Lenzing AG: New members proposed for appointment to the Supervisory Board

- Christian Bruch and Stefan Fida proposed to serve as new members of the Supervisory Board

- Hanno Bästlein and Christoph Kollatz will resign from their positions on the Supervisory Board at the upcoming Annual General Meeting

Prior to the Annual General Meeting of the publicly traded company Lenzing AG scheduled for April 17, 2019, the Nomination Committee dealt with the future composition of the Supervisory Board. It has proposed that the Annual General Meeting appoint Christian Bruch to serve on the Supervisory Board. Mr. Bruch has been a member of the Executive Board of Linde AG since 2015 and a member of the Management Committee of Linde plc since 2019. The graduate in mechanical engineering will contribute his extensive experience in plant engineering and various technical and management positions in internationally operating industrial companies. The Viennese lawyer Stefan Fida has also been nominated as a future member of the Supervisory Board.

As previously announced, Hanno Bästlein will resign from his position on the Supervisory Board at the upcoming Annual General Meeting in order to be able to increasingly devote his attention to his own business activities. Christoph Kollatz will also step down from the Supervisory Board for professional reasons at the Annual General Meeting in April 2019.

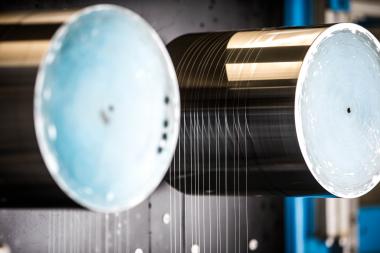

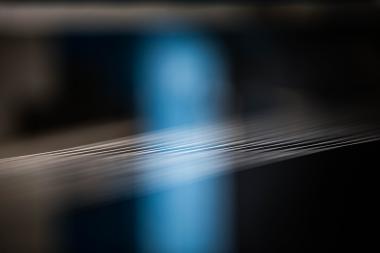

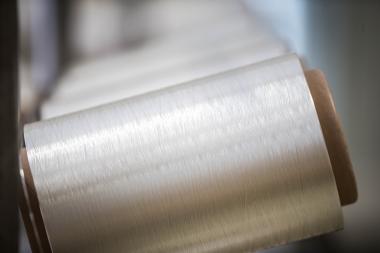

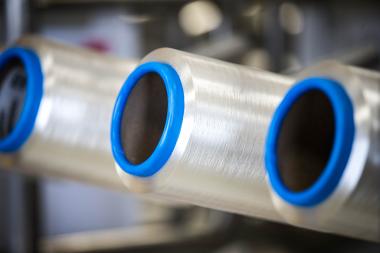

“We would like to thank Hanno Bästlein and Christoph Kollatz for their dedicated work on the Supervisory Board of Lenzing AG. Thanks to their expertise, they made a major contribution to important strategic decisions in the company. During his four years as Chairman of the Supervisory Board, Hanno Bästlein decisively supported the strategy of the Lenzing Group and thus contributed to the enhanced resilience of the company based on the expansion with specialty fibers”, says Stefan Doboczky, Chief Executive Officer of Lenzing AG.

Lenzing Group

Lenzing AG