Stratasys: Expanded Materials and Technology Updates

Stratasys Ltd. is announcing updates to several Industrial and Healthcare Business Unit products and Stratasys Direct. These include a new open platform for the F900™ 3D printer, more on-demand 3D printing capabilities and a new high-performance material for its Fused Deposition Modeling line.

OpenAM comes to the F900

Stratasys OpenAM™ is a software application that enables the user to modify machine controls to achieve results beyond standard print settings. Already available for the Fortus 450®mc printer, Stratasys is now making its OpenAM software available for the F900 printer. This will allow for expanded functionality and capabilities and will unlock new materials for F900 users.

New VICTREX AM 200 material for FDM

A new material offering that opens the application potential for demanding industries like aerospace and medical, where material properties are critical components of a 3D-printed solutions. This new high-performance, high-strength, validated material, VICTREX AM™ 200, will be available for the Fortus 450mc and the F900. VICTREX AM 200 is a PEEK-based polymer that is temperature, corrosion, and chemical resistant, with excellent mechanical properties which can be utilized with soluble and breakaway support material.

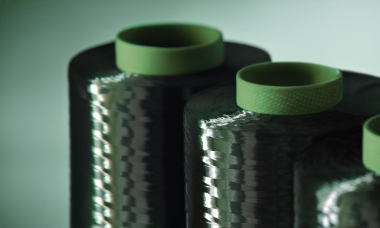

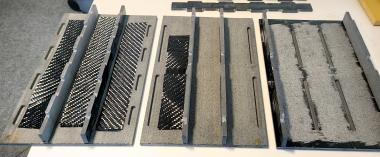

Carbon Fiber Visual Print Option for the F-Series

Carbon Fiber Visual Print Option is a new 5-slice (0.005”) layer height across the F-123 Series™ line of printers that is coming later this month for FDM®ABS-CF10. It produces a smoother surface finish, to provide the perfect finish when a part’s visual appearance is important to the application. It is built for applications that demand the durability of a carbon-filled polymer, but also requires a visually appealing result without additional post-processing.

F770 adds New Colors

The F770® printer can now print in multiple colors, in addition to its original single ivory color. Six new ASA colors, including red, white, light gray, black, blue, and yellow, will allow for more application versatility with FDM® ASA and ABS-M30 tried-and-true engineering plastics. The new colors enable printing without painting or other post-production marking, allowing parts to be available much faster, increasing productivity.

Somos NeXt Validated for SLA

Somos® NeXt™ is now a validated material for Stratasys NEO® stereolithography 3D printers. Somos NeXt is a resin with superior strength and can be used in automotive and consumer products, along with other applications, including prototyping, to produce durable, accurate and detailed parts.

New GrabCAD Software Print Integration Enhances On-Demand 3D Printing Capabilities

Stratasys has introduced Parts on Demand by GrabCAD, a new integration that synchronizes the company's software platform with Stratasys Direct. This addition allows GrabCAD Print™ customers to access Stratasys Direct’s fleet of 3D printers, allowing for larger and more intricate designs, a selection of more than 50 engineered materials, and the assurance of stringent quality inspections.

Stratasys Ltd.