Launch of ERCA Textile Chemical Solutions

In January 2024, ERCA Textile Chemical Solutions TCS was launched as an independent entity within the ERCA Group.

The decision to make ERCA TCS a separate company stems from the desire to focus exclusively on solutions for the textile industry and to build an agile entity oriented towards responsible research and production, while continuing to leverage a solid productive and financial background from ERCA S.p.A.

ERCA TCS aims to be the unique and innovative point of reference for textile companies in terms of products and services specifically designed for the needs of a sector that is currently facing challenges and opportunities related to sustainability and responsible production.

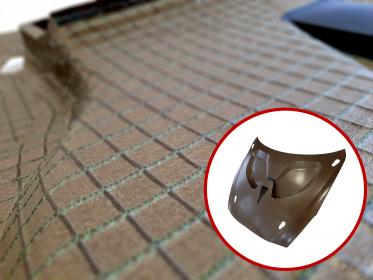

ERCA TCS bases its activity on the principles of "green chemistry" to offer the textile industry chemical solutions that make concrete the concepts of safety, performance, and circularity. Its flagship product - REVECOL® - is born from critical waste materials (used vegetable oils) and present in abundance, which through a process attentive to environmental compatibility and safety, are transformed into a line of innovative, certified, high-performance chemical auxiliaries usable by the entire textile industry.

ERCA Group has six plants in three macro-regions: Europe, Latin America, and Asia and produces chemical specialties and auxiliaries with an approach of responsible innovation. Its production covers several markets: textile, cosmetics, polyurethanes, concrete. It has a turnover of 150 million euros and employs 350 people worldwide, 100 of whom are in the sole Grassobbio plant.

ERCA Textile Chemical Solutions (ERCA Group)