Trützschler and Valérius 360 start collaborative project for recycled yarn

Valérius 360 wanted to make a sustainable, circular approach possible in the fashion industry. Working together with Trützschler, a collaborative project has now achieved high-quality recycled yarn – opening up massive potential to drive measurable progress toward a circular and sustainable textile industry.

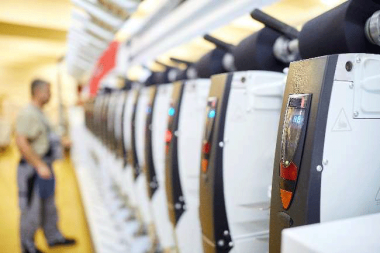

Testing at the Trützschler Technical Center

The team from Valérius 360 wanted to find ways of improving the processes for yarns made from 50 % recycled and 50 % virgin cotton (Ne30). In particular, it was seeking ways to reduce thick and thin spots, which disturb the appearance of the textile surface.

At the Trützschler Technical Center in Mönchengladbach, they conducted special trials that showed that using a direct spinning process for this application delivers much better results than a process with a draw frame passage for rotor yarns.

In direct spinning, the sliver from the card is directly drawn in the draw frame which is integrated in the can stock. This involves one less process step than using an autoleveller draw frame, while also saving space and giving staff more time for other operations.

On-site support from Trützschler Customer Service

The team from Valérius 360 also received in-house training from the Trützschler Customer Service department. Together, they analyzed and significantly improved the process at the Valérius 360 production site. This helped to bring yarns made from recycled raw materials up to the required level of the 50% Usterstatistics. This is the reference level for yarns made from virgin raw materials. Accordingly, 50 % of all yarn producers with raw cotton for rotor yarns and comparable yarn counts produce a poorer quality.

Trützschler Group SE