Kelheim Fibres to present bio-based hygiene solutions at INDEX™23

Absorbent hygiene products such as diapers, sanitary pads, and incontinence products are an integral part of our daily lives. However, most of these products contain synthetic components and contribute to the global plastic waste problem. The search for alternatives is becoming increasingly urgent. The catch is that only innovations that offer the same performance and reliability as conventional products can be successful in the market. After all, no one wants to compromise in such a sensitive area as personal hygiene.

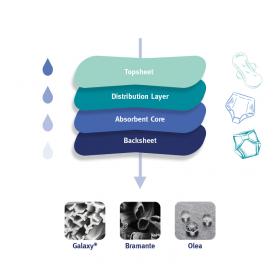

Kelheim Fibres is currently working on various development projects to design fully biobased AHP (absorbent hygiene product) concepts that do not compromise on performance. In this area, the company continues to focus on its wood-based specialty fibres, which the tampon industry has trusted for decades. However, the requirements for AHP products differ, as each layer must fulfil a specific function.

To meet these requirements, Kelheim Fibres has developed a range of functionalized specialty fibres, including hydrophobic Olea, trilobal Galaxy®, and the hollow fibre Bramante. These specialty fibres ensure optimal results in every layer of the AHP product.

All of Kelheim's fibres are manufactured from 100% wood pulp derived from certified and sustainably managed forests. They are fully biodegradable - microorganisms in soil and seawater ensure that no residues remain.

A current example of such a partner project is the development of a completely bio-based panty liner with the nonwovens manufacturer Sandler and the hygiene products manufacturer pelzGROUP, which is due to be launched on the market shortly.

In addition to new projects in the field of biobased disposable and reusable solutions, Kelheim will also present its tried and tested fibres at INDEX™23, for example for tampons or flushable wipes.

Kelheim Fibres GmbH