Trevira CS at the Cruise Ship Interiors Design Expo Americas in Miami

Trevira CS is exhibiting for the first time at CSI Miami (Cruise Ship Interiors Design Expo Americas). Taking place on 6 – 7 June, 2023 at the Miami Beach Convention Center, CSI will bring together buyers and suppliers involved in cruise ship interiors, including interior designers, architects, outfitters, shipyards and suppliers.

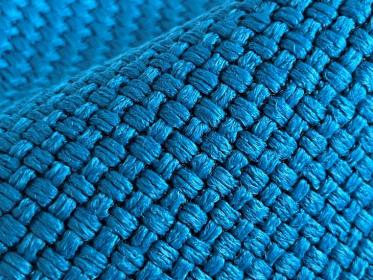

On the Trevira CS stand, visitors can get an idea of the wide range of flame retardant fabrics suitable for use on board cruise ships. 53 fabrics from 20 Trevira CS customers will be on display that either have IMO certification and/or have been tested to the fire safety standards (FTP Code) required in the marine sector. Trevira CS fabrics are inherently flame retardant, meaning that their flame retardant properties cannot be washed out or lost through aging or use. This is due to the chemical structure of the polyester fiber: the flame retardant properties are firmly anchored in the fiber and cannot be altered by external influences. A surface-applied flame retardant finish is therefore not necessary.

In the marine sector, the demands placed on textiles are not only high in terms of fire protection, but also with regards to light resistance and durability. This is particularly true for textiles used in outdoor applications. These must be extremely robust, as they are exposed to moisture and sunlight. To meet these requirements, Trevira CS has launched a range of 30 new spun-dyed, UV-stable filament yarns. Besides color depth and durability, spun-dyed yarns offer another advantage: They are more sustainable because the fabrics made from them can be produced in a more environmentally friendly way than textiles that are dyed in one piece or consist of brightly colored yarns. In fabric production, a large share of resource consumption goes to the dyeing and finishing of fabrics as well as the use of chemicals and water. However, with spun-dyed yarns, these processing steps are unnecessary – the yarn immediately comes out of the spinneret in the desired color, reducing the products’ environmental impact.

The topic of sustainability is also taken up in other Trevira CS products. For example, Trevira CS fabrics are available in recycled versions. They consist of fiber and filament yarns obtained in different recycling processes. Filament yarns are produced using recycled PET bottles, they contain 50% post-consumer recycled material. Recycled fibers are obtained using an agglomeration plant and in further processing steps from residual pre-consumer waste from production. They consist of 100% recycled material (pre-consumer recycling). All flame retardant recycled Trevira® products are GRS (Global Recycled Standard) certified.

Fabrics made from these yarns are marked with the Trevira CS eco trademark. The prerequisite for this is a recycled content of at least 50%. Among the fabrics presented at the Trevira CS trade fair stand are 8 fabrics bearing the Trevira CS eco brand.

The long-term goal in developing sustainable products is undoubtedly to enter a circular economy. For this new path, an innovative Trevira CS product development was launched, producing flame retardant fibers and filament yarns from chemically recycled raw material. In this case, the basic raw material for the chemical recycling was PET bottles, but essentially it could be most any other PET recyclables, such as packaging material or even textiles. Chemical recycling involves depolymerization, a sequence of chemical reactions in which the polymer chains are broken down again into their original components, i. e. the monomers. In a further processing step, impurities are removed. Before the polymerization process is initiated, a small amount of MEG (mono ethylene glycol) is added.

The same technology used to produce the original (virgin) raw material for Trevira CS is also used here. The flame retardant modification is added during polymerization. In this way, the flame retardant properties are indelibly anchored in the polymer.

By recycling valuable materials such as packaging material, waste can be avoided. The raw material obtained from the recycling process is comparable to the original material can be used again in high-quality products.

Indorama Ventures Fibers Germany GmbH