THE BEST INNOVATIONS AT THE NOVEMBER 2016 PERFORMANCE DAYS ARE COMING OUT OF ITALY!

Coveted awards for active insulation and sustainable hybrids

The awards presented at PERFORMANCE DAYS are coveted trophies in the world of functional textiles. The winning fabrics or technologies are always truly pioneering innovations. In Fall 2016, the "Oscars of Function" go to Imbotex and Pontetorto.

PERFORMANCE AWARD for the insulation "TWINS" from Imbotex

The Italian company Imbotex is well known for its high quality insulations. The latest generation is called "TWINS" and does not merely hold the warmth, it applies intelligent technology to create heat on demand. This is made possible by the two "faces" of the twin design. The patented, bonded fleece material consists of a lining made from a blend of polyacrylic and polyester that transports moisture quickly away from the skin. On the outside, hydrophobic polypropylene rapidly releases the moisture into the environment. The water vapor formed at the level of "insensible perspiration" is quickly transported to the outside and the body stays dry. During this process, the kinetic energy of the water vapor converts to heat energy and the inner lining of the garment remains pleasantly warm, even in the low temperatures of winter. "TWINS" from Imbotex was the winner of the PERFORMANCE AWARD for this intelligent solution that produces additional warmth and ensures a dry feeling.

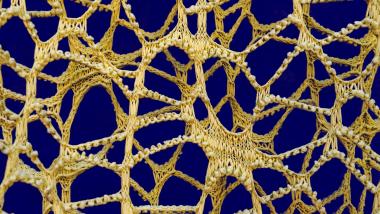

ECO PERFORMANCE AWARD for the hybrid design "ECO HYBRID" from Pontetorto

Engineered hybrids, that is, hybrid solutions that combine multiple zones and fibers in one fabric length are the future of functional clothing. Through such hybrid engineering, sports styles are given the added value of such useful features as thermal retention, climate management, durability, lighter weight, and elasticity; and, all of these at the exact position where it is desirable to have the function. Another advantage of this fabric design is the elimination of irritating seams, which means increased comfort for the wearer. Nevertheless, to manufacture these hybrids requires much experience with jacquard production. The new fabric "ECO HYBRID" introduced by fleece specialist Pontetorto represents not only a sophisticated and highly functional jacquard hybrid with different zones – it is entirely produced with absolutely sustainable methods. The fibers used, in this case polyamide and merino wool, are both quickly degradable and environmentally friendly. The fact that merino wool is degradable is not unusual as it is a natural product. The special aspect of this concept is the polyamide fiber used exclusively by Pontetorto, which is fully degradable within three years! For so much "green" innovation, Pontetorto was selected as the winner of the ECO PERFORMANCE AWARD.

All of the newest trends for Winter 2018/19 and our FOCUS TOPIC are on display on November 16-17, 2016 at PERFORMANCE DAYS in the Munich MTC. For all those who cannot wait, a lot of information is already provided for you online at: https://www.performancedays.com

About PERFORMANCE DAYS

PERFORMANCE DAYS — The “functional fabric fair” launched in 2008, is the first and only event created especially for functional fabrics for sports and work clothing. The aim of the semi-annual trade fair is to give leading and innovative textile manufacturers, suppliers and service providers the opportunity to present their functional fabrics, membranes plus treatments, laminates, paddings, finishes, and accessories such as yarns, tapes, prints, buttons and zippers.

No entry fee and free admission to all events for industry visitors.

Detailed information and advanced registration online at: www.performancedays.com

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

© PERFORMANCE DAYS functional fabric fair

Textination GmbH