Lectra: Financial statements for first nine months of 2023

- Revenues: 358.3 million euros (-7%)

- EBITDA before non-recurring items: 59.2 million euros (-17%)

- Net income: 24.9 million euros (-30%)

- Free cash flow before non-recurring items: 32.1 million euros

- 2023 outlook: revised revenues – confirmation of EBITDA before non-recurring items

Lectra’s Board of Directors, chaired by Daniel Harari, reviewed the consolidated financial statements for the third quarter and first nine months of 2023, which have not been reviewed by the Statutory Auditors.

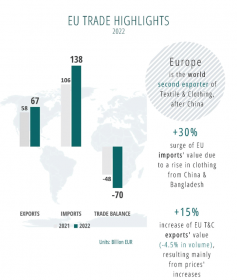

Currency changes between 2022 and 2023 mechanically decreased revenues and EBITDA before non-recurring items by 6.4 million euros (-5%) and 2.8 million euros (-10%) respectively in Q3, and by 7.3 million euros (-2%) and 3.0 million euros (-5%) respectively in the first nine months of the year, at actual exchange rates compared to like-for-like figures.

Business Trends and Outlook

In its 2022 Financial Report, published February 8, 2023, Lectra presented its new roadmap for 2023-2025. The Group also specified that 2023 remained unpredictable given the degraded macroeconomic and geopolitical environment, which resulted in many uncertainties that could continue to weigh on its customers’ investment decisions.

At the beginning of the year, the Group set itself objectives of achieving, in 2023, revenues in the range of 522 to 576 million euros and EBITDA before non-recurring items in the range of 90 to 113 million euros. It subsequently reported on April 27 that it then anticipated revenues in the range of 485 to 525 million euros and EBITDA before non-recurring items in the range of 78 to 95 million euros.

In what continues to be a highly degraded environment in macroeconomic and geopolitical terms, orders and revenues from new systems in Q3 were lower than anticipated by the Group. Recurring revenues, on the other hand, which should account for over 65% of total revenues in 2023, continued to grow in Q3, and provide good visibility. In addition, the initial measures to reduce overhead costs have begun to bear fruit.

In light of these factors, full-year revenues are now anticipated in the range of 474 to 481 million euros, thus slightly lower than anticipated on April 27, and EBITDA before non-recurring items in the range of 78 to 82 million euros, in the lower part of the range indicated on April 27. These scenarios are based on September 30 exchange rates for Q4, including $1.06 to the euro.

Because the Group's customers operate in a highly competitive environment that demands they continue to improve performance, their investments will pick up as soon as the macroeconomic situation improves. Lectra's roadmap for 2023-2025, which was launched on January 1, 2023, will enable the Group to take full advantage of the upturn and accelerate its growth.

Lectra