAS NG" warp-knitted fabric (95 g/100 m2): a recyclable single-fibre material made from 100% polyamide. The resulting fabric is the first nylon of its kind, designed to meet the transfer printing needs of the third project partner, EFI Reggiani, as well as the recyclability standards requested by RadiciGroup. The choice of fabric was born from extensive applied research, in which EFI Reggiani tested a wide range of fabrics to find the best colour results and the best resistance to rubbing and perspiration, which is vital for the bibs' intended use. In addition to using the new GOTS-certified EFI Reggiani IRIS Plus water-based inks, EFI Reggiani opted for a printing solution on transfer paper that does not consume water and requires a minimal amount of energy per square metre. Finally, the white fabric from Sitip and the transfer paper printed by EFI Reggiani arrived at Santini, who were responsible for transferring all the graphics for the 2023 UCI Cycling World Championships bibs from the paper onto the fabric. Santini also took care to assemble the garments using only thread and components made from nylon or chemically similar materials, allowing the bibs to enter the recycling process at the end of their lives without any further processing.

RadiciGroup