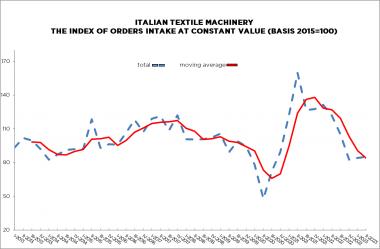

Italian Textile Machinery: 2nd Q 2023 Drop in Order Intake

During the second quarter of 2023, the orders index for textile machinery, as compiled by the Economics Department of ACIMIT, the Association of Italian Textile Machinery Manufacturers, dropped significantly compared to 2022 April – June 2022 period (-30%). In absolute terms, the index stood at 85.1 points (basis 2015=100).

This drop is the result of a reduction in the collection of new orders recorded by manufacturers both domestically and on foreign markets. The decrease in orders in Italy amounted to 21%, whereas a 31% downtrend was observed abroad. The absolute value of the index on foreign markets settled at 81.9 points, while in Italy it stands at 117.2 points. New orders for the second quarter amounted to 4.1 months of guaranteed production. ACIMIT’s data also shows that the use of production capacity by Italian manufacturers was 70% for the first half of 2023. This percentage is expected to remain stable for the second half of the year.

ACIMIT president Marco Salvadè stated that, “The orders index for the second quarter elaborated by our Economics Department clearly shows a decline in new orders both in Italy and abroad compared to the previous year. The decline that usually precedes an event such as ITMA, the international textile machinery exhibition held last June in Milan, however, is part of a negative trend that has been going on for several quarters”.

Uncertainty appears to be weighing heavily especially on markets abroad, where foreign trade statistics updated to the first quarter of 2023 are marked by a slackening in Italian sales in some important reference markets, such as Turkey, China, the United States and Pakistan.

Salvadè added that, “Feedback from over 400 Italian companies that took part in ITMA is positive. It’s now necessary for the many contacts made during the event to materialize and for the demand for machinery in the main textile machinery markets to resume a path towards growth.”

ACIMIT