Borealis celebrates 30th anniversary

Borealis is commemorating its thirtieth year of operations. Born of a merger between Statoil and Neste, Borealis has expanded from its early Nordic roots to become one of the top polyolefins players. Its dedication to value creation through innovation has produced proprietary and transformative technologies which benefit society and accelerate the transition to a circular economy. The company is regularly ranked as Austria's top innovator in the European Patent Index and holds an extensive patent portfolio of around 8,900 granted patents. In Europe in particular, Borealis has for decades bolstered the industrial landscape by investing in its capital assets, and by providing thousands of jobs.

Innovations

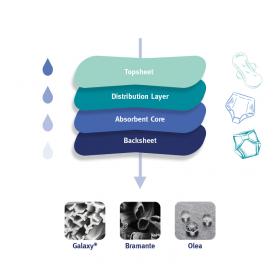

Borealis uses technological innovation to add value to polyolefin-based applications, ensure that production processes are made more resource efficient, and to accelerate plastics circularity. Borstar®, the multi-modal proprietary technology for the manufacture of polyethylene (PE) and polypropylene (PP), has been a mainstay of Borealis success since the start-up of the first Borstar PE plant in Porvoo, Finland in 1995. Borstar has since been joined by other technology brands, like Borlink™, an innovation for the power cable industry; Borstar® Nextension Technology, an innovation that among other benefits facilitates the production of monomaterial applications designed for recycling; or the Borcycle™ M technology for mechanical recycling, which breathes new life into polyolefin-based, post-consumer waste, transforming it into applications with a lower carbon footprint.

Global Expansion

With the strong support of its two majority shareholders OMV (Austria) and The Abu Dhabi National Oil Company (ADNOC, UAE), Borealis continues to expand its global footprint. The joint venture Borouge, established in 1998 in the UAE, and listed on the Abu Dhabi Securities Exchange (ADX) since 2022, is one of the largest integrated polyolefin complexes. It is currently the site of the company’s largest-ever growth project: Borouge 4, the new USD 6.2 billion facility in Ruwais, which will serve customers in the Middle East and Asia. In North America, the Baystar™ joint venture, founded in 2017 and operated with partner TotalEnergies, entailed the construction of a new ethane cracker as well as the most advanced Borstar plant ever built outside of Europe. The PE Borstar 3G plant in Pasadena, Texas was started up in late 2023 and has brought Borstar to this continent for the first time. Borealis’ commitment to Europe as a production location is evidenced by the new, world-scale propane dehydrogenation (PDH) plant currently under construction at Borealis operations in Kallo, Belgium.

Borealis