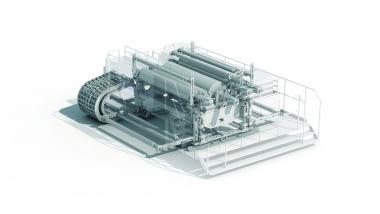

Mayer & Cie. launches upgrade kits for existing circular knitting machines

This month, the circular knitting machine manufacturer Mayer & Cie. is launching its upgrade kits for circular knitting machines that are already successfully in use by customers. With tailor-made packages, the company wants to give its users the opportunity to take advantage of technological progress in their existing machines. The aim is to improve the performance of the existing machines and to extend their service life. In addition to the machine-specific upgrade kits, the company now starts offering tailormade spare parts packages. They are intended to ensure machine availability and equip customers with spare parts for standard situations. In addition, they offer a degree of independence from possible failures in the supply chain and rising transport costs.

Longevity, a popular product property

“Longevity of our circular knitting machines is definitely a property that our satisfied customers mention regularly”, Mayer & Cie. sales director Wolfgang Müller says. The company estimates that up to 50 percent of all the circular knitting machines it has ever made are still around in the market somewhere.

Upgrades boost performance and value

Value retention, maintenance and upgrades for existing machines are a key issue for the company – and for the customers who successfully use existing Mayer & Cie equipment. That’s why the company recently launched customised upgrade kits to improve the long-term performance of machines.

Low budget, clear benefit

Compared to a new machine, upgrade kits are a low-cost investment that deliver clearly defined benefits. For example, an improved yarn guide ensures a significant increase in the plating reliability and output of the machine in question.

Most of the upgrade kits is machine-specific; the aforementioned yarn guide ensures a boost in productivity for the Relanit 3.2 II and Relanit 3.2 S. For S4 machines an optimised fluff blowing device can be the solution. It ensures that less fluff is knitted in and thereby improves the fabric quality. It also reduces downtimes that would otherwise be required for cleaning. Upgrade kits suitable for most Mayer & Cie. machines are the edge trimmer to open a fabric hose before the fabric’s rolling-up and the laying facility for high-quality hose fabric.

Spare part packages: Inside is what is required

In addition to individual upgrade kits Mayer & Cie. now offers spare parts packages. They too are customised for individual machines. When purchasing a machine, the customer can also order a small or a large spare parts package. Selected specially for the machine in question, it contains the most important consumables and spare parts.

The new spare parts packages also increase customers’ independence of supply chain failures and rising transport costs.

Mayer & Cie GmbH & Co. KG