Research to reduce shed of microplastics during laundering

A collaboration between Deakin University researchers and Australia’s largest commercial linen supplier Simba Global is tackling a critical global issue, the spread of harmful microplastics through our laundry.

Clothing and textiles are estimated to generate up to 35 per cent of the microplastics found in the world’s oceans, making them one of the biggest contributors. But there is still a lot to be learnt about the characteristics of these microplastics and exactly how and why they are generated.

Researchers at the ARC Research Hub for Future Fibres in Deakin’s Institute for Frontier Materials (IFM) have teamed up with Simba Global, a global textile manufacturing and supply company, to better understand the extent and type of microplastics shed when their products are laundered. Simba Global wants to lead the charge to reduce the environmental impact of textiles.

Lead scientist IFM Associate Professor Maryam Naebe said working with an industry partner on the scale of Simba Global meant the research could have a huge real-world impact.

Simba Global is the major linen supplier to Australia’s hospitals, hotels and mining camps, resulting in 950,000 tonnes of textile products – including bedsheets, bath towels, scrubs and much more – going through the commercial laundering process each year. It also supplies international markets in New Zealand, Singapore and the US.

“As part of our research, we will investigate potential solutions including the pre-treatment of textiles to reduce the shedding of microplastics, or even increasing the size of the plastics that break down so they can be better captured and removed by filtration during the laundering process,” Associate Professor Naebe said.

“Microplastics are now ubiquitous in the environment, they’re in the air we breathe, the food we eat and the earth we walk on. The magnitude of the problem is bigger than previously thought.

“Of serious concern is the mounting evidence that microplastics are having a negative impact on human and animal health. There are not just physical, but chemical and biological impacts.”

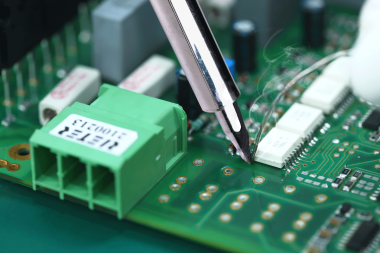

Associate Professor Naebe’s team have taken the first steps in the project, analysing wastewater samples from commercial laundries with high-powered electron microscopes in their Geelong laboratory, part of the largest fibres and textiles research facility in Australia.

The team recently presented a new scientific paper at the Association of Universities for Textiles (AUTEX) Conference 2023, which started the important process of formally categorising these types of microplastics, as well as developing standard terminology and testing methods.

“Because our understanding of microplastics is still in its infancy, we needed to start right at the beginning,” Associate Professor Naebe said.

“We need to have a standard definition of what is a microplastic. Up to this point that has been lacking, which makes it difficult to compare and incorporate other studies in this area.

“We are now developing a systematic method for sampling and identifying microplastics in laundry wastewater. It has been tricky to measure the different sizes, but this is important information to have. For example, there are studies that suggest some sizes of microplastics are causing more issues in certain animals.

“The next step will be establishing an essential method to prevent the release of microplastics from textile laundering. This may involve a coating on the surface of the textile or better ways to collect the waste during the washing process.”

Simba Global Executive Chair Hiten Somaia said the company had a strong focus on sustainability, driven by the business’ purpose statement.

“We are proud to partner with Deakin University in what is the first significant research into textile microplastic pollution in Australia. What we are most excited about is sharing the results of this research with all other textile markets in Australia – including clothing – and putting an end to microplastic pollution from textiles.”

Deakin University