Rieter: First Repair Services station in Uzbekistan

Rieter has opened its first Repair Services station in Tashkent, Uzbekistan, on December 1, 2023. It will enable both faster repair turnaround and minimum production downtime.

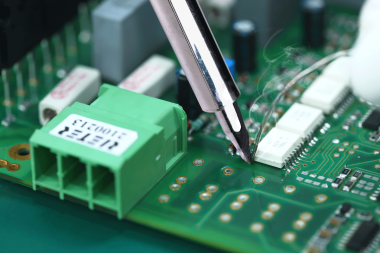

The station’s capabilities cover both mechanical and electronic repairs for all types of Rieter machines, including spinning and winding. In addition, the repair station has a warehouse where critical parts, such as control units, sensors and drives are stocked to ensure quick turnaround times for repairs. The new service station will operate in collaboration with Textile Service Solutions.

Rieter’s global Repair Services network comprises 25 repair stations in 19 countries. Each repair station is fully equipped with the testing and calibration equipment required to provide the highest quality repairs. Certified Rieter repair services engineers perform both on-site and in-workshop repairs, using original Rieter repair components and spare parts. The new Repair Services station in Tashkent complements Rieter’s presence in Uzbekistan, providing state-of-the-art repairs and sustainable solutions combined with dedicated support to local customers.

Rieter Management AG