Rieter starts sales process for the remaining land owned by Rieter

- Order intake of CHF 869.4 million, order backlog of more than CHF 2 100 million

- Sales of CHF 620.6 million, preproduced deliveries in the three-digit million range had to be postponed until the second half of 2022

- EBIT of CHF -10.2 million, net result of CHF -25.2 million due to significant cost increases, additional costs, and acquisition-related expenses

- Action plan to increase sales and profitability

- Rieter site Winterthur

- Outlook

Rieter continued to be successful in the market in the first half of 2022. Based on the company’s technology leadership, innovative product portfolio and the completion of the ring- and compact-spinning system, a high order intake and a significant increase in sales were generated. The increase in sales was achieved even though preproduced deliveries in the three-digit million range had to be postponed until the second half of 2022. The order backlog is at a record level. Despite higher sales, the significant increase in material and logistics costs, additional costs for compensation of the material shortages and the expenditure incurred for the acquisition in the years 2021/2022 resulted in a loss. Rieter is implementing an action plan to increase sales and profitability. The sales process for the remaining land owned by Rieter was initiated.

Order Intake and Order Backlog

Rieter posted an order intake of CHF 869.4 million, which included CHF 176.6 million from the businesses acquired in the years 2021/2022. As expected, demand has thus returned to normal compared with the exceptionally high figure for the prior-year period, but remains well above the average figure for the last five years of around CHF 570 million (first half 2021: CHF 975.3 million, first half 2022 excluding acquisition effect CHF 692.8 million).

The regional shift in demand with investments in additional spinning capacity outside China along with investments in the competitiveness of Chinese spinning mills continues. Rieter benefits from its technology leadership, the innovative product portfolio and the completion of the ring- and compact-spinning system through the acquisition of the automatic winding machine business. The largest order intakes came from India, Turkey, China, Uzbekistan, and Pakistan.

On June 30, 2022, the company had an order backlog of more than CHF 2 100 million (June 30, 2021: CHF 1 135 million). Cancellations in the reporting period amounted to around 5% of the order backlog.

Sales

The Rieter Group posted sales of CHF 620.6 million, which included CHF 68.9 million from the businesses acquired in the years 2021/2022 (first half 2021: CHF 400.5 million).

As a result, sales were significantly higher than in the prior-year period, although preproduced deliveries, which mainly affected the Business Group Machines & Systems, in the three-digit million range had to be postponed until the second half of 2022. The reasons for the postponements were the COVID lockdown in China and supply chain bottlenecks.

EBIT, Net Result and Free Cash Flow

Rieter posted a loss of CHF -10.2 million at the EBIT level in the first half of 2022.

Earnings were impacted by significantly higher material and logistics costs. The price increases already implemented are having a delayed effect, mainly in the Business Group Machines & Systems, and were therefore unable to compensate for the high increase in costs. In addition, costs in connection with material shortages negatively impacted profitability. The result also includes acquisition-related expenses of CHF -11.2 million.

The loss at the net result level was CHF -25.2 million, of which CHF -17.6 million was due to the acquisition.

Free cash flow was CHF -57.1 million, attributable to the build-up of inventories in connection with the high order backlog and postponed deliveries.

Action Plan to Increase Sales and Profitability

Rieter is implementing a comprehensive package of measures with the aim of increasing sales and profitability in the second half of 2022.

The package focuses on two main priorities: Firstly, Rieter is continuing to systematically implement price increases while working to improve the quality of margins of the order backlog, so as to compensate for cost increases in materials and logistics.

Secondly, Rieter is working closely with key suppliers and is developing alternative solutions to eliminate material bottlenecks, as far as possible, in order to safeguard deliveries.

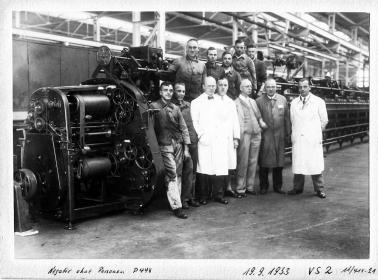

Rieter Site Winterthur

The Board of Directors has decided to begin the process for the sale of the remaining land at the Rieter site in Winterthur (Switzerland). In total, around 75 000 m2 of land will be sold.

Outlook

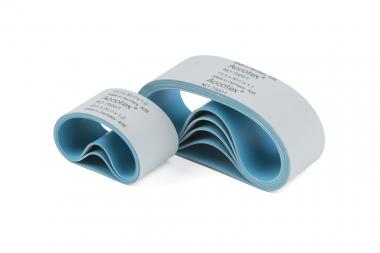

As already reported, Rieter expects demand for new systems to normalize further in the coming months. Due to the capacity utilization at spinning mills, the company anticipates that demand for consumables, wear & tear and spare parts will remain at a good level.

For the full year 2022, due to the high order backlog and the consolidation of the businesses acquired from Saurer, Rieter expects sales of around CHF 1 400 million (2021: CHF 969.2 million). The reduced sales forecast compared to early 2022 (March 2022: CHF 1 500 million) reflects the impact of global supply bottlenecks. The realization of sales revenue from the order backlog continues to be associated with risks in relation to the well-known challenges.

Despite significantly higher sales, Rieter expects EBIT and net result for 2022 to be below the previous year’s level. This is due to the considerable increases in the cost of materials and logistics, additional costs for compensation of material shortages as well expenses in connection with the acquisition in the years 2021/2022. Despite the price increases already implemented, global cost increases continue to pose a risk to the growth of profitability.

Rieter Holding AG