MAURITIUS DAY DÜSSELDORF

Destination Mauritius - rebuiding former relationsships

Island of dreams in the middle of the Indian ocean for some travellers neighbouring the last European outpost, French overseas department La Réunion, a destination for reliable production of textiles and apparel for the European, notably German fashion market, this is the spectrum

of associations that Mauritius evokes in the heads of people. Mauritius looks back on a long time experience in producing textiles and apparel since its independence from Britain in 1968. Republic since 1992 the group of islands is one of the very few stable democracies in Africa.

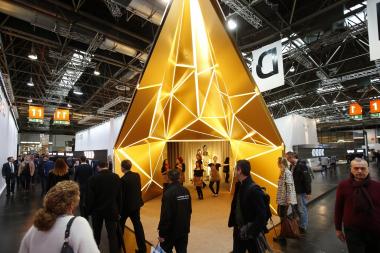

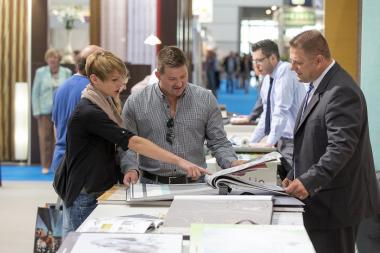

Arvind Radhakrishna, CEO of Enterprise Mauritius, the organiser of the Mauritius day, April 5, 2017 at Düsseldorf Fashion House II, gives it a strong regret that the relation between Mauritius and Germany, mainly based on knitwear, dating back in the early 70ies nearly came to an end. The amount of textile exports into Germany in 2015 was just about 30 million Euros and counting. Anyhow this does not represent the strength of the Mauritian apparel industry which is a hub in the region with own inland production completed by production plants on the neighbour island Madagascar, in South Africa and some even in Bangladesh to serve a lower price level, which cannot be achieved with Mauritian production itself. In 2015, domestic exports to Europe accounted for 40 %, USA: 24% and South Africa: 21%. Charming is the fact that the delivery of Mauritian goods is duty free.

Strong support by the government

Interested buyers are heartily invited to come and see with their own eyes what the Mauritian textile and apparel industry can offer. This industry is one of the strong pillars of the gross domestic output. Others are tourism and - up and coming - the lapidary and jewellery industry. Traditional fields of production are spices, sugarcane products including rum or cosmetics.

To foster textiles and apparel exports the government sponsors airfreight costs by 40%, part of a holistic program in the speed to market scheme. To compare the benefits of Mauritius as a sourcing destination compared for example with China, besides the shorter distance, is that the minimum order quantities per style are much smaller than in China, the quality standard is high, the social compliance is given. Mauritian companies must spend 1% of their gains for Corporate Social Responsibility – CSR projects. Certificates such as BSCI, SA8000 or WRAP are common. Free entry to the EU market is guaranteed by the EU partnership agreement. And - a point that should not be neglected - most of the companies offer creative services executed by their inhouse design departments or people. This makes it clearer why the textile and apparel industry had been a strong engine for economic growth in Mauritius.

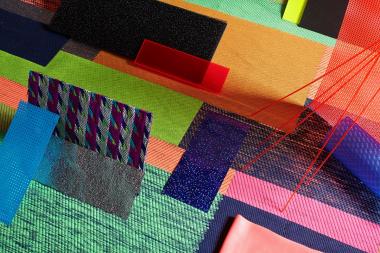

Main products are: T-Shirts, Polo Shirts, Shirts, Trousers & Denim, Pullovers & Cardigans, Formal Suits, Beachwear & Underwear, and Childrenswear etc. Main material used: cotton and its blends. There is a strong focus on knitted fabrics and jerseys of all kind paired with woven denims. The price segment of Mauritian clothing mainly ranges in the lower middle range. There is a high awareness for sustainability. The exporting companies aim to use eco-friendly substances in resources saving production processes. Laser technology for effects on denim is widely in use.

A look to the companies presenting

- FINE TEXTILES LTD

Contact: Mamade Nohur

Tel.: +230 2661092/57321079

E-mail: finetextileltd@gmail.com

Type: Final Product

Products: Polo shirts/T-shirts/Sweat shirts

Minimum order: 600 pcs. per colour

Fine Textiles mostly produce menswear. They distribute their garments under own label M*RIYANO and private label for their customers. The own label is calculated to compete with the Chinese market. Time from sample to delivery takes about 5 to 6 weeks.

- FIREMOUNT TEXTILES LTD / FM DENIM LTD

Contact: Sangeeta Gobin

Tel.: +230 2075836

Email: sangeeta@firemount.mu

Website: www.firemount.mu

Type: Final Product

Products: Denim fabrics & Denim and Twill Jeans pants/Jackets/shirts/Shorts/Dresses

Minimum order: 6000-7000 yd. fabric or 2500-3000 pcs. of jeans per order

Certifications: WRAP

The company is fully vertical and the biggest supplier of apparel in Mauritius, still growing, looking for direct relations to retailers. Due to the latest technologies available, the company aims to fulfil the needs for sustainable production. Stretch, even power stretch is used in nearly every jeans style.

- TEX KNITS LTD

Contact: Suresh Radha

Tel.: +230 2865577

Email: info@texinternational.com

Type: Final Product

Products: Denim trousers, jackets, shirts etc. /Knitted garments for ladies, men and children

Minimum order: 800 pcs. per style/colour

Certifications: Sedex Members Ethical Trade Audit (SMETA)

The knits company is part of a group offering garments in a broad range. To serve the UK market they run an office in London. The company puts a strong focus on design input for the international clients. Production plants in Madagascar and Bangladesh serves different price ranges.

- PALMAR LTEE

Contacts: Yannick Capiron (Knits), Genevieve Marie Figaro (Denim)

Tel.: +230 401 7000

Email: y.capiron@palmar.intnet.mu; gfigaro@palmar.intnet.mu

Type: CMT & Final Product

Products: Jeans, Chinos, Shorts, Dresses, Skirts for kids, Women & Men

Minimum order: 600 pcs. for jerseys; 800 pcs. for jeans

Over two thirds of the production is for menswear. The company is a family business which takes special interest in sustainable and resources saving production. The knitting department is fully

vertically integrated. A fair trade line is being offered, pure organic is in development.Contact: Ranil Gunasekara

Tel.: +230 4130034

Email: camdenimltd@gmail.com

Type: Final Product

Products: Denim jeans for men, women, children and toddlers

Minimum order: 1200 per style

The company solely works for private labels. The main market until now is South Africa. The production is going to be shifted to a higher percentage of eco-friendly production, representing 17% for the time being. Prices range in the upper middle segment.

- TARA KNITWEAR LTD

Contact: Fabiola Law

Tel.: +230 2123715/52553621

Email: fabiolalaw@taragroup.intnet.mu

Type: Final Product

Products: T-shirt, polo shirt, sweat shirt, hoody, short, pant, skirt, dress, baby grow, baby/kid swear accessories (beanie, bootie, blanket, sleeping bag, headband), sleepwear, loungewear

Minimum order: Basic styles: 4000 units. Fancy styles: 1000-2000 units

Certifications: BSCI

Tara is very design oriented with a big in house design department open for design services to customers too. The company's organisation is vertically integrated. Modern equipment such as the

Eton Mover system enables the company to react fast and operate Fast Track orders too.

- BEACHWEAR EXPORTS

Contact: Mr. G.M Toolsee

Tel.: +230 4545600

Email: girdhar@beachwear.intnet.mu/beachwear@intnet.mu

Type: Final Product

Products: Swimwear and related products

Minimum order: 300-500 units per style

Certification: BSCI, SMETA, SEDEX

All production is for private label. The company features as the leading supplier of swim and beach wear in Mauritius. Well known international brands are customers from US to Europe, mainly in Italy, France and UK as well as South Africa and Zimbabwe.

Brigitte Methner-Opel / Textination