Monforts at Innovate Textile & Apparel (ITA) 2020

During the Innovate Textile & Apparel (ITA) virtual textile machinery show which will run from October 15th-30th 2020, Monforts will be emphasising its leadership position in three key fields – advanced coating, denim finishing and fabric sanforizing.

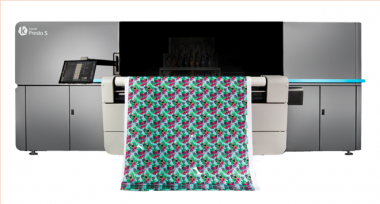

With its multi-head capability, the latest Monforts texCoat coating system provides flexibility with an unprecedented range of options and a wide range of modules available.

Refinements

“Since we acquired the coating technology that our systems are based on we have made a lot of refinements and all of them are reflected in higher coating accuracy and the resulting quality of the treated fabrics,” says Monforts Head of Technical Textiles, Jürgen Hanel.

“Our systems have the shortest fabric path from the coating unit into the stenter and we have all variations of coating application systems too – and all of these options are available in wider widths, with the engineering and manufacturing from a single source here in Europe.”

CYD

Denim finishing is meanwhile a field in which Monforts has an undisputed lead and it has been working closely with its many partners in the key denim manufacturing countries of Bangladesh, Brazil, China, India, Mexico Pakistan and Turkey to develop advanced solutions. The latest of these is the CYD yarn dyeing system.

“CYD is based on the proven Econtrol® dyeing system for fabrics*,” explains Monforts Head of Denim Hans Wroblowski. “It integrates new functions and processes into the weaving preparatory processes – spinning, direct beaming, warping and assembly beaming, followed by sizing and dyeing – in order to increase quality, flexibility, economic viability and productivity. The CYD system has been developed in response to a very strong market demand.”

Pre-shrinking

Monforts has also recently delivered a significant number of its latest Monfortex sanforizing lines to customers around the world.

Sanforizing is vital to final fabric quality, pre-shrinking it by compressing prior to washing, to limit any residual or further shrinkage in a made-up finished garment to less than 1%, for perfect comfort and fit over an extended lifetime.

As with industry-leading Montex stenters, Monfortex lines benefit from the latest Qualitex 800 control system which allows all parameters to be easily automated via the 24-inch colour touchscreen, including production speed, control of all fabric feed devices, rotation spray or steaming cylinder options, the width of the stretching field and the rubber belt pressure. Up to 10,000 separate process parameter records can be generated and stored by the data manager.

*Econtrol® is a registered mark of DyStar Colours Distribution GmbH, Germany.

A. Monforts Textilmaschinen GmbH & Co. KG Coatings textile machinery denim finishing

AWOL Media