A GREAT POTENTIAL AT TENDENCE 2016: CONTRACT BUSINESS

- The ideal Market Place to gather Information and meet new Business Contacts

In its recent business-travel analysis for 2016, the German Business Travel Management Association (Verband Deutsches Reise-management – VDR) announced that German companies are sending more employees on business trips than ever before. In 2015, they made a total of almost 183 million business trips, four percent more than the year before. Five years ago, only one in four employees made a business trip at least once a year. Today, that figure has reached almost 40 percent. Moreover, the number of people taking their holidays abroad is also set to rise to 1.8 billion by 2030 according to the World Tourism Organisation (UNWTO). Three years ago, it was around one billion. A great opportunity with an excellent growth potential for the contract business – for the number of overnight stays increases concomitantly. Hotels and aircraft have to be furnished and equipped to cater for so many guests. Accordingly, it is a field of business that is booming. “The contract business is an enormous growth market. Therefore, Tendence is characterised by numerous high-grade exhibitors for furnishing specialists, interior architects, hotels and restaurants. Thanks to the special services offered, contract-business buyers can plan and organise their visit to the fair for maximum efficiency”, says Tendence Director Bettina Bär.

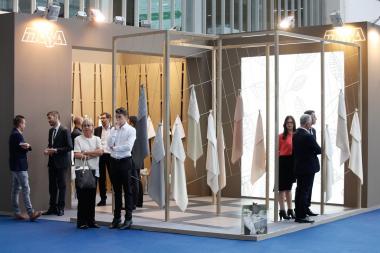

At Tendence, over 65 specialist exhibitors present an attractive spectrum for furnishing hotels and restaurants. AdHoc, Asa Selection, Koziol and Zero One One offer products from the tableware and wining & dining segments for the premium contract business. In the furniture, home and decorative accessories segment, renowned companies such as Decorama, DPI, Fink, Guaxs, Lambert and Scholtissek are distinguished by great experience in furnishing commercial premises. When it comes to textile furnishings, the exhibitors with suitable ideas include Rica Riebe, Steen Design and Zoeppritz.

The exhibition stands of suppliers for the contract business are clearly marked with the Contract Business label. Additionally, all Contract Business exhibitors are marked in the Tendence catalogue and listed in a separate section in addition to their entry in the main part.

Tendence, the international consumer-goods event

Tendence (27 to 30 August 2016) is Germany’s most international and biggest order fair for consumer goods in the second half of the year with an extensive range of products from the home, furnishing, decorating, gifts, jewellery and fashion accessory segments. At this new-products platform, top brands and key players present their Christmas trends thus giving the national and European retail trade the opportunity to place follow-up orders for the Christmas season. At the same time, they show their collections for the coming spring and summer.