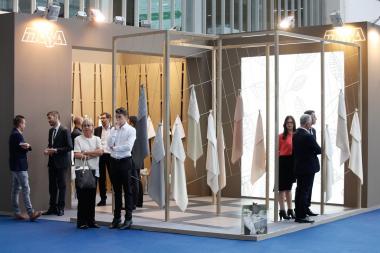

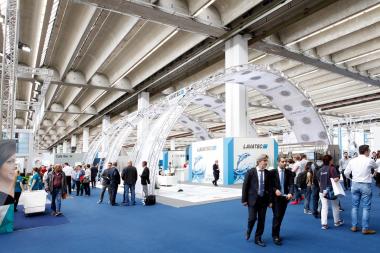

TEXCARE INTERNATIONAL CLOSES WITH A NEW INTERNATIONALITY RECORD

- Trade visitors very pleased with the bigger and more extensive range of products at the world’s leading trade fair for the sector

- Exhibitors and visitors rate the economic situation in the sector as very good

98 percent of visitors said they were very pleased with the range of products and services at Texcare International. Andreas Schumacher, Managing Director of the German Dry Cleaning Association (– DTV Deutscher Textilreinigungsverband), says, “We are delighted with the course of business at

the fair. The echo from exhibitors and visitors has been excellent. Very popular was the opportunity to exchange information and opinions about subjects of topical importance to the sector at Texcare Forum in addition to visiting the exhibition stands. The DTV stand itself was also a welcome meeting place for holding discussions with our members and sponsors. We were particularly pleased with the highly positive response of visitors to our programme of events, which included a fashion show and ironing competition.”

A highlight at Texcare International was the fashion show where manufacturers presented their collections and showed the latest trends in terms of colour, design and function for industrial, healthcare and catering workwear. The first ironing competition to be held at Texcare gave participants the chance to match themselves against others and to demonstrate their skills.

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

© Foto: Jens Liebchen / Messe Frankfurt GmbH

Textination