Euratex Manifesto: 15 requests for competitiveness and resilience

2024 is a turning point for the European textiles and clothing industry: From 6 to 9 June 2024, European citizens will vote for a new European Parliament and, based on the results, a new European Commission will be formed. In view of this important election, EURATEX publishes a Manifesto, presenting 15 requests which will help to ensure a competitive European textiles and clothing industry.

The textile and apparel industry is making a substantial contribution to European wealth, jobs and growth. Europe counts 192,000 companies employing 1.3 million workers with a turnover of €167 billion and over €67 billion of exports. Entrepreneurship should be recognised as the foundation for a competitive textile industry, offering high quality and sustainable products, based on innovation, creativity and design. European policy makers should recognise such role to textiles and apparel companies and have an open dialogue to create better framework conditions to operate in the internal and global markets.

To realise that vision, the industry and policy makers need to work together on a mix of policy measures and initiatives, which are coherent and offer a transparent and predictable framework for our companies, and make them more resilient and competitive.

These policies should focus around four points:

Develop and implement a “smart” EU industrial policy

Europe should create policies which enhance competitiveness, instead of creating administrative burdens. To EURATEX, each new piece of legislation should undergo a “competitiveness test” to critically look at the impact of the new rules. Europe should also create a favourable environment to promote education and jobs in the industry. The EU textile industry currently employees 1,3 million people, 30% of which is above 50 years old. A critical bottleneck for the textile industry is to attract (young) people and make sure these people have the right set of skills, to operate in a changing textile ecosystem. EURATEX also asks the EU to invest in innovation and digitalisation as they are key to the European competitive advantage. Not only, as the last years have proved, Europe should provide companies with access to sustainable energy at lower prices.

No sustainability without competitiveness

The EU Strategy for Sustainable Textiles is pushing our sector towards new business models with a lower environmental footprint. To realise that ambition, no less than 16 regulatory proposals are on the table, each of them with a different timetable, managed by different departments of the European Commission. EURATEX is committed to sustainability, but asks for economic realism. This set of new regulations needs to be coherent, enforceable, feasible and applicable for SMEs, and not push textile companies out of the market. Moreover, some member states are moving forward faster and some legislations will be decided at national level, creating fragmentation of the market. Such scenarios will hamper Europe and its possibilities to grow.

Ensure free and fair trade

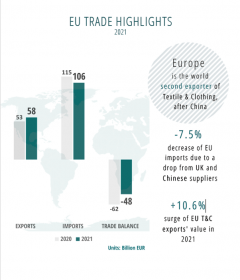

With $224 billion in sold merchandise, Europe is the second major world exporters of textiles and clothes after China ($321 billion). It is therefore important that the global market should be open, free and fair for our industry to continue to thrive. Besides the support to FTAs in general, EURATEX wants to emphasise that all trade agreements should offer effective market access for EU companies and a level playing field in these markets. A free and open market should go hand in hand also with protection against free riders. The EU must always consider enforcement and enforceability when making new laws; it should also take action together with the member states for a better coordination with harmonised criteria for action among Customs Authorities.

Incentivise the Demand for sustainable textiles

Sustainable textile products typically come at a premium price, making it difficult for many consumers and buyers to purchase such products. Many surveys across Europe confirm that around 50% of interviewees do not purchase sustainable fashion products and the main reason is price. EURATEX believes that, to create a demand and help consumers to buy a (genuine) sustainable textile product, there should be standard requirements and fiscal incentives. Public authorities should also implement green public procurements, by increasing the importance of sustainability criteria in their evaluation grids.

Euratex Textile and clothing industry elections European Parliament competitiveness resilience

Euratex